Choosing the right trading technology for RIAs can feel urgent—especially when internal resources are stretched and RIAs are under pressure to do more with less. Many firms want a solution they can “turn on and go,” but that’s one of the biggest misconceptions in our industry.

The reality: Implementing a trading tool should be more than flipping a switch. The best outcomes come when firms invest time in customizing the tool to their workflows, integrating it with their tech stack, and training their teams. That’s why the quality of onboarding and ongoing support is just as important as the technology itself.

If your firm is evaluating new trading tools, consider the following core technology features, critical service offerings, and exciting new features when making your decision.

Core features of RIA trading platforms

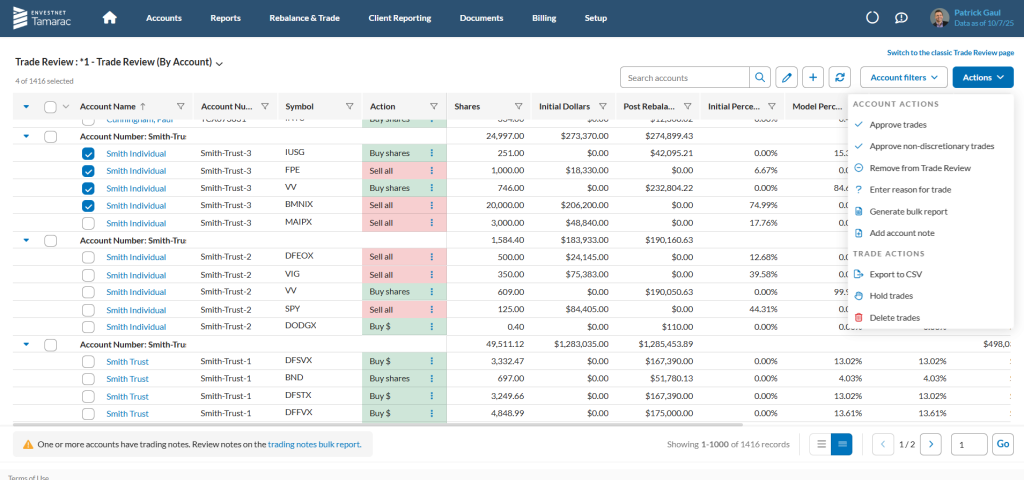

The right trading technology for RIAs should do more than execute trades. It should empower RIAs to deliver personalization at scale, while maintaining tax efficiency and operational ease. Key capabilities to evaluate include:

Mass customization at scale

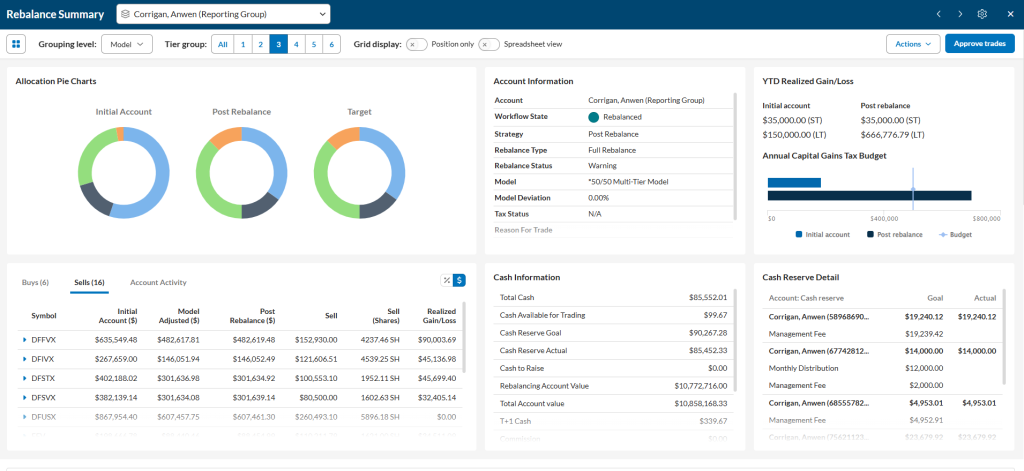

This allows RIAs to tailor models for individual clients, families, or segments while still maintaining efficiency across the firm. Rank-based modeling ensures that priorities, such as tax optimization or liquidity needs, are applied consistently across complex portfolios.

Comprehensive security rules

RIAs need tools that support firm-level control and compliance. Comprehensive security rules, including customizable fee schedules, trading restrictions, and cash management functions, allow firms to enforce trading policies automatically, helping to reduce operational risk and ensure regulatory alignment. Cash management tools allow RIAs to maintain target reserves while optimizing liquidity and returns.

Tax-aware rebalancing

RIAs should look for tax-aware rebalancing tools that support tax-loss harvesting and household-level rebalancing across SMAs, UMAs, alternatives, and aggregator accounts. These capabilities help RIAs maximize after-tax returns while maintaining alignment with client objectives. Household-level visibility ensures that related accounts are managed efficiently as a single portfolio.

UMA and managed account integration

A fully integrated trading tool should support UMA and managed account workflows from modeling to proposal to portfolio implementation. This kind of end-to-end integration reduces manual work and ensures consistency between the models RIAs create and the portfolios they manage. It also enables faster proposal generation and implementation for clients.

