With more assets to protect, high-net-worth (HNW) individuals tend to have more advisors than the average investor. According to a recent study from Bank of America Private Bank1, nearly two-thirds of wealthy individuals work with multiple advisors—including financial advisors and planners, accountants, estate attorneys, and private bankers—who manage their investments and financial landscape.

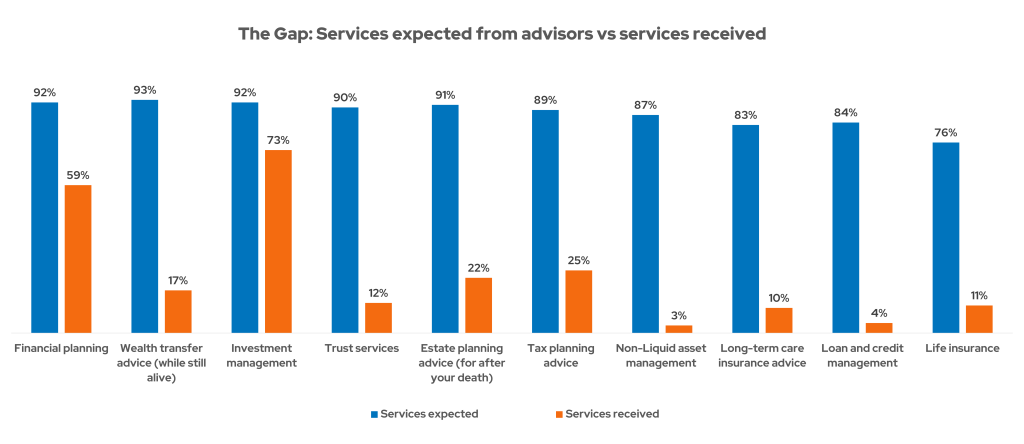

Financial advisors—from independent RIAs to those at asset management firms—have a unique opportunity to gain a competitive edge by connecting the dots across a client’s financial life. While other financial professionals may handle individual pieces, the financial advisor who brings all these services together becomes the one the client turns to for more.

Long-term financial planning is critical for helping HNW individuals meet their goals and protect their legacy. Advisors who take the lead on financial planning have an opportunity to increase their value, deepen relationships with clients and their families, and open the door to greater wallet share.

Who qualifies as high-net-worth (HNW)?

High-net-worth classifications hinge on investable assets—liquid wealth available for investment, excluding primary residences and illiquid holdings like private business equity. This differs from total net worth, which includes all assets minus liabilities. Since advanced strategies require liquid capital to implement, investable assets provide a more realistic measure of planning capacity than total net worth.

While definitions vary by firm and region, the financial services industry generally recognizes these three wealth bands for high-net-worth clients:

- Millionaire Next Door (MND): $1M–$5M in investable assets

- Mid-Tier Millionaire (MTM): $5M–$30M in investable assets

- Ultra-High-Net-Worth Individual (UHNWI): $30M+ in investable assets

Each wealth band introduces distinct planning considerations. MND clients typically face federal estate tax exposure and may benefit from foundational tax management and tax-loss harvesting tactics along with basic trusts. MTM clients encounter concentrated stock positions, multigenerational estate complexity, and tend to qualify for private placements and hedge funds. UHNWI clients typically need dynasty trust structures and sophisticated gifting strategies to address nine-figure estate tax liabilities.

Understanding these distinctions is important for deploying appropriate high net worth strategies.

| Tier | Investable Assets | Key Planning Focus |

|---|---|---|

| MND | $1M–$5M | Estate tax mitigation, retirement optimization |

| MTM | $5M–$30M | Concentrated stock management, alternative investments |

| UHNWI | $30M+ | Family office services, dynasty planning, philanthropic structures |

What are high-net-worth investors concerned about?

While HNW individuals have a number of financial concerns, their #1 concerns are surprisingly straightforward: “Am I going to be ok in retirement?” and “Can I maintain my current lifestyle in retirement?”

