Unified Managed Accounts

Deliver highly customized portfolios that align with investors’ goals, values, and tax needs—while maximizing scale and efficiency.

Unlock the Power of the Unified Managed Account

Unified Managed Accounts (UMAs) represent one of the fastest-growing segments in managed investment solutions—and it’s clear why. By consolidating multiple investment vehicles—including Separately Managed Accounts (SMAs), mutual funds, ETFs, and individual securities—into a single brokerage account, UMAs enable seamless coordination of client-specific strategies. These may include tax and impact overlays, index replication, tax-loss harvesting, and customized restrictions, all designed to enhance efficiency and support business growth.

Through Envestnet UMA’s platform, advisors can:

Consolidate multiple portfolios from various managers into a single account to meet the needs of individual investors

Choose from over 1,700 third-party SMAs integrated with UMA administration

Centralize management, automate tasks, and streamline trading to save time and increase efficiency

Prepare for client and prospect meetings with automated proposal generation, investment research, and analysis tools

Further customize portfolios with tax overlay, direct indexing strategies, and more

Benefit from potential cost savings through negotiated pricing with leading asset managers

Personalization: Your competitive edge

Research has shown that 70% of wealth management clients view highly personalized service as a factor in deciding whether to stay with their current advisor.2 Envestnet's UMA platform allows for personalization at scale through features like proposal creation with custom models, a comprehensive portfolio construction process, and a system for managing individual sleeves within a UMA. The platform also supports various strategies within one account, including advisor sleeves, SMA sleeves, FSP sleeves, and single-security sleeves.

Uncover more opportunities to personalize client portfolios

Tax management

Deliver ongoing tax support, customized for each client’s individual tax needs, preferences, and goals.

Direct indexing

Create tax-efficient, customized portfolios that track market indices while allowing for individual security selection and optimization.

Take action with the Envestnet RIA Marketplace

The Envestnet RIA Marketplace is a program that offers advisors a low-cost managed account solution. It was built to allow you to expand your investment capabilities through access to third-party money managers, and ultimately assist you in delivering personalized portfolio management that aligns with your clients’ evolving financial goals and expectations.

Harness the power of Envestnet UMAs today

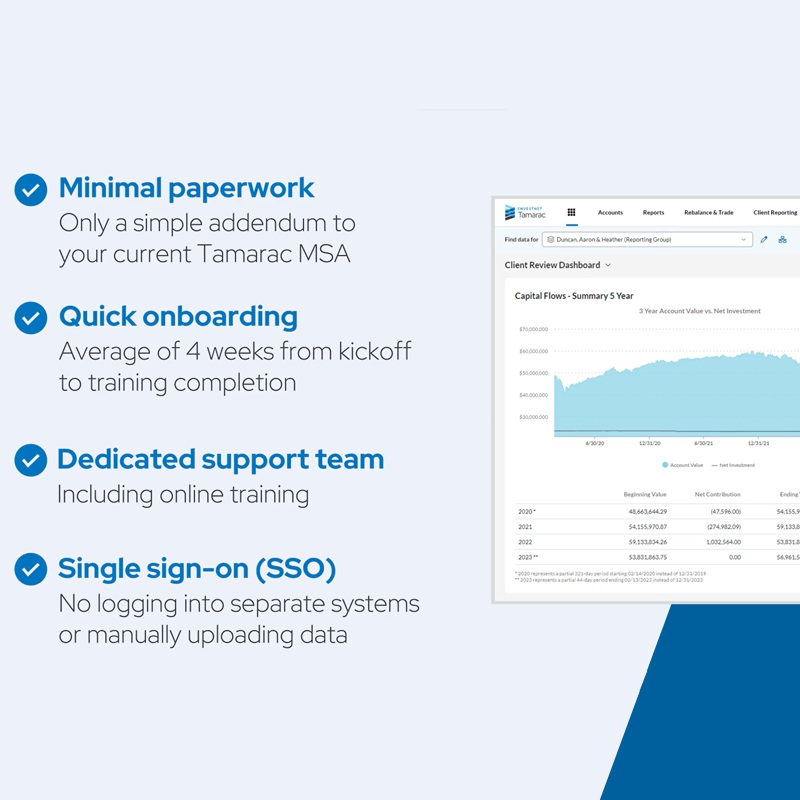

We’ve made it simple for RIAs to get started with UMAs, with:

Discover how to deliver greater personalization at scale with Envestnet’s Unified Managed Account Solution

Contact usLearn more about Unified Managed Accounts

-

Brochure

Deliver Personalized Portfolios At Scale

Today’s top RIAs are evolving the products and services they offer to deliver more personalized portfolios that are tailored to their clients’ unique needs and preferences.

-

Blog

Help clients meet their goals with managed accounts & sustainable investments

Managed accounts and sustainable investing options can enable RIAs to deliver more personalized service to clients.

-

Webpage

Envestnet RIA Marketplace

Align with clients' evolving investment needs.

-

Blog

How unified managed account solutions can help meet complex needs

As the financial lives of high-net-worth (HNW) clients become increasingly complex, so do their expectations regarding portfolio customization, tax efficiency, and transparency.

1 Cerulli Edge—U.S. Managed Accounts Edition. July 21, 2022.

2 Predicts 2019: Marketing Seeks a New Equilibrium. Gartner Research.

Disclosures

The information, analysis, and opinions expressed herein are for general and educational purposes only. Nothing contained herein is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. The services and materials described herein are provided on an ‘as is’ and ‘as available’ basis, with all faults. Nothing contained in this presentation is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. Envestnet disclaims all warranties, express or implied, including, without limitation, warranties of merchantability or fitness for a particular purpose, title, non-infringement or compatibility. Envestnet makes no representation or warranties that access to and use of the internet while utilizing the services as described herein will be uninterrupted or error-free, or free of viruses, unauthorized code or other harmful components. Envestnet reserves the right to add to, change, or eliminate any of the services and/or service levels listed herein without prior notice to the advisor or the advisor’s home office. This document refers to information products or services that may be in development and not yet available. Accordingly, nothing in this presentation should be construed as a representation or legal agreement by Envestnet to make available specific products or services (including, without limitation, concepts, systems or techniques.) Past performance is not indicative of future results.