Did you know that Envestnet offers one of the largest asset manager networks in the industry? Regularly throughout the year, we like to share perspectives from our Envestnet | PMC research and due diligence teams.

What we’re seeing and hearing about the global energy transition

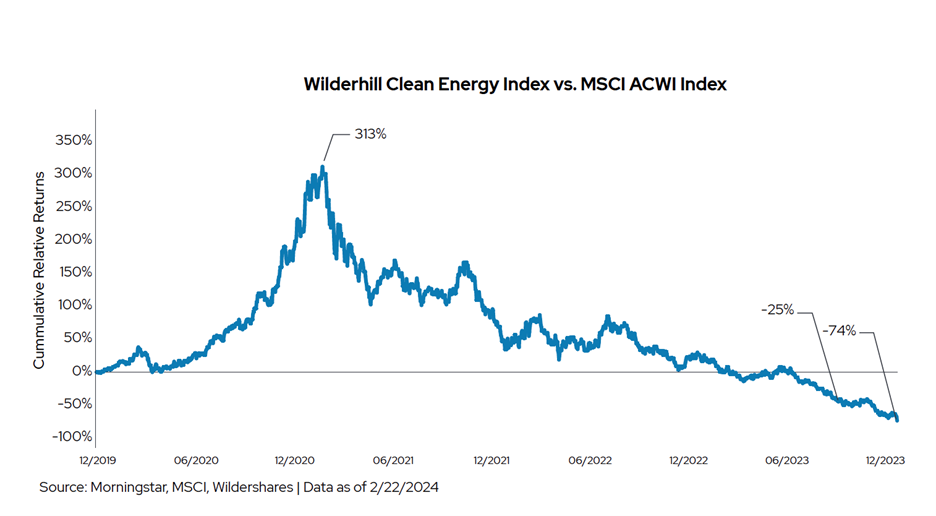

Investors don’t have to look hard to find signs of negative sentiment surrounding the industries and firms at the front line of the energy transition. Sales of electric vehicles are falling short of Detroit’s lofty targets. Offshore wind, a crucial component of the U.S. East Coast’s future carbon-free energy mix, spent 2023 in the doldrums due to cost overruns that led to projects being rebid. Necessary growth in the U.S.’ balkanized electric grid continues to be strangled by NIMBYism or monopoly utilities themselves as they jealously guard their rate base from competition by cheap renewables from outside their service area. Rising interest rates, high materials costs, and geopolitical tensions have all been major contributors to these and other challenges facing the clean tech and climate action universe of stocks, which have struggled versus the broad market since their relative peak in early 2021.

In September 2023, GMO partner, Lucas White, who manages the firm’s Resources and Climate Change strategies, penned a whitepaper that’s worth reading in full and that addresses this period of relative weakness in cleaner energy and conservation stocks. In brief, Mr. White argues that clean energy stocks’ “abysmal” stretch of underperformance is typical of an asset class driven by sentiment. However, the author notes that these increasingly mature and profitable businesses now boast valuations that are “quite sober and price in negative or negligible growth in many instances.” This ambient negativity toward the sector’s prospects would seem to be at odds with the increasing economic viability of clean energy and broad, well-financed policy support in the U.S., EU, and China. Despite this, the “vibecession” that gripped the broad market for much of 2023 has yet to abate in the climate solutions space, with these stocks falling further behind broad global equities over the past several months.

