Make tax management easier with Envestnet's Tax Overlay

Leverage tax overlay to bring holistic, automated tax management across your book of business.

Experience the benefits of outsourced tax management

Go beyond mere tax loss harvesting by addressing tax management needs while adhering to your client's portfolio strategy. Use Envestnet’s Tax Overlay service to:

Grow your practice with automated tax management

See how providing holistic, personalized tax management services can be a potential win-win for you and your clients.

Work with clients—instead of working on their taxes

Extensive Automation

Envestnet's Tax Overlay Services team automates tax management for more than $24B in assets at over 100 firms.*

Enhanced Customization

Our patented risk- based optimization process is designed to manage portfolios to customized client/account specific mandates.

Tax Management

Sophisticated tax management services work to reduce tax exposure with the goal of improving after-tax returns.

Break

On-Demand Webinar—Holistic Tax Management: What are Advisors Missing?

Advisors have a lot on their plates and planning for their clients’ taxes and tax loss harvesting eat up much of that time. In this session, we walk you through some of the solutions advisors use to go on the offensive when it comes to their clients’ taxes and demonstrate how to incorporate truly active, holistic, tax management.

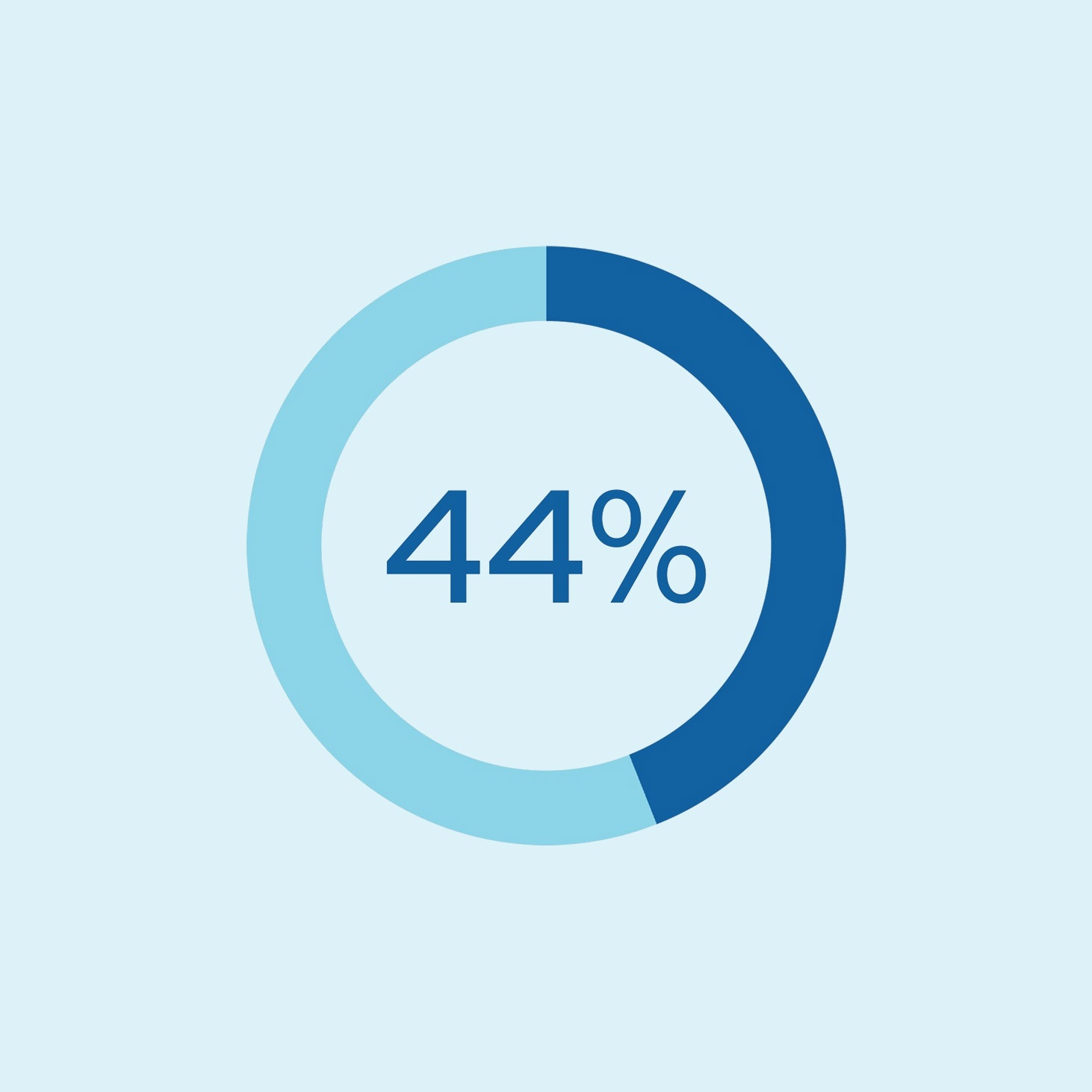

44% of portfolio gains could go to taxes...but they don't have to

Envestnet's Tax Overlay service helps manage tax drag for more tax-efficient investing.

Learn more about our Tax Overlay service

-

Resources

Tax Overlay Service: Tax-Efficient Investing

Capital gains taxes—on profits from investments—can be your portfolio’s biggest cost. They may reach 50% or more. Learn why managing them year-round matters. Read our brochure to find out more.

-

Resources

Fundamentals of Tax Loss Harvesting

In this guide we dive into everything investors need to know when it comes to tax loss harvesting.

-

Resources

Guide to Holistic Tax Management

This guide explores how holistic tax overlays can help manage equity portfolios in taxable accounts, deliver tax alpha, and reduce complexity for affluent clients. Read on to learn more.

-

Resources

After-Tax Reporting: Showing the Potential Value of a Holistic Tax Overlay

Envestnet’s Tax Overlay helps manage capital gains based on client instructions while tracking a target model. This proactive strategy aims to boost after-tax returns. Read our brochure to learn more.

Line break

Connect with us!

* Required Field

Make tax-smarter investing automatic

Add value year round with tax efficient strategies that work to minimize capital gains and maximize tax efficiency.