Tax-managed strategies

Tax-managed accounts are investment solutions designed to help minimize tax liabilities and boost returns by taking advantage of tax-smart strategies. For a more comprehensive tax advantage, advisors can pair these accounts with Envestnet’s Tax Overlays in an effort to enhance portfolio outcomes beyond standalone solutions.

How can advisors leverage tax-managed accounts?

Tax-managed accounts are designed to help maximize tax efficiency through portfolio management strategies like tax loss harvesting. Options include mutual funds to limit capital gains, tax-managed SMAs, ETFs offering low-turnover and in-kind redemptions, and UMAs that combine multiple investment vehicles into one account with a tax-aware overlay.

Line Break

Manage after-tax returns for your clients

Enable tax-loss harvesting

Implementing tax-loss harvesting strategies allows for the realization of losses to offset gains, thereby reducing taxable income.

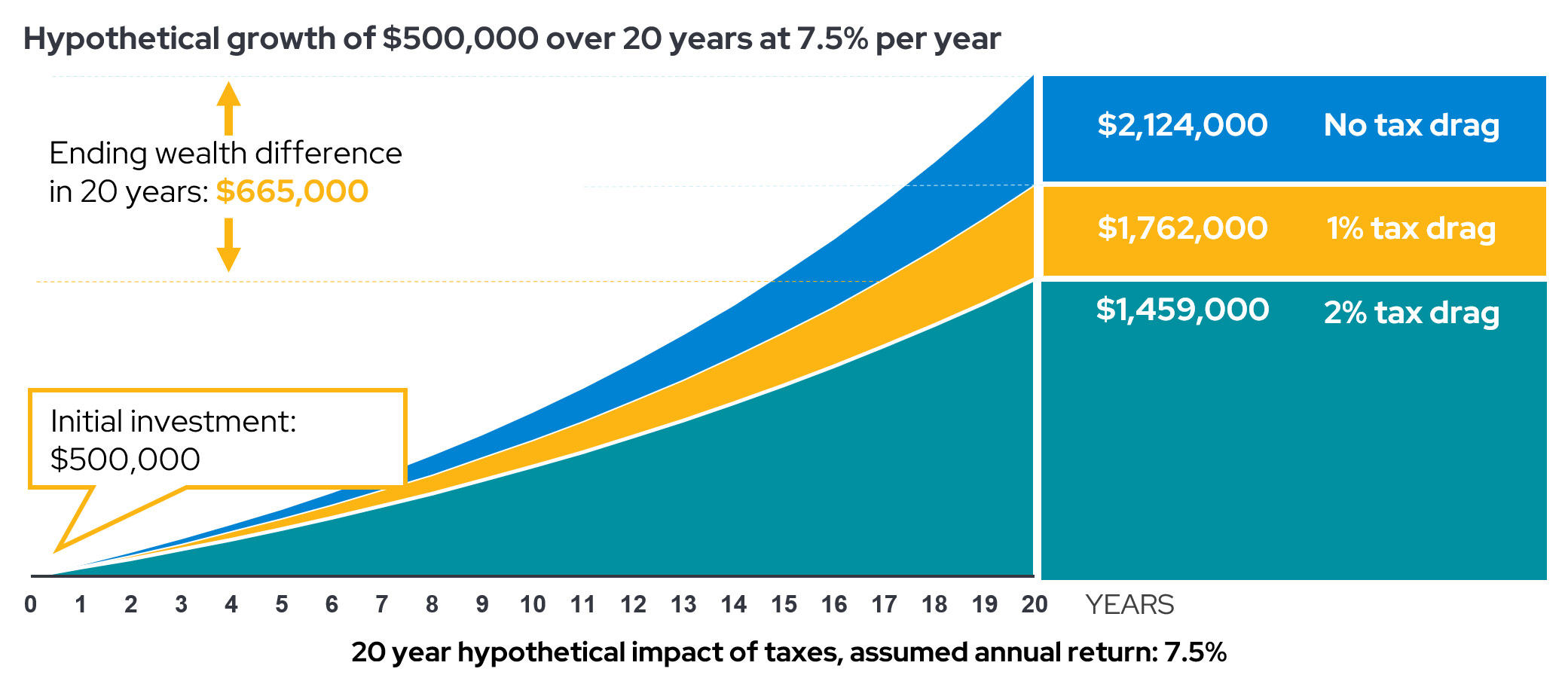

Reduce tax drag

By minimizing unnecessary taxable events, tax-managed accounts help in reducing tax drag, enhancing the efficiency of investment management.

Manage after-tax wealth

Aligning investment strategies with clients' specific investment objectives ensures the growth of after-tax wealth over time.

Line break

How does tax-managed investing compare?

Compared to traditional investment methods, tax-managed strategies focus on after-tax returns, providing clients with more efficient investments. These accounts can offer significant tax savings – particularly when advisors deploy techniques like tax loss harvesting and strategic asset allocation.

Envestnet’s comprehensive solutions, including tax overlay services and direct indexing, empower advisors to implement personalized, tax-efficient strategies that go beyond standard portfolio management.

This is a hypothetical illustration and not meant to represent an actual investment strategy.

Tax drag is the reduction of potential investment returns due to taxes.

Taxes may be due at some point in the future and tax rates may be different when they are.

Investing involves risk and you may incur a profit or loss regardless of strategy selected.

Frequently asked questions about tax-managed accounts

What is a tax-managed SMA?

