The piece was written in collaboration with Phil Buchanan, Executive Chairman, Cannon Financial Institute.

This year, the U.S. is expected to surpass 8.8 million high-net-worth (HNW) investors1. Many of them hold high expectations, so as a financial advisor, knowing the right questions to ask clients is non-negotiable. They’re seeking the personalized attention of a family office, with the speed and convenience of a modern, digital-first relationship.

Many HNW investors are self-made, confident decision-makers who believe they can manage their own wealth. And in a sense, they can. That’s why they aren’t interested in having an advisor tell them what to do. Instead, successful advisors guide clients to achieve better outcomes by asking thoughtful questions.

At Envestnet, we have access to data on approximately 1/3 of all U.S. financial advisors, and we’ve found that a disciplined, empathy-rich questioning approach is a powerful way to build trust, uncover needs, and accelerate organic growth. This five-stage questioning framework, backed by our experience with high-net-worth consulting, is designed for use with clients and can be easily integrated into your practice's workflow.

Why is asking questions as a financial advisor powerful?

Three foundational truths shape every client interaction:

- My story is more important than your story

- When you encourage me to tell my story, I’ll tell you every way you can help me

- When I’m talking, I like you better

This is why high-performing advisors often refrain from rushing into recommendations. They pause. They listen. And they ask questions that uncover what really matters.

Imagine yourself as a client. You walk into your advisor’s office, where he or she runs through a list of the risks currently at play for your investment portfolio and then launches into a detailed explanation of what changes they recommend to your financial plan and investment portfolio. At the end of the presentation, they hand you a summary of everything they presented. You may be impressed with their thoughtfulness and organization. You may like the direction things are headed. But do you feel heard? Are you sure that they customized the plan for your family? Do you remember the details?

Now, imagine a meeting where you walk in and there is no presentation to start with. There’s a discussion. Your advisor asks numerous questions, listens attentively, takes notes, and then follows up with additional questions. Together, you identify the risks that are most pertinent to your family (you’ve brought up several yourself). Together, you talk through your options and choose what is best for you.

Many advisors “push” the risks and information to their clients, like in the first example. This can be effective in some cases, but is less likely to be relationship-building. How many times does a doctor dictate to their patients, “you should stop X, and start Y,” only to be ignored? In the second example, the advisor uses questioning to guide the client to verbalize key information themselves. It is a two-way conversation. The client is engaged, feels heard, and is more likely to retain the information and buy into the decisions made.

If it feels a little awkward to dive right into asking questions, that’s likely a sign that you need to spend a little time first building rapport with your client. Before you can guide, you have to connect, and that connection begins with how you ask, not just what you ask. Effective questioning is rooted in genuine curiosity and active listening. It requires finding common ground, personalizing your language, and demonstrating empathy in every interaction. Subtle cues, such as mirroring body language and maintaining professional courtesy, go a long way in building trust. As one client put it, “You asked about our ‘why’ before pitching the ‘what.’ That made all the difference.”

