Sustainable investing is a hot topic right now. But it’s more than just hype. A full 73% of North American wealth advisors report their clients are interested in sustainable investment strategies.1 And more than 1 in 5 advisor models today include sustainable products, which marks an increase of nearly 11% over the past three years.2

In the new Sharing Perspectives whitepaper, “The Opportunity with Sustainable Investing,” Envestnet and BlackRock offer evidence that sustainable investing can be a concrete way to distinguish your practice from the competition and fortify client connections. As the trend toward personalization continues to gain momentum, sustainable investing may be a crucial strategy for aligning portfolios with your clients’ preferences.

Three reasons why advisors choose sustainable investing

When it comes to addressing clients’ diverse needs, many advisors are increasingly drawn to sustainable investing. Here’s why:

1. It offers an opportunity for growth

Offering tailored strategies to existing clients can pave the way for business growth and enhance your ability to attract new clients. An 18-month analysis by Envestnet Analytics revealed that advisors who allocated a minimum of 10% of their assets to sustainable products on the Envestnet platform achieved higher asset growth rates in contrast to those who did not.3 Additionally, these advisors saw fewer redemptions, underscoring the possible benefits of integrating sustainable investments into your practice.4

Research shows that high-net-worth (HNW) investors5, millennials6, and women7 are particularly interested in sustainable investing, and introducing sustainability-based strategies can be a strategic way to connect with these clients. Offering sustainable investment choices can also enable advisors to connect with the prospective beneficiaries of the unprecedented transfer of wealth from baby boomers to younger generations.

2. It enhances the stickiness of client assets and increases cross-sell opportunities

Understanding your clients’ values and goals not only enhances asset stickiness and cross-selling opportunities but also fosters stronger client loyalty and attracts long-term-minded clients, all contributing to sustained business growth.

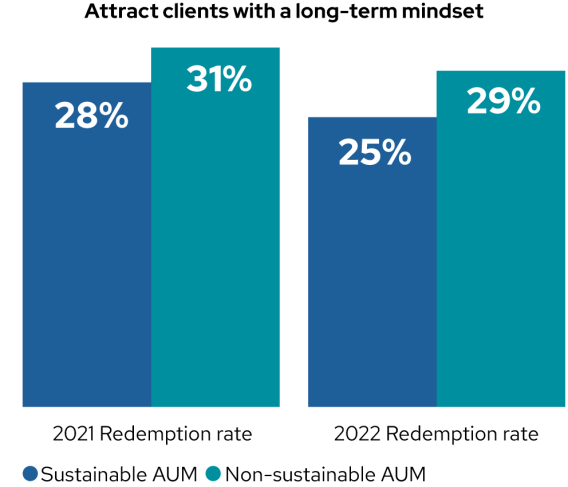

Envestnet's analysis reveals that investors holding sustainable investments exhibited higher investment retention rates compared to those without such investments. In 2021, redemption rates in sustainable investments were 28% compared to 31% in traditional investments, and in 2022, they were 25% and 29%, indicating that clients may be more likely to hold investments aligned with their values through short-term market movements.

3. It can help drive outperformance and provide access to investment opportunities

Incorporating sustainability factors into the investment process can help deliver competitive performance. In fact, BlackRock’s research shows that, on average, public companies with the highest environmental, social and governance (ESG) ratings outperformed the global broad market index, and peers with lower ESG ratings underperformed since the start of 2019.8

Along with competitive performance, sustainable investing offers an opportunity to unlock and deliver value to clients through exposure to emerging and innovative investment themes like clean energy, sustainable agriculture, water efficiency technology, and more.

Elevate your business with sustainable investing

Envestnet and BlackRock share a steadfast commitment to supporting advisors interested in identifying and capitalizing on opportunities related to sustainable investing. By leveraging our advanced tools and resources, you can gain a deeper understanding of your clients’ preferences, effectively align sustainable investment strategies with your business objectives and your clients’ core values, and foster enduring client relationships.

View the full whitepaper: The Opportunity with Sustainable Investing

For tips on how to discuss sustainable investing performance with your clients, watch our Navigating Sustainable Investing video.

Discover more about alternative solutions and tools from Envestnet and BlackRock.