While no one knows for certain what the future will look like, that doesn’t stop industry experts and analysts from predicting what’s next. RIAs are being asked to do more for clients with the same, or fewer, resources, so how do RIAs scale more efficiently and reduce operational risk, all while delivering a more consistent client experience across their growing books of business?

As a leading provider of Adaptive WealthTech for financial advisors, we believe these five trends will take center stage and play a critical role in transforming individual RIA practices and the wealth management industry as a whole in 2026 and beyond.

Trend #1: Advisors leverage AI for client insights

Opportunity-driven insights help drive client engagement, optimize portfolios, and identify new business opportunities.

AI is reshaping industries across the board, and wealth management is no exception. In a recent survey, more than half of RIAs reported using AI technology.1 While many advisors use AI to reduce administrative burdens, one of the most significant opportunities of AI lies in its ability to generate timely insights.

At Envestnet, we use AI to help advisors uncover insights that inform strategic decisions, enhance client outcomes, and drive growth. According to our AI-powered Insights Engine, the most commonly accessed insights are associated with portfolio optimization, retirement planning and tax efficiency.2

The key AI-driven themes and insights for RIAs are3:

- Underperforming Products – Identifying products with the lowest 3-year performance quartile for potential replacement

- High Cash – Uncovering accounts with high cash concentration that could be better allocated for growth

- Significant Client Outflow – Spotting significant client withdrawals that could derail long-term objectives

- Tax Loss Harvesting – Leveraging underperforming product insights to pinpoint tax loss harvesting opportunities

- High Fee Products – Flagging high fee products that could be replaced with more cost-effective alternatives

Like the rest of the industry, we expect even more advisors will explore and implement advanced AI-driven tools in 2026 to help them anticipate their clients’ needs, make faster and more strategic decisions, and provide trust-based, outcome driven financial advice.

“AI is becoming the invisible layer of intelligence. It supports advisors by helping to keep plans current, surfacing what matters most, and supporting continuous engagement.”

Jeremi Karnell

Head of Envestnet Data Solutions

Trend #2: The rise of Unified Managed Accounts (UMAs)

With more advisors using fee-based pricing, managed accounts grew 19.8% to reach $13.7 trillion in 2024 (after increasing 19.6% in 2023.)4 This growth continues to accelerate, with Cerulli expecting managed account assets to reach $31.8 trillion by 2028.5

According to Cerulli Unified Managed Accounts (UMAs) experienced the highest net flows among managed account types in 20245, driven by their ability to consolidate multiple investment types into a single, professionally managed account that can free up advisors’ time, make it easier for advisors to expand their investment capabilities, and efficiently address clients’ needs.

Among other advantages, UMAs enable RIAs to:

- Integrate multiple SMAs, mutual funds, ETFs, and individual securities into a single brokerage account to help increase efficiency and potentially drive business growth

- Streamline portfolio management — providing one account, one statement, one tax report

- Offer coordinated tax management and more efficient tax-loss harvesting across all strategies

- Offer the customization, transparency, and efficiency that high-net-worth clients value

Research shows that as client wealth increases, so does demand for institutional-grade investments and advanced tax management.6 UMAs can help advisors deliver both.

We believe even more advisors will discover how UMAs can help them build scalable, future-ready practices in 2026. Through solutions like Envestnet’s low-cost managed account solution with the Envestnet RIA Marketplace, RIAs have the ability to customize portfolios at scale and align allocations with clients' financial goals while maintaining operational efficiency.

Trend #3: Growing emphasis on tax management and estate planning

Cerulli forecasts that the high-net-worth market, or those with $5 million or more in investable assets, will grow annually at about 9.3% to surpass $30 trillion in total assets by 2028. For advisors, that will mean more clients seeking services beyond retirement planning.7

Given that taxes are typically investors’ largest expense, tax management represents a high-impact area where advisors can demonstrate their worth.

According to Cerulli research, 7 out of 10 affluent investors value providers who help reduce their tax bill.8 73% of HNW-focused advisory practices say tax minimization is among their most important investment objectives. Automated tax overlay services can make it easier to manage individualized tax outcomes across all your client relationships.

Along with tax planning, estate planning is another highly prized component of holistic financial planning, driven by the massive wealth transfer, changing demographics, and evolving tax laws. In a recent study, 70% of clients said they want their financial advisors to provide estate planning as part of a holistic approach, with 40% saying they would switch advisors for that service.9

The research confirms an emerging industry reality: the future of wealth management is driven by the dual goals of wealth preservation and wealth transfer. Advisors who address and integrate these factors into their practices may be best positioned for growth.