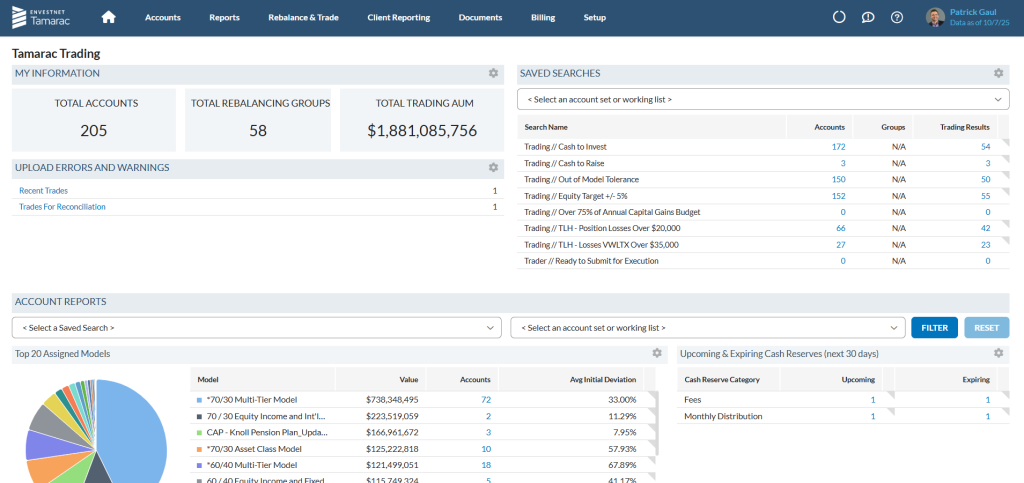

Real-Time Account Monitoring and Performance Tracking

A trading tool with always-on monitoring and customized saved searches allows RIAs to track performance, monitor triggers, and identify opportunities in real time without waiting for reports. These features allow firms to focus on the accounts or strategies that matter most.

Multi-custodian trading tool integration

RIAs need the flexibility to manage client accounts across multiple custodians without disrupting workflows. RIAs can standardize processes across all accounts while maintaining operational efficiency.

Modern user experience

RIAs with an intuitive trading tool interface can help them navigate complex tools quickly, reducing the learning curve for new team members. A clean interface supports efficient decision-making while maintaining access to advanced capabilities when needed.

Tools like the Envestnet | Tamarac Trading Tool deliver on all these fundamentals, helping RIAs streamline their processes without sacrificing flexibility or control.

Trading execution technology for RIAs should come with service and support

Even the most advanced platform won’t deliver value without the proper support behind it. As you compare options and build the RIA tech stack for your firm, be sure to also evaluate:

RIA Onboarding and training support

The successful adoption of a trading tool begins with onboarding and training. RIAs should receive personalized guidance from trading specialists who understand the nuances of portfolio management. Training programs should ensure the tool aligns with their firm’s workflows and client strategies. Training programs should encompass everything from model setup to advanced trading techniques, enabling teams to adopt best practices quickly and confidently.

Proven track record and a history of innovation

Decades of experience mean the platform has been thoroughly tested and refined across multiple market cycles, providing users with a trusted foundation for managing client portfolios. Continuous updates and enhancements demonstrate a commitment to evolving with the industry and client needs.

Scalable trading platform built on modern engineering

Advanced engineering ensures that the platform can handle high-volume trading, complex account structures, and future functionality without performance issues. This modern infrastructure also enables the faster deployment of updates and new features, keeping RIAs at the cutting edge of innovation.

Dedicated and ongoing support to help RIAs optimize their workflows

Support doesn’t end at implementation; RIAs have access to experts who can troubleshoot issues, suggest workflow improvements, and assist in integrating new functionality. This continuous partnership ensures firms can adapt the platform as their business grows and client needs evolve.

This combination of technology and service ensures firms don’t just adopt a new system, but rather evolve their entire trading process.

Why RIAs choose the Envestnet | Tamarac Trading Tool

Our Tamarac Trading Tool brings more than 25 years of trading technology leadership to RIAs. Beyond delivering on the fundamentals, our team works diligently behind the scenes to keep the platform optimized—allowing for quick, effective updates and seamless integration with your existing tech stack. This focus matters because we’re committed to long-term relationships with our clients. Tamarac Trading Tool users benefit from one of the most modern and efficient trading tools on the market, supported by dedicated training and service teams that ensure they can fully leverage its capabilities.

What does the future of Envestnet | Tamarac Trading Tool look like?

Beyond core functionality, RIAs should keep an eye on the “bells and whistles” that can meaningfully add value through improving efficiency and client outcomes. Our Tamarac Trading Tool, for example, continues to innovate with:

Open fixed income order management tools for RIAs

RIAs managing complex fixed income strategies need full lifecycle visibility. RIAs can track and manage fixed income orders from initial placement through settlement, giving full visibility into every stage of the trade. Tools like the TAM order blotter help reduce errors, streamline workflows, and ensure compliance with firm trading policies, making it easier to manage complex fixed-income strategies efficiently.

Automated cash management solutions for RIAs

Maximizing yields starts with smart, automated cash management. RIAs can set automated rules for cash allocations, ensuring client accounts maintain target reserves while optimizing returns. Customizable features allow RIAs to select from multiple money market funds, automate reinvestment strategies, and tailor cash management to the unique needs of each portfolio—turning idle cash into a more productive component of client portfolios.

More than a trading tool, RIAs should look for a true partner

Selecting a trading tool is about more than technology—it’s about finding a partner who can help you scale personalization, drive tax-aware outcomes, and evolve your business over time.

Benjamin Littman, one of the founding members of Pure Financial Advisors LLC and a Tamarac user, said, “Envestnet has been there every step of the way. From collaborating on new features to hearing our feedback, we’ve always felt like a valued customer.”1

With Tamarac Trading, RIAs can feel confident they’re investing in both advanced functionality and expert support, ensuring they’re positioned for success today and in the future.

Email us directly at RIASales@envestnet.com to see if Tamarac Trading is right for your advisory practice.