Retirement planning isn’t just about saving—it’s about strategizing. Tax strategies can dramatically shape retirement outcomes, helping clients keep more of what they’ve earned and pass on a stronger legacy.

Why tax planning for retirement matters in 2026

Recent years have brought a whirlwind of tax law changes—Path Act, Secure Acts, Tax Cuts and Jobs Act, and the One Big Beautiful Bill Act (OBBBA). These shifts mean that retirement planning is never static. In fact, more than 90% of ultra-high-net-worth investors expect their wealth manager to provide tax and estate advice, but only 25% feel they’re actually receiving it.1 The takeaway? Advisors need to communicate their tax planning efforts more clearly and proactively.

Recent tax law changes affecting retirement

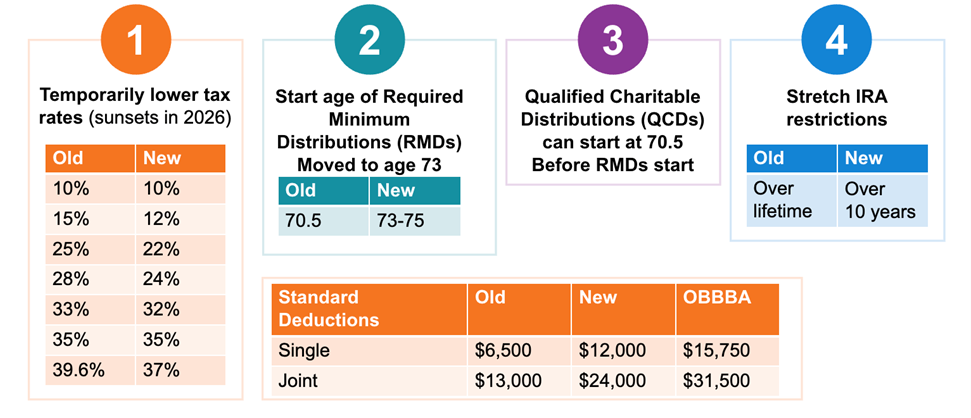

- Tax bracket adjustments: While the 10% bracket remains, others have shifted (e.g., 15% to 12%, 25% to 22%). Standard deductions have also increased, especially for those 65 and older.

- RMD age changes: Required Minimum Distribution (RMD) ages have moved from 70½ to 73 (and eventually 75), thanks to the Secure Acts.

- QCD opportunities: Qualified Charitable Distributions (QCDs) can still start at 70½, even if RMDs begin later.

- Stretch IRA restrictions: The “stretch” IRA now generally applies over 10 years, except for certain eligible beneficiaries.

These legislative shifts underscore the importance of proactive, tax-aware retirement planning. Advisors play a key role in helping clients navigate evolving rules: identifying opportunities to reduce tax drag, optimize charitable giving, and align distribution strategies with their broader financial goals.

Powerful tax strategies for retirement

As clients approach or enter retirement, thoughtful tax planning can make a meaningful difference in how long their assets last. The following strategies can help advisors uncover opportunities to reduce lifetime taxes, enhance flexibility, and align income with long-term goals.

1. Find the optimal timing window

The years between retirement (typically age 65) and the start of Required Minimum Distributions (now 73+) present a unique opportunity for tax planning. Delaying Social Security, for example, can keep marginal tax brackets lower, opening the door for strategic withdrawals and Roth conversions.

It’s important to pay close attention to this “gap period” because it offers a valuable window to shape clients’ long-term tax outcomes. By managing income strategically before RMDs begin, you can help clients smooth future tax liabilities, enhance retirement income, and preserve more wealth over time.

2. Strategic goal funding

Take advantage of lower tax years by making qualified withdrawals early. This isn’t just about Roth conversions—it’s about pulling money from IRAs before RMDs and Social Security kick in, potentially reducing future RMDs and overall tax liability.

Best practices:

- Use financial planning software to identify years with lower tax brackets.

- Consider delaying Social Security to maximize early tax savings.

- Stay flexible—future tax law changes are always a risk.

3. Roth conversions

Roth conversions allow clients to pay taxes now (often at a lower rate) and enjoy tax-free growth and withdrawals later. This strategy can reduce future RMDs, benefit heirs, and even lower healthcare costs by keeping Modified adjusted gross income (MAGI) low.

Best practices:

- Fill up lower tax brackets with conversions.

- Consider the timing—early retirement years are often best.

- Be mindful of penalties and rules (e.g., the five-year rule, age restrictions).

4. Qualified charitable distributions (QCDs)

For clients with a charitable inclination, QCDs offer a tax-efficient way to give. Distributions made directly from IRAs to qualified charities can offset RMDs and reduce taxable income.

Best practices:

- Ensure clients are eligible (age 70½+)

- Keep documentation for gifts

- Coordinate with overall gifting goals to avoid “gifting into poverty”

By proactively implementing these strategies before RMDs and higher tax brackets take effect, advisors can help clients turn tax efficiency into a powerful driver of retirement success. The key is balancing today’s opportunities with tomorrow’s uncertainty through careful, personalized planning.

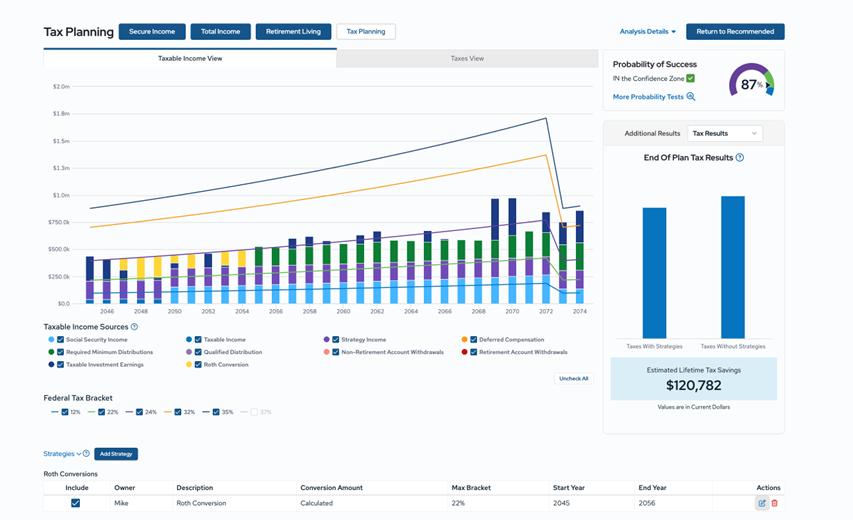

How to use MoneyGuide for tax planning in retirement

MoneyGuide’s latest features make it easier than ever to model tax strategies for your clients:

- State taxability options: Customize how withdrawals, Social Security, and pensions are taxed at the state level.

- Tax planning details: View federal and state taxes side by side, including ordinary income, long-term capital gains, and effective tax rates.

- Monte Carlo simulations: See how strategies like Roth conversions and QCDs impact the Probability of Success and legacy outcomes.

Tax planning isn’t a one-time event—it’s an ongoing process that can make a significant difference in retirement outcomes. Whether you’re an advisor or a retiree, understanding and leveraging these strategies can help you navigate changing laws, maximize savings, and achieve your financial goals.

Explore MoneyGuide’s tax planning features and start shaping better outcomes today