While many factors affecting portfolio performance are beyond an advisor's control, taxes aren’t necessarily one of them. That's why we're launching a blog series focused on helping financial advisors adopt a proactive, client-specific, and year-round approach to tax management.

Why it's important to minimize tax drag

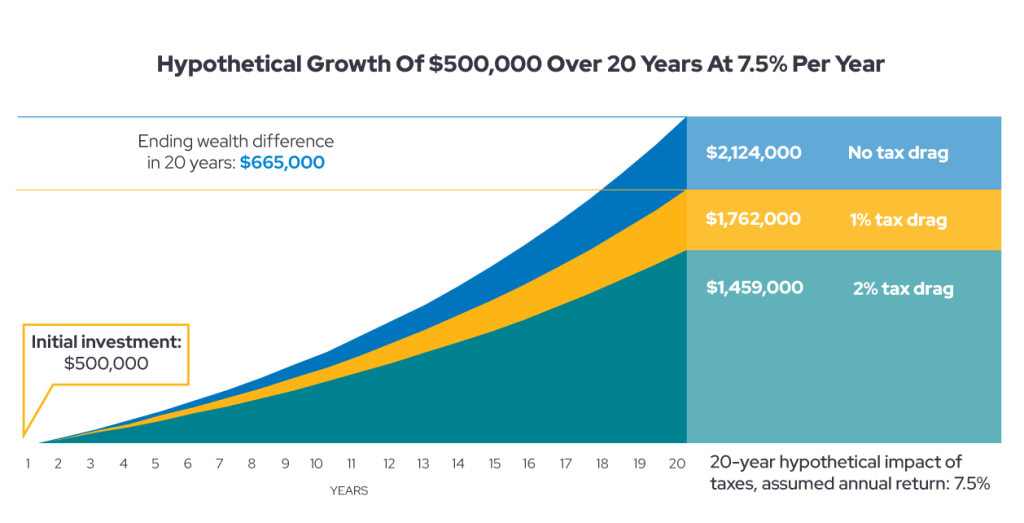

Despite having significant consequences, tax drag often goes unnoticed. This silent threat to portfolio performance quietly erodes investment returns over time, creating what can be thought of as “portfolio leakage” that steadily diminishes value. For some investors, the impact is particularly severe, with taxes on capital gains approaching 50% or higher.

Source: Tax Overlay Service, Tax-efficient investing, Envestnet | PMC, 2024.

With losses of this magnitude, advisors can’t afford to wait until end of year to evaluate potential impacts to clients’ portfolios – especially for high-net-worth (HNW) investors in higher tax brackets. Many HNW clients wouldn’t be happy receiving an exorbitant tax bill that could have been avoided by proper planning.

Since taxes directly affect both investment outcomes and client satisfaction, proactive tax management is a critical tactic for client retention.

Clients are asking for tax planning – all year long

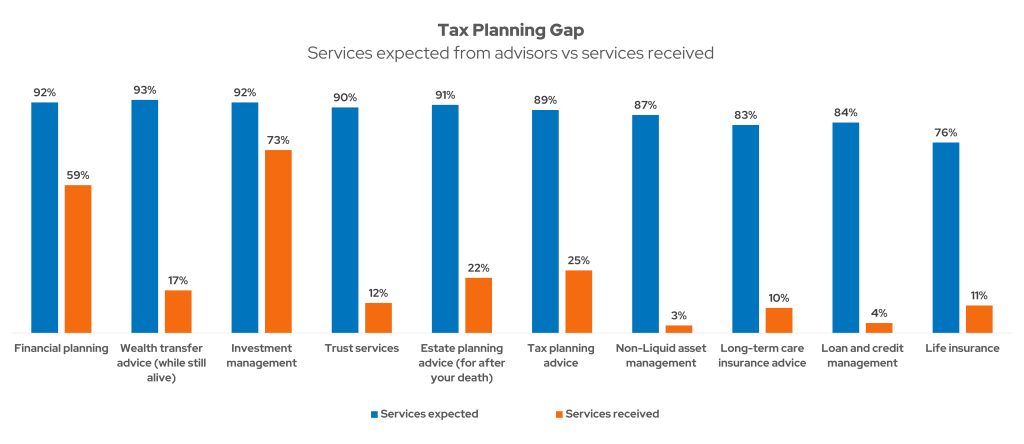

Research shows that investors expect advisors to consider taxes when managing their portfolios. In a 2024 Cerulli survey, HNW practice management executives ranked tax preservation as the second most important objective for their clients, and wealth preservation (also served by minimizing taxes) as the first.1

Neither Envestnet, Envestnet PMC nor its representatives render tax, accounting or legal advice.

Among planning services at HNW practices, tax planning has been one of the fastest-growing service areas in the past few years.1 While 89% of clients expect tax planning advice from their advisors, we’ve found that only 25% of clients are actually receiving that service.

Tax management is performance management

Many advisors evaluate potential impacts to clients’ portfolios and take action at the end of the year, when most funds have reported their capital gains. While this may seem practical, it is often reactive and can leave valuable opportunities on the table.

Tax management does not have to be just about reducing a client’s tax bill. It can improve net returns. No matter where your client falls in the tax bracket, every unnesssary dollar lost to taxes is a dollar not contributing to a client’s overall financial future. And your clients will feel that.

Moving beyond traditional year-end tax loss harvesting does more than help reduce tax exposure. It can help minimize short-term capital gains, and enhance the overall value clients perceive from your services.

Tax management goes beyond loss harvesting

While tax loss harvesting and selling investments at a loss is a critical strategy for offsetting any capital gains that have realized throughout the year, truly optimizing tax efficiency goes beyond tax loss harvesting.

Manual tax loss harvesting can be both time-consuming and complex, so it’s no wonder many advisors address it at year-end. But this approach has limitations. If the market rallies in the fourth quarter, like it did last year, there may be few losses available to harvest. Timing is a key factor – directly impacting potential opportunity, or lack thereof.

Advisors who want to deliver more consistent value throughout the year may also employ additional strategies such as gain-loss matching, deferring short-term gains, or aligning trades with a client’s specific tax budget.

An always-on approach that leverages tax overlay can make a significant difference. Advisors can offer clients a proactive tax management solution that’s customized for each client’s unique tax situation, preferences, and goals. Once preferences are set, our service continuously monitors the client’s portfolio, tracking year-to-date gains and identifying opportunities to offset them through tax-smart trades, with no annual manual work required. As long as the market is open, the service is working. Even when account changes are initiated, the overlay can evaluate their tax impact in real time and suggest more efficient alternatives that maintain similar risk exposure.

A new standard of financial advice

Tax planning has become an integral part of comprehensive financial advice, and is no longer just a separate service handled by tax professionals. Advisors have a huge opportunity to differentiate their practice and position themselves as true wealth managers by incorporating tax management strategies.

At Envestnet, we’re here to help with a wide range of tax management solutions. Envestnet has been actively managing portfolios for 21 years—all the way back to 2004, with a strong breadth of capabilities that include advanced tax overlay, tax-loss harvesting, and integrated tax management solutions optimizing after-tax returns across multiple market cycles and tax law changes.

Make tax management your competitive edge

Tax alpha is real, and it’s year-round. This is why we’ll continue to address different aspects of tax management to help advisors incorporate these strategies to their practice.

In the next article of our tax management series, we’ll take a deeper dive into tax loss harvesting and demonstrate how it’s just one lever in a broader strategy. Stay tuned to see what real tax management looks like.

To learn more about Envestnet Tax Overlay, visit https://www.envestnet.com/tax-overlay