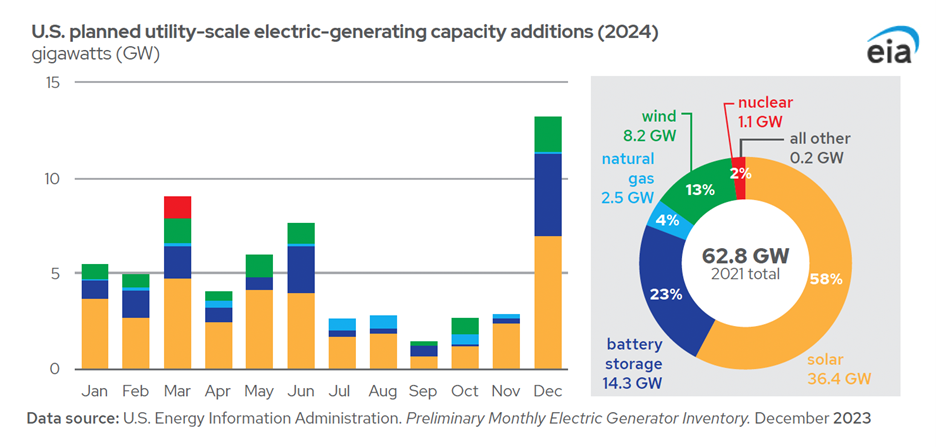

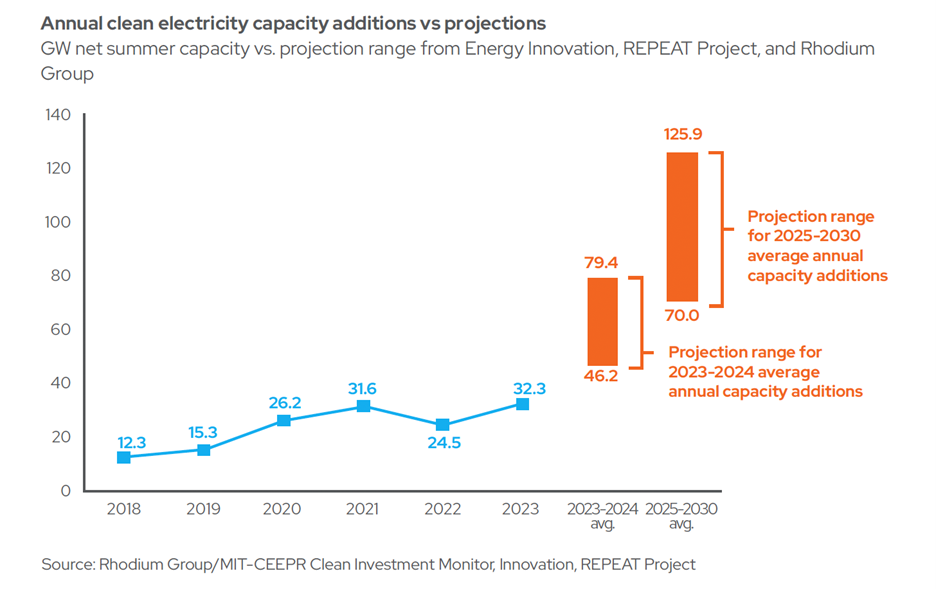

Clean energy stocks’ underperformance has been painful and sustained since 2021, with only brief retracements to the downtrend. Our covered managers that focus on this space—namely GMO and Impax—and others with expertise in clean technologies (e.g., Lazard) argue that recent underperformance has only amplified valuation anomalies and brightened the long-term outlook for these stocks. Writing in November 2023, Lazard laid out a four-fold justification for its heightened conviction in clean tech: 1) unprecedented government and private investment are poised to transform the industry; 2) nascent technologies are becoming ever more economically viable; 3) logistical and inflationary headwinds that have driven the recent selloff are expected to dissipate; and 4) current valuations don’t reflect the earnings potential in the space, which provides an attractive entry point for patient investors willing to tolerate elevated volatility. Despite clean tech stocks having yet to turn a corner in the financial markets, 2023 was still a record year for solar PV capacity additions, and almost all U.S. grid capacity additions in 2024 are expected to be clean, according to the U.S. Energy Information Agency.

A good time to add Clean Energy exposure

While aligned with this thesis and the strong growth trajectory for renewables, neither GMO nor Impax are encouraging investors to rush pell-mell into clean energy stocks, despite their attractive valuations. This space is diverse, spanning various stages of the solar PV supply chain, wind, biofuels, storage, etc., and some companies are better positioned than others to grow and navigate uncertainty. Both GMO and Impax argue for a fundamentally disciplined, thematic approach that combines clean energy stocks with those of firms focused on other aspects and exigencies of the energy transition, such as energy efficiency, grid tech, sustainable agriculture solutions, critical minerals, and water. For example, while Impax selectively holds wind exposure in its Global Environmental Markets Fund, the investment team has higher conviction in its building energy efficiency, industrial energy efficiency, and smart/efficient grid investments, given their greater stability versus the more capital intensive and volatile wind business. Reflecting Mr. White’s conviction in the space, GMO’s Climate Change Fund held roughly 47% of its assets in clean energy—primarily solar, biofuel, and battery investments—at the end of January 2024. Still, the investment team nonetheless diversifies beyond this segment by holding large strategic stakes in energy efficiency companies, copper miners, sustainable agriculture firms, and grid tech providers. Investors should always critically evaluate their risk tolerance and goals, and clean energy stocks have tended to be significantly more volatile than broad market equities. However, for those seeking to capitalize on the secular tailwinds of the global energy transition and/or diversify away from mega-caps that have driven the recent market rally, there has rarely been a better time to consider adding exposure to this dynamic sector.

Envestnet | PMC provides independent advisors, broker-dealers, and institutional investors with comprehensive manager research, portfolio consulting, and portfolio management to help improve client outcomes. For more information on Envestnet | PMC, please visit www.investpmc.com.