Tax management advice can be a good way for a financial advisor to demonstrate their value to their clients. Clients can often swing between two extremes—being so worried about taxes that it adversely affects their decision making, or ignoring taxes until December or April, when they can do little strategic management.

It is important for financial advisors to take time to explain both short- and long-term capital gains. Tax-loss harvesting is often a part of the conversation, as it is a common way advisors attempt to limit the capital gains their clients realize in a year. Advisors may also employ gain-loss matching, gains deferral, and other tactics that can be used to ensure that a client's portfolio is managed to their specific tax budget.

But manual tax loss harvesting and other tactics can lead to unintended consequences and the timing can be challenging (e.g., there must be losses available, the client can miss out on substantial gains as you wait out the wash sale period, etc.). Such efforts are also traditionally time consuming, as the advisor must assess each client’s needs individually. That is one reason why tax management is often thought of as a year-end or annual process only.

Simply explaining and utilizing tax management techniques can go a long way towards addressing the 75% of clients who report not receiving tax planning advice. However, savvy advisors can do much better than that—utilizing a more precise, “always-on” approach to strategic tax management across their book of business that can strengthen client relationships and potentially improve client outcomes.

Efficient, always-on tax management

Rather than only discussing tax management seasonally, what if there was a way to deliver tax support to your clients that could be always on (vs. yearly or even quarterly) , and customized to each client’s individual capital gains budget?

Imagine a tax management service that, once set to your client’s preferences , would keep a constant eye on the capital gains their account has realized YTD, identifying if there are opportunities with securities within the portfolio that could be traded to offset those gains. No annual “manual labor” to be completed by the advisor. Instead, as long as the market is open, the technology monitors the portfolios, looking for opportunities for tax management.

And further imagine, every time a trade is requested within the account, the same service would look at the tax impact of it, given the client's specific tax preferences, to see if there is a more tax-efficient way to get the portfolio a similar risk exposure.

With the right support, sophisticated tax management literally sits at the advisor’s fingertips, ensuring that clients are receiving personalized tax management, not once a year, but year-round.

Year-round tax management can benefit both advisors and their clients

Implementing year-round tax management strategies can help improve client outcomes. Your clients can benefit from not only a lower annual tax bill, but also more certainty around what their long-term capital gains taxes could be. They can enjoy the convenience of discussing both the contents of their portfolio and tax-efficient investing with you at the same time, as you’ll have the correct data at your fingertips for the discussion. And as they see these results, they may also gain confidence that you are addressing their unique risk tolerance, preferences, and tax sensitivities. That confidence can help to build the trust that feeds deep, long-term client relationships.

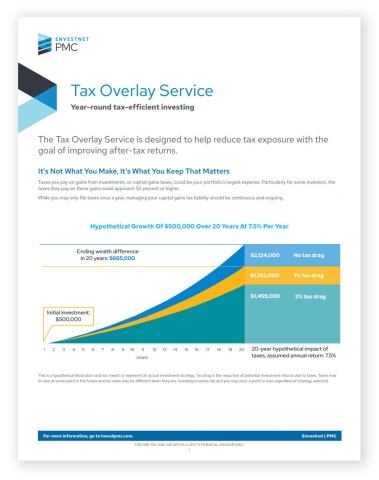

Download this PDF for a deeper dive into the client outcomes you could expect with year-round tax-efficient investing.

As more and more advisors adopt various technology platforms, year-round tax management becomes an “if you don’t deliver it, someone else will” issue. As we mentioned at the beginning of the post, we already know that clients want you to advise them about tax planning. It is important for you to meet that need. Even with various technology tools, advisors are often either going account by account to manage client taxes, or they may avoid taking a client-focused approach. By taking advantage of outsourced tax management services, advisors are able to both take a client focused approach and scale their practice, offering the service to all their clients, when appropriate.

The conversations you have with your clients around taxes, and the tax savings you help them achieve, can help to strengthen your client relationships and the future of your business. The opportunity is there. Advisors just need to take advantage of the services and support available to make the shift from seasonal tax support to year-round tax support.

For more examples of how to efficiently personalize the way you serve your clients, at scale, visit envestnet.com/personalize.

The information, analysis and opinions expressed herein are for informational purposes only and do not necessarily reflect the views of Envestnet. These views reflect the judgment of the author as of the date of writing and are subject to change at any time without notice. Nothing contained in this piece is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type.

Neither Envestnet, Envestnet | PMC™ nor its representatives render tax, accounting or legal advice. Any tax statements contained herein are not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state, or local tax penalties. Taxpayers should always seek advice based on their own particular circumstances from an independent tax advisor. Client must carefully determine if the use of tax overlay services is appropriate for their circumstances, risk tolerance, and investment objectives. Tax management services are limited in scope and are not designed to permanently eliminate taxes in the account. In providing tax overlay services, Envestnet will allow Client's account to deviate from Client's selected investment strategy. Client's account may experience significant performance differences from the selected investment strategy due to Client's selection of tax overlay services. Envestnet makes no guarantee that the account's performance will be within any range of the selected investment strategy or the strategy´s benchmark. If Client subsequently disables tax overlay services this may result in the recognition of significant capital gains.

FOR INVESTMENT PROFESSIONAL USE ONLY ©2023 Envestnet. All rights reserved.

* Spectrem August 2018 Defining Wealth Management. Neither Envestnet, Envestnet | PMC nor its representatives render tax, accounting, or legal advice.