But the questions don’t stop there. Beyond retirement, HNW clients are focused on how to:

- Protect wealth amidst economic volatility

- Minimize tax exposure with sophisticated tax management

- Plan for philanthropic goals

- Navigate complex family dynamics and generational estate planning

- Prepare for reductions in the estate tax exclusion

- Preserve their legacy

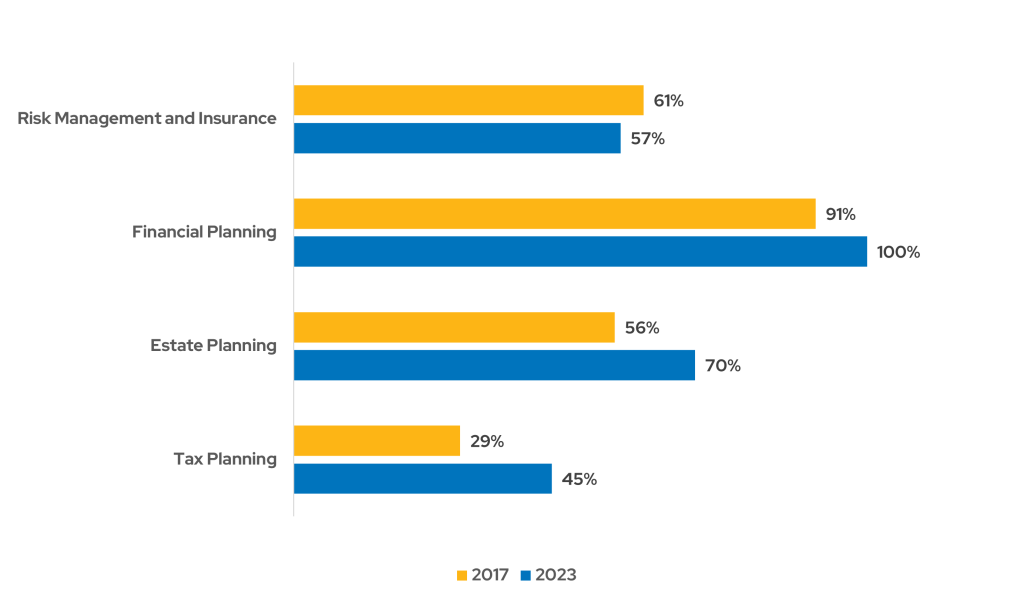

Research shows between 2017 and 2023, HNW clients have shown increasing interest beyond retirement planning. Many of these concerns can be mitigated by working closely with HNW clients and using rapport-building techniques to get a better understanding of their needs and goals. With this deep insight, financial advisors can craft a plan that addresses their concerns and unique circumstances and builds confidence in their financial future.

Why HNW financial planning matters

For affluent households, investment management alone can’t address the layered complexities of substantial wealth. But by coordinating tax, estate, risk management, cash-flow, and goals-based guidance, comprehensive financial planning can help to address the entire financial life of HNW clients. Along with helping clients achieve meaningful outcomes, integrated planning capabilities have the potential to drive growth by attracting and retaining high-net-worth clients.

Client impact

Comprehensive financial planning can deliver multiple potential advantages for HNW households:

- Improved after-tax outcomes – Strategic asset location across taxable, tax-deferred, and tax-exempt accounts can help to minimize annual tax liability.

- Concentration and liquidity-event planning – Coordinated strategies for stock option exercises, business sales, or inheritance windfalls can work to prevent avoidable tax hits and preserve wealth.

- Clearer estate and legacy path – Structured gifting, trust design, and charitable vehicles can help ensure wealth transfers align with family values while minimizing estate tax exposure.

- Coordinated CPA and attorney teamwork – By acting as quarterback, advisors can align CPAs, attorneys, and other specialists around one comprehensive plan to prevent siloed advice and enable more cohesive recommendations.

- Confidence through scenario modeling – Stress-testing different asset classes, spending levels, and market conditions can provide clarity during decision making.

Advisor value

For advisors, comprehensive financial planning for high net worth individuals can strengthen the business model:

- Higher retention and share of wallet – Studies show clients who view you as their financial architect, not just portfolio manager, tend to develop stickier relationships and stay longer.2

- Multi-generational relationships – Planning that involves heirs and trusts can extend client lifecycles across decades.

- Clear differentiation – In a crowded market, holistic high net worth financial planning can separate you from competitors.

- Scalable, repeatable process – Systematized planning workflows and integrated technology can allow you to serve more HNW clients, more efficiently, regardless of your firm’s size or structure.

Putting it into practice

Effective planning layers multiple strategies: a $5M client selling a business might combine tax-loss harvesting in their taxable account, a donor-advised fund to offset capital gains and reduce tax liability, and detailed cash-flow projections to determine safe spending from proceeds. Understanding which financial planning questions to ask clients during discovery is critical for ensuring strategies address real priorities, setting the foundation for the specific high net worth financial tactics covered below.

Legacy planning for HNW clients is about relationships, not just transfers

"Death is not the end. There remains the litigation over the estate."