How asking questions helps clients make more informed decisions

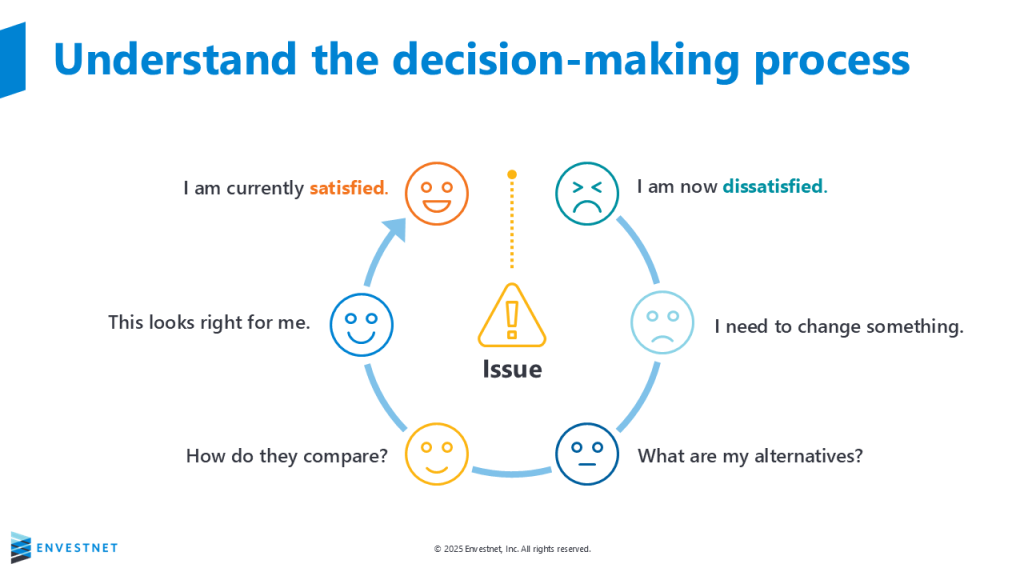

Our colleagues at the Cannon Financial Institute use a powerful graphic to understand how clients make decisions.

When we use questioning skills, we help the client move through this process in a clockwise direction: to identify their own issues, think through what they need to change, understand their alternatives, and provide guidance as they choose the option that is best for them.

How to ask the right questions as a financial advisor, with examples

1. Establish trust and context

Before diving into the client’s investment goals, risk tolerance, or other more tactical topics, begin with open-ended questions that demonstrate your curiosity about their lives.

A few questions a financial advisor should ask might include:

“Walk us through the decision you’re most proud of in the past 12 months.”

“Which family voices aren’t in the room today but should be?”

Make eye contact first, open your notebook last.

2. Surface the issue (dissatisfaction trigger)

Once you have established a good rapport for the meeting, it is time to identify the issue that needs to be addressed. That might mean asking the client bridging questions, such as “What shifted since then that feels off track?” or “What are your biggest concerns about your wealth over the next five years? Or ten years?”

The goal here isn’t to identify the issue for them. It is to guide the client to voice any concerns they have before racing straight to solutions.

3. Quantify the consequences

Now that you’ve established the issue and triggered dissatisfaction, it can be helpful to use numeric framing (i.e., putting numbers to the problem) to make the pain or urgency of the issue more self-evident.

That might look like asking, “If we do nothing for five years, what’s the potential cost in dollars or in peace of mind?”

Be prepared to be an active participant in this brainstorming. Your client might not have the knowledge or skill set to explore all the facets of the issue. Your input both ensures that the client feels supported and demonstrates your expertise and experience.

4. Translate investment options into life outcomes

At this point in the discussion, help your client understand what their options are in plain English. As you do that, take care to go beyond just giving return projections. It is more powerful to take it one step further and explore how each option could play out in the client’s life.

Once you have all the options on the table, financial planning questions to ask clients might look like, “When you picture each of these paths, which aligns best with your family’s values and goals?”

5. Paint a positive vision and drive urgency

After focusing on and exploring the issue, it is powerful to leave the client with a positive vision for the future. Try asking a question like, “So if we choose to go with option B, let’s think about what that means for your family in 2040. What is jumping out for you?”

After asking the question, take a breath and count to seven. The next words that are spoken in the meeting are gold.

After you’ve listened to their answer, ask “Why wait?” If there is a reason to delay action, consider it carefully. In many cases, there won’t be. You are creating gentle urgency by asking the question after the client has just imagined their ideal future.

Tech tip: Implement questioning today

Embedding questions into the high-net-worth client experience

To grow a high-net-worth (HNW) client base, advisors must move beyond transactional conversations and embed strategic questions throughout the client experience. The goal is simple: every answer should create a new workstream, and every workstream should strengthen client retention.

To operationalize this, start by digitizing pre-work using a secure portal to gather foundational data before meetings. This ensures in-person time is reserved for deeper, more meaningful dialogue. Consider establishing a weekly “Question Lab”— a 30-minute Friday huddle to role-play HNW personas, practice asking better questions, and critique real-world follow-ups. Track your impact through a dashboard that connects the dots between questions asked, opportunities logged, solutions delivered, and revenue booked. Finally, take steps toward building a “pseudo family office” by involving tax, estate, and philanthropic partners in client debriefs, and use a shared action board to coordinate deliverables across the team.

This disciplined, question-driven approach helps advisors uncover more value, demonstrate deeper expertise, and build lasting relationships.

Strong client relationships begin with thoughtful questions. Let us help you make more time for the conversations that matter most: www.envestnet.com/private-wealth