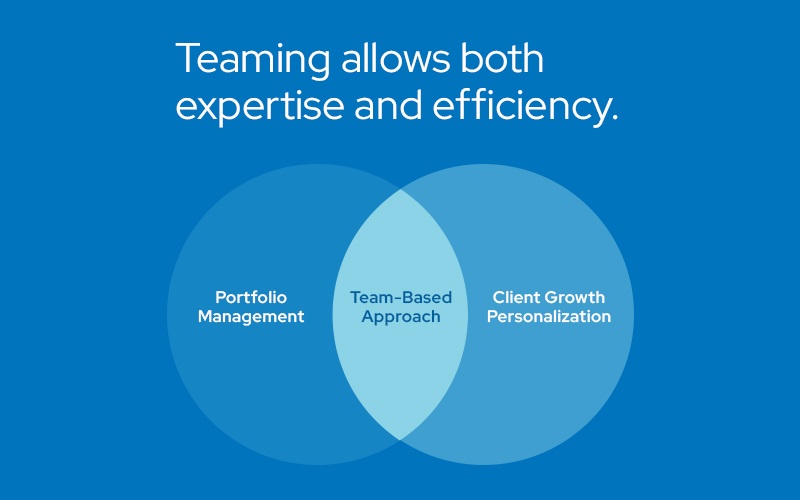

Trend #4: Taking a team-based approach to investing

Offering more services to clients is becoming a mainstream approach, with advisors in 2024 offering HNW investors an average of 12 services, up from 10 in 2017.10

While adding estate planning, tax planning, and other services to your advisory practice can drive AUM growth, acquiring niche expertise, staying on top of compliance requirements, and providing personalized advice to each client can be challenging and time consuming.

Fortunately, advisors don’t have to do it alone.

A growing number of financial advisors are outsourcing investment management to third parties and utilizing model portfolios to outsource investment decisions.11 This shift is driven largely by the desire to focus more on client relationships and holistic financial planning.

By partnering with external specialists in areas like investment management, legal and trust, taxes, technology, and marketing, firms can increase and enrich the services they offer to attract new clients and free up time to service existing clients more effectively.

In 2026, RIAs have the opportunity to learn how to build a team-based approach to investing into their practice to drive business growth and deepen client relationships. A team-based approach isn’t just a trend. It’s a strategic necessity.

Trend #5: Integrated tech stacks

Tech integration, or the lack of it, is a frequent pain point among advisors:

- In a recent study, 24% of advisors reported that disconnected solutions is their biggest tech-related challenge.12

- Disconnected data has real consequences, with 82% of advisors reporting that they lost prospects, and 67% losing clients due to subpar tech. 12

For these and other reasons, the industry is moving toward platform consolidation. Advisors today use 2.0 platforms on average, down from 2.2 in 2024. In addition, 71% of new client flows are directed to advisors’ primary platform.13

More than just a collection of tools, an integrated tech stack is the framework for a well-built advisory practice. The best RIA tech stacks combine critical functions like client onboarding, data management, and portfolio analytics to boost efficiency, increase data accuracy, improve decision-making, and provide a personalized and streamlined client experience.

A comprehensive and effective RIA tech stack armed with the right combination of tools can help advisors stay relevant in a world where competition is fierce and investors’ expectations and financial lives are more urgent, more complex, and more nuanced.

Envestnet is committed to supporting RIAs with wealth management technology that adapts to how advisory firms actually grow, helping them standardize where it matters, customize where it counts, and deliver a more consistent experience for both advisors and clients.

If building or optimizing your RIA tech stack is on your to-do list for 2026, we’re here to help.

“We're focused on delivering technology that supports scale, reduces risk, and enables advisors to spend more time with clients and less time managing the platform."

Sean Meighan

Head of Envestnet RIA Distribution

Preparing your RIA practice for 2026

While we don’t have a crystal ball, these RIA Industry trends are shaping the wealth management landscape in 2026. That’s why we’re focused on making our wealthtech platform more intuitive and connected to help RIAs turn emerging trends into opportunities and deliver a superior level of service.

What are your predictions for 2026? How will technology and rising client expectations transform the way you run your business?

See how other advisory firms are using Envestnet’s adaptive wealthtech to grow their business. Schedule a demo to learn more.