–Ambrose Bierce

When generational wealth is involved, there needs to be a plan to make sure everything transfers smoothly and without conflict. While many HNW individuals tend to have good relationships with their advisors, building a relationship with the family should be a top priority as well, especially because data indicates:

- Only 60% of practices have a relationship with the client's spouse3

- 45% have a relationship with the client’s children3

- 90% of most children and heirs will leave their parents’ advisor upon receiving their inheritance4

Building relationships with many generations can help advisors understand generational goals. Those relationships can help advisors facilitate timely conversations between the HNW individual and their heirs to help make the transfer process smoother while improving client retention.

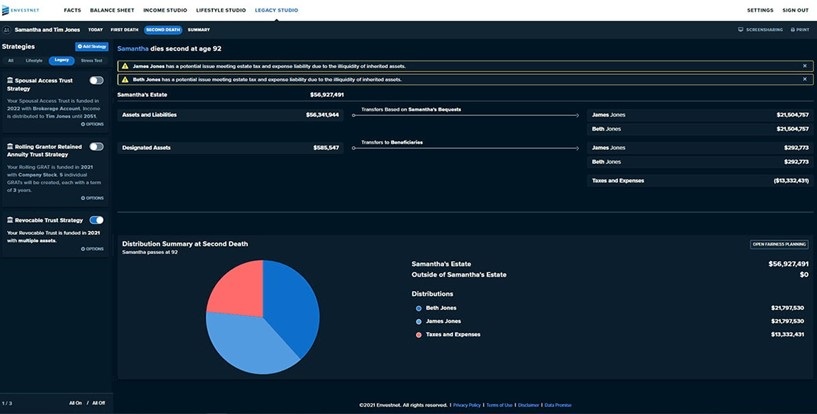

While family dynamics and challenges may be exasperated by wealth, there’s a lot that can be done from a planning perspective to help HNW individuals avoid leaving a legacy of conflict. Tools like Legacy Studio from Envestnet Wealth Studios can help show what the transfer of wealth looks like between generations, the impact of establishing trusts, and the potential benefits of various gifting strategies. It’s well worth exploring these estate planning strategies and building relationships with investors’ families now to make the most of the years to come.

Tips for financial planning for high-net-worth individuals

Successful HNW financial planning unfolds in stages, beginning with foundational goals and gradually incorporating more advanced planning strategies. This structured approach allows advisors to build comprehensive wealth strategies that align with clients' priorities while adapting to their evolving needs over time.

Start with lifestyle, not legal documents

When working with HNW individuals, it can help to start with goals-based planning that addresses investors’ lifestyle and goals instead of focusing on legal documents like wills or trusts. Keeping it simple and focusing on what truly matters to clients can keep clients engaged. It can also uncover gaps and surface hidden assets that might otherwise remain undiscovered.

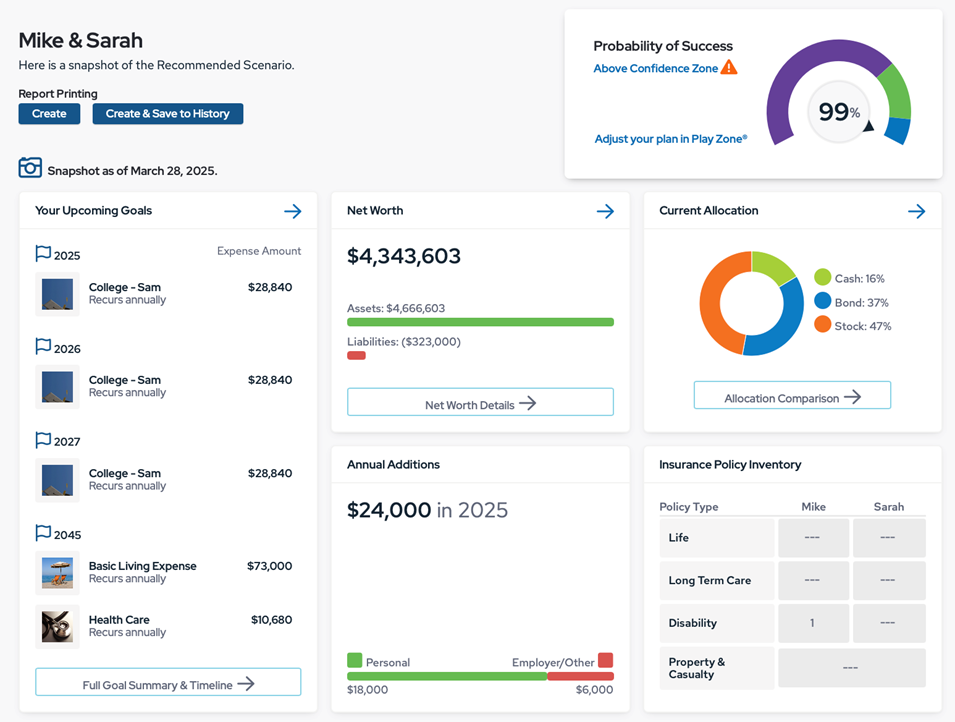

Envestnet’s MoneyGuide Goal Plan (formerly MoneyGuidePro) can help translate clients’ lifestyle objectives into concrete financial strategies. Even ultra-affluent clients benefit from seeing a probability of success for their goals—it makes the abstract feel real.