What is a tax-managed mutual fund?

How does tax drag impact investment returns?

Does Envestnet offer tax-managed accounts?

4 tips for managing capital gains taxes

Taxes are often a client’s biggest expense. But they can also create an opportunity to enhance your value by proactively identifying ways to help your clients save.

Schedule a 15-minute discovery call with us to discuss tax management strategies for your practice.

Connect with usRelated content

-

Whitepaper

Unlocking Personalization at Scale to Better Help Serve Clients Today and Tomorrow

Envestnet’s concept of the Intelligent Financial Life™ represents a shift in the way we approach financial management.

-

Whitepaper

Annuities as an Asset Class for Fee Based Advisors

RIAs usually emphasize investment-centric approaches that rely on earning the risk premium from the stock market as the most effective way to support a retired client's financial goals.

-

Whitepaper

Help Clients Keep More: Managing the Impact of Taxes in a Personalized Way

In this issue of Sharing Perspectives, we offer insights on the importance of tax optimization and why a personalized approach matters.

-

eBook

Rethinking Expectations for High-Net-Worth Investors

This study looks at advisors who serve HNW clients to find out which services they use most, what they’re happy with, and where there is room for improvement.

-

eBook

An Opportunity within Reach: A Guide to Retaining Today's High-Net-Worth Investor

Whether your clients have wealth in the $1 to $5 million range, the $5 to $30 million range, or $30 million and above, this guide to retaining HNW clients is intended to provide valuable insights.

-

eBook

An Opportunity within Reach: A Guide to Understanding Today's High-Net-Worth Investor

This guide, the first in a series of practical implementation guides, is meant to help you understand today’s HNW investors.

-

eBook

Investment Methodology Guide

This Investment Methodology Guide summarizes PMC’s research and portfolio construction work, which are embedded into services available on the Envestnet platform.

-

Whitepaper

Asset Class Portfolios Methodology

More than half a century has passed since Markowitz introduced the Nobel Prize-winning theory of optimal portfolio allocation in the mean-variance framework.

-

Brochure

Active ETFs are Gathering Steam. What Are They Anyway?

When most people think of Exchange-Traded Funds (ETFs), their minds turn to passively managed products. The growth of active ETFs is changing the landscape, though.

-

Brochure

Overview: FIDx Desk

FIDX Desk expands the solutions you can bring your clients by providing access to a diverse selection of annuity providers and products.

-

Brochure

PMC Foundation Series Portfolios

Using a proprietary methodology, PMC constructs a series of risk-based asset class portfolios (ACPs) at various domestic equity tiers, each with a multitude of diversifying asset class combinations.

-

Brochure

Values Overlay: Personalized Values-Based Screening

The values overlay program at Envestnet allows clients to apply customized values-based restrictions to their investment portfolios.

-

Brochure

Tax Overlay Service: Tax Efficient Investing

The Tax Overlay Service is designed to help reduce tax exposure with the goal of improving after-tax returns.

-

Brochure

The Nuts and Bolts of ETFs

In the first post of this series, we investigated the potential advantages of ETFs and how they may benefit investors.

-

Brochure

Do Active ETFs Delivery on Tax Efficiency?

Active ETFs can offer significant tax reductions, on average, versus active mutual funds in three of the four categories we examine. Active ETFs may provide direct cost savings, too.

-

Brochure

Foundation Series Portfolios: Low Cost, Low Minimum Models

For accounts over $2,000, the PMC Foundation Series include five suites of portfolios designed to provide low-cost investment exposure through index mutual funds or ETFs.

-

Brochure

PMC Active Passive Foundation Portfolios

Constructed exclusively with PMC’s proprietary ActivePassive ETFs, the PMC ActivePassive Foundation Portfolios bring together two seeming opposite investment approaches.

-

Brochure

PMC Environmental Active Passive Portfolios

A diversified portfolio solution for investors looking to manage exposure to climate risks and capture climate related investment opportunities.

-

Brochure

Values Overlay Services

Values Overlay Services provides a truly customized experience, allowing advisors to exclude investment exposures based on a client’s personal preferences.

-

Brochure

Strategic ETF Portfolios

Featuring thoughtful asset allocation and systematic rebalancing, the PMC Strategic ETF portfolios are a straightforward investment solution intended to help investors.

Disclosures

The information, analysis, and opinions expressed herein are for general information only. Nothing contained in this website is intended to constitute legal, tax, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. Investing carries certain risks and there is no assurance that investing in accordance with the portfolios or strategies mentioned will provide positive performance over any period of time. Investors could lose money if they invest in accordance with the portfolios or strategies discussed herein. Past performance is not indicative of future results.

Neither Envestnet, Envestnet | PMC™️ nor its representatives render tax, accounting or legal advice. Any tax statements contained herein are not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state, or local tax penalties. Taxpayers should always seek advice based on their own particular circumstances from an independent tax advisor. Client must carefully determine if the use of tax overlay services is appropriate for their circumstances, risk tolerance, and investment objectives. Tax management services are limited in scope and are not designed to permanently eliminate taxes in the account. In providing tax overlay services, Envestnet will allow Client's account to deviate from Client's selected investment strategy. Client's account may experience significant performance differences from the selected investment strategy due to Client's selection of tax overlay services. Envestnet makes no guarantee that the account's performance will be within any range of the selected investment strategy or the strategy´s benchmark. If Client subsequently disables tax overlay services this may result in the recognition of significant capital gains.