Envestnet’s interconnected ecosystem of technology, intelligence, and solutions

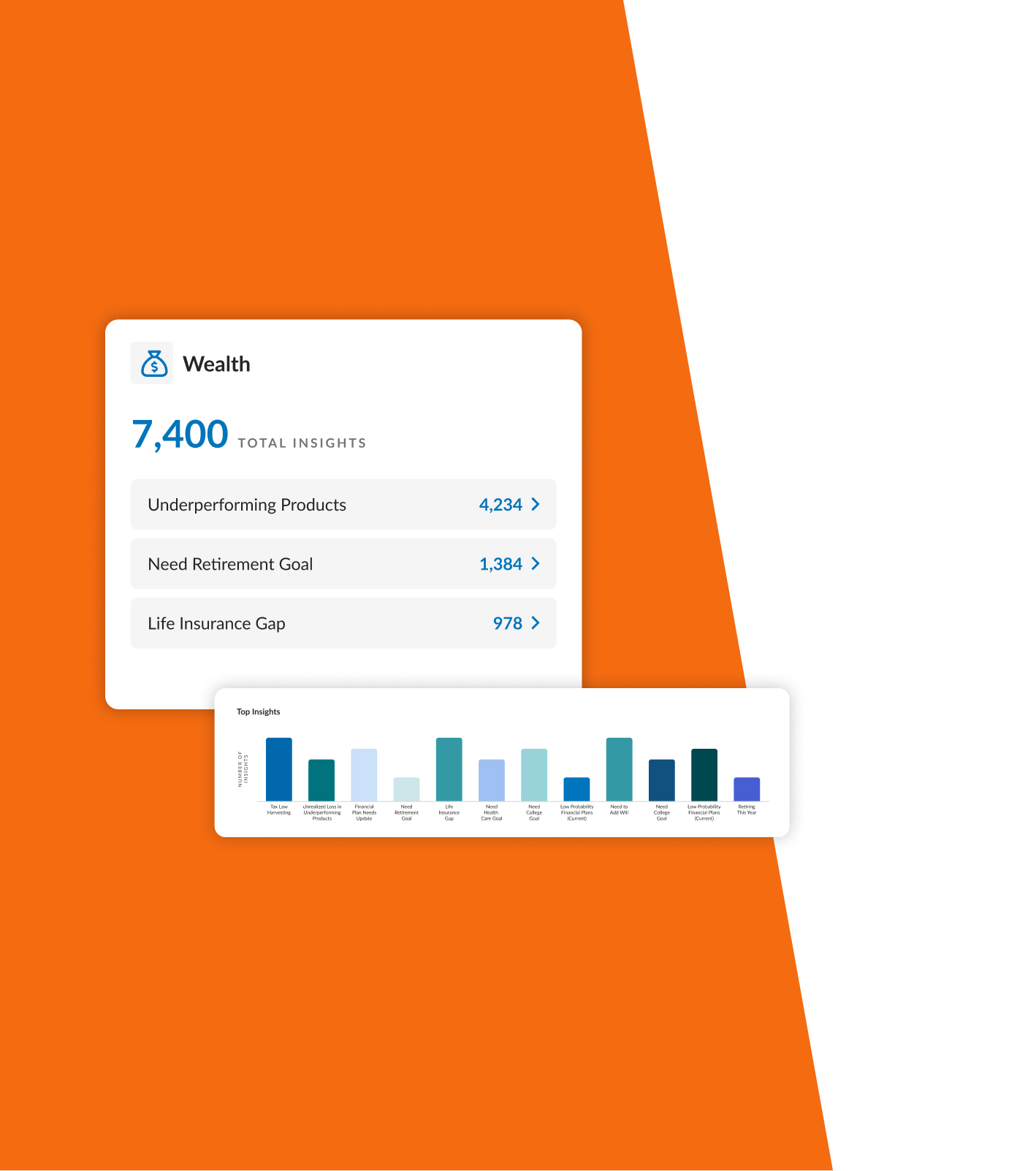

FUELED BY DATA

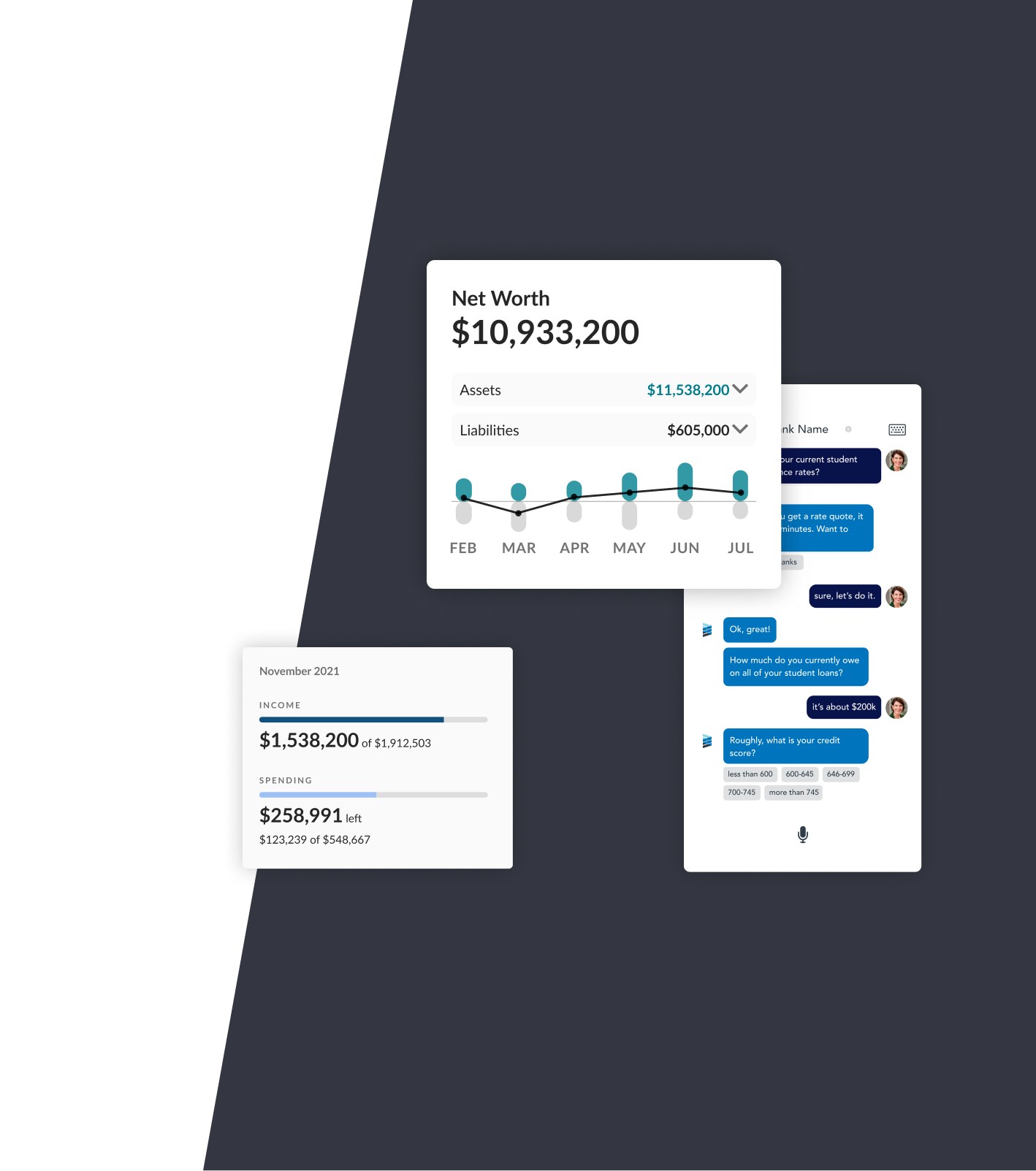

Powered by aggregated data of unrivaled quality, depth, and breadth, Envestnet’s AI-driven ecosystem unlocks robust insights and opportunities.