Transition to cashflow and scenario planning

For many high-net-worth clients, a high probability of success doesn't mean the planning work is done—it means it's just beginning. Once a client’s goals are defined and their basic retirement picture is in focus, that’s your cue to go deeper.

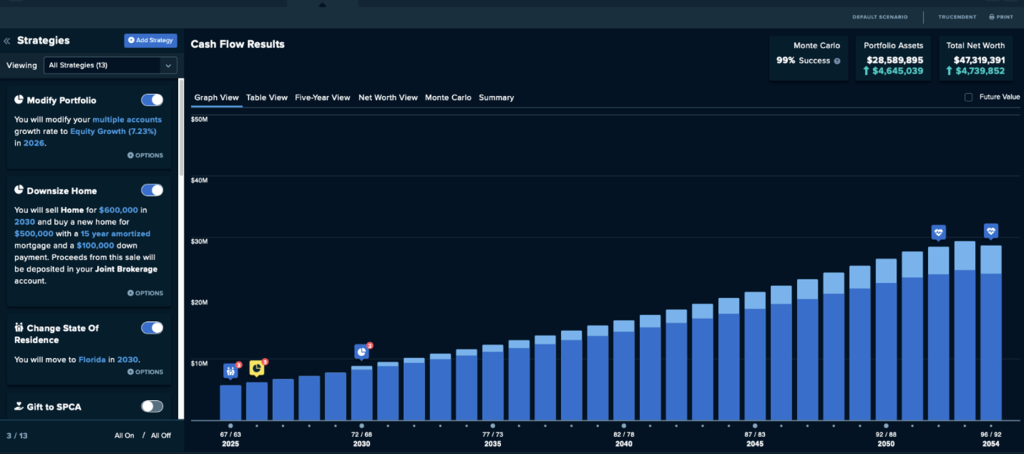

Cashflow and scenario-based planning are critical next steps. You can use Lifestyle Studio from Envestnet Wealth Studios to model real-world events like market declines, Roth conversions, and tax sunsets to show their potential long-term impact. This interactive approach can help HNW individuals become co-creators in shaping their financial future.

Factor in estate planning

Estate planning is complex, but Legacy Studio can help advisors and clients get a better handle on estate planning strategies. Using Legacy Studio, advisors can visualize estate transfers, simulate first and second death scenarios, and model complex trust strategies while quantifying the potential impact on heirs, taxes, and charitable outcomes. Unequal distributions can cause conflicts, and built-in fairness planning features can address prior gifts and sibling dynamics to help families navigate sensitive conversations about these topics.

By providing clear data visualization of different scenarios, advisors can help clients balance financial optimization with family harmony in their wealth transfer strategies.

Transform planning into an ongoing partnership

Family dynamics evolve, laws shift, and charitable priorities change. That’s why MoneyGuide is designed to help advisors seamlessly update plans. The idea is to make planning your service model—not just a one-time event—to strengthen relationships with your clients and their heirs.

As the solid foundation of a comprehensive wealth management relationship, successful financial planning extends beyond investment management to encompass a client's entire financial life.

Neither Envestnet, Envestnet | PMC nor its representatives render tax, accounting or legal advice.

Automate tasks and prioritize relationships with Envestnet | MoneyGuide

By leveraging technology to streamline routine processes and customize investment approaches, advisors can dedicate more time to the meaningful personal connections. With Envestnet | MoneyGuide, advisors can deliver the sophisticated, personalized service that high-net-worth clients expect while building deeper relationships across generations.

Comprehensive planning for mutual success

For advisors serving high-net-worth clients, comprehensive financial planning is a win-win. While helping clients achieve their goals, it simultaneously unlocks opportunities for greater share of wallet through asset consolidation, builds competitive differentiation in the marketplace, and enables intergenerational wealth retention that benefits both advisors and the families they serve.

To take a test drive of Envestnet | MoneyGuide, visit www.moneyguidepro.com/ifa/Home/Trial