- 1/3of all U.S. advisors

- $6.5T+in assets

- 20M+investor accounts

- 19K+data sources

- 800~asset management partners

- 44M+paid users

As of December 31, 2024. Includes accounts/assets under management, administration, and subscription arrangements.

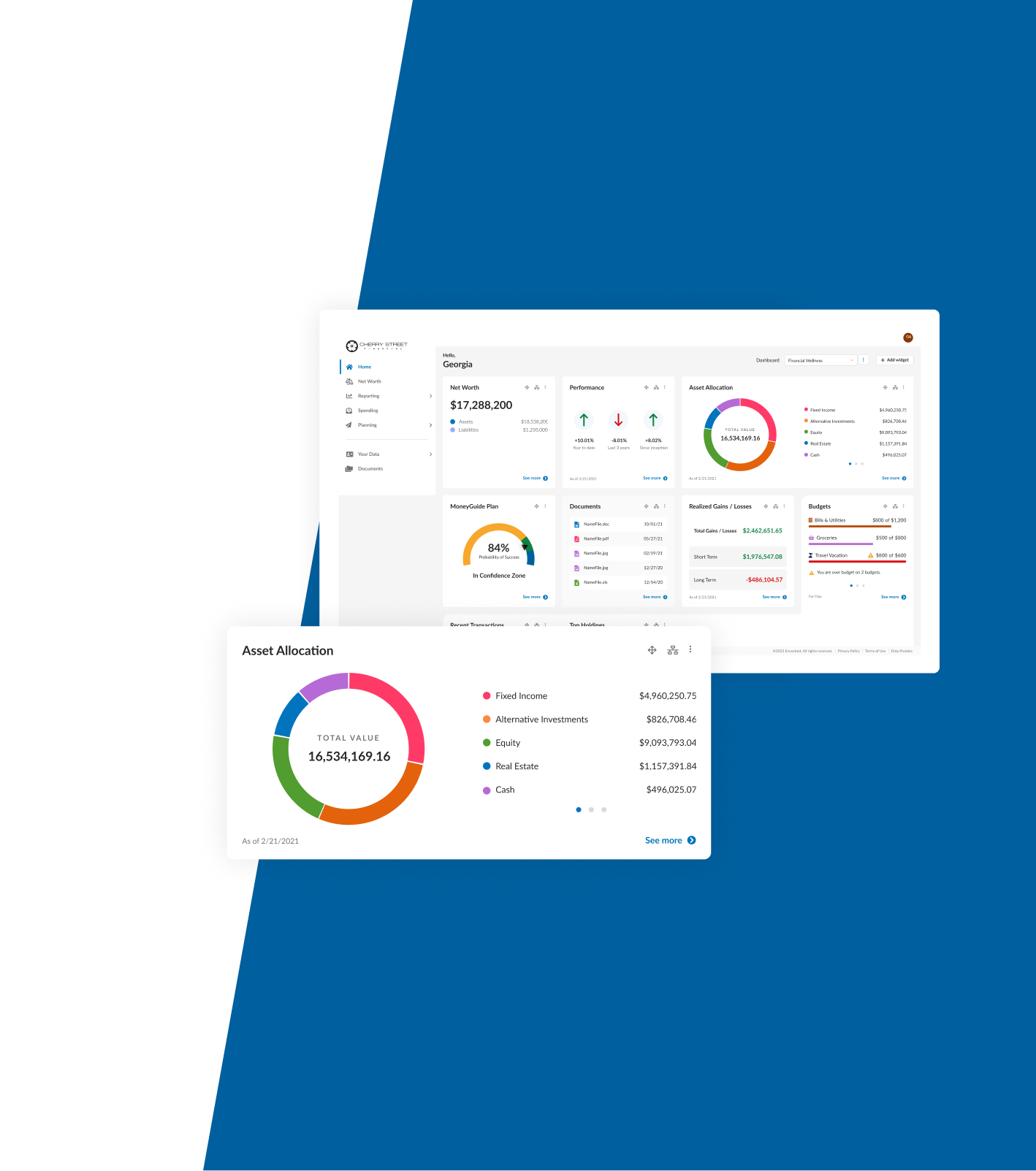

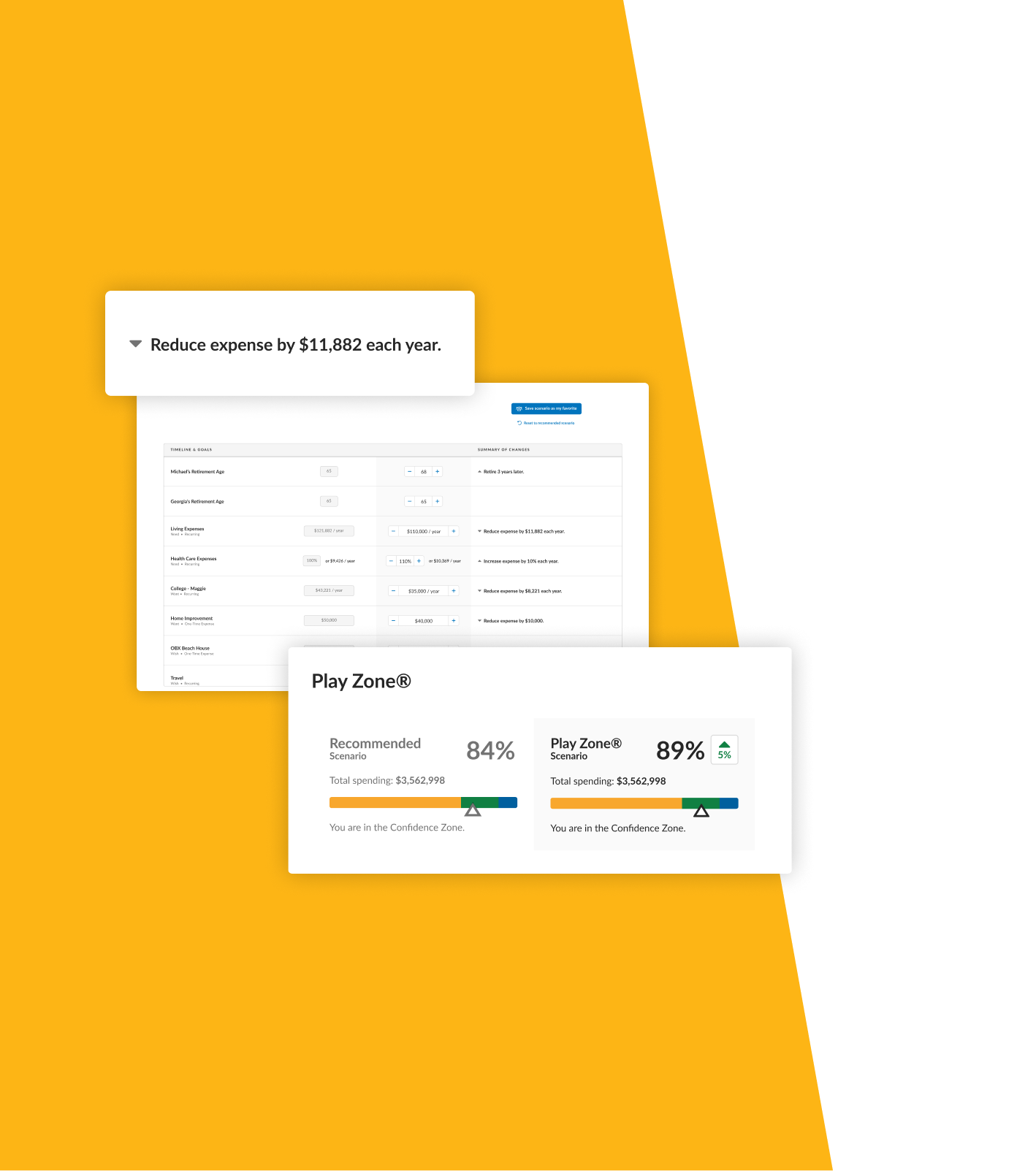

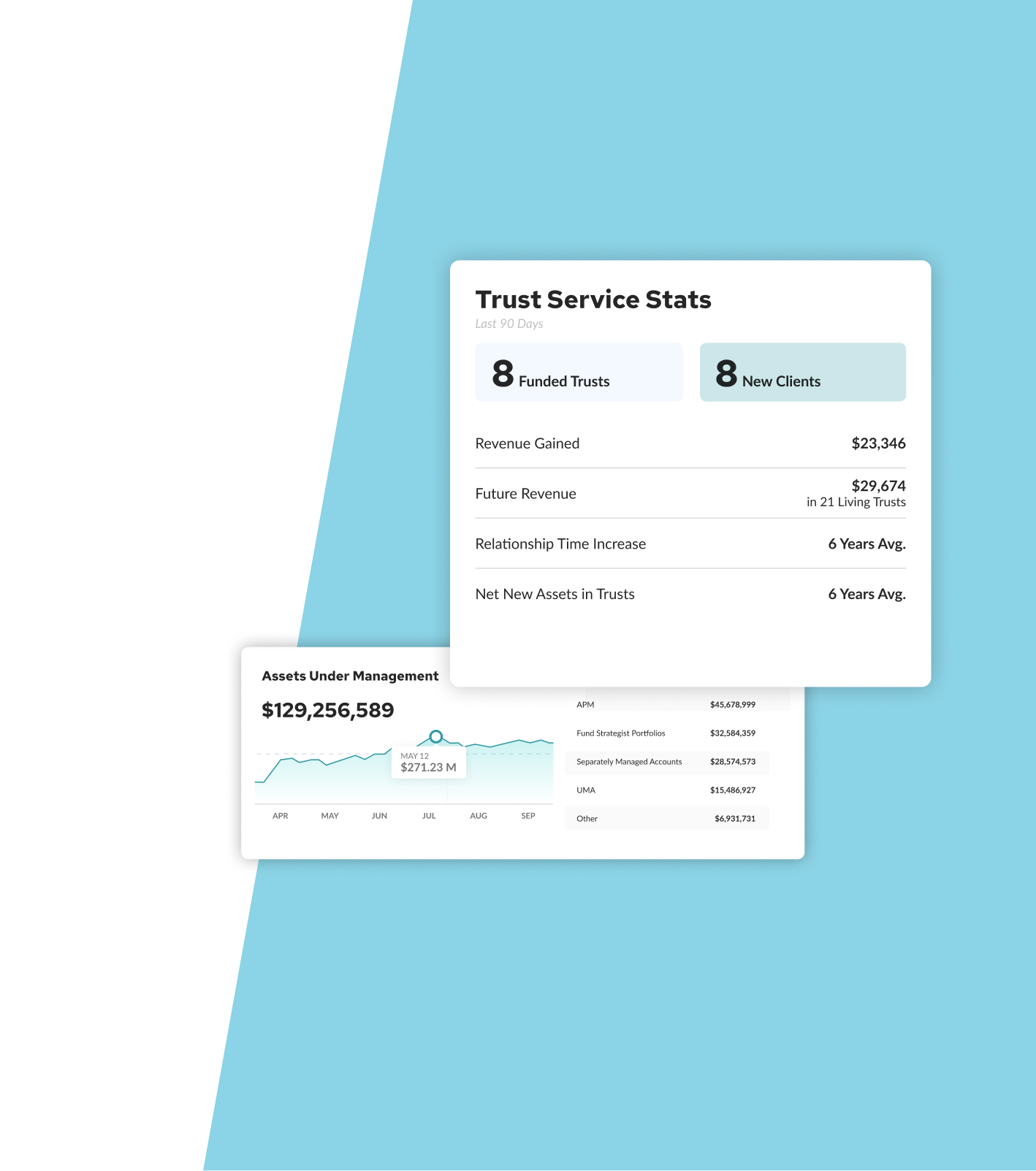

TECHNOLOGY

Tap into the power of Envestnet's ecosystem with technology that's

Experience the transformative power of Envestnet’s financial wellness ecosystem

Connect with Us