One of the many choices advisors face is the “active vs. passive” decision: whether to construct client portfolios with traditional active managers or to explore innovative passive approaches such as direct indexing. While active strategies seek to outperform benchmarks through security selection based on fundamental analysis, direct indexing offers a systematic, transparent method with several potential benefits, including tax optimization, customization, fees, and even performance. Let’s examine the research and practical considerations that may support the case for direct indexing over conventional active management.

What academic research says about active vs. passive investing

One of the most important ways advisors can help their clients achieve their desired financial outcome is to design an appropriate strategic asset allocation aligning with the client’s risk profile and return expectations. And it just so happens that one of the most seminal academic research studies of the past 40 years on the importance of strategic asset allocation also supports a passive direct indexing approach.

Brinson, Singer, and Beebower’s landmark 1991 study, “Determinants of Portfolio Performance,” sought to quantify how much of a portfolio’s return could be attributed to three distinct decisions:

- Strategic asset allocation (the long-term “policy” mix of stocks, bonds, cash, and other classes)

- Tactical or active asset-allocation shifts (temporary over- or under-weights)

- A manager’s security selection within each asset class

The authors demonstrated that almost 94% of the variation in portfolio returns stemmed simply from the strategic allocation. Tactical shifts and the manager’s security selection together accounted for only a small fraction of return dispersion and did not, on average, add significant incremental return.

What industry research says about active vs. passive investing

Industry research has also been supportive of the idea of direct indexing. For many years, Envestnet | PMC has published and updated a research paper titled, “Active vs. Passive Asset Management,” to identify which asset classes indicate that active managers should be employed and those in which passive strategies would likely fare best. The general findings show that for equity asset classes the domestic large cap asset classes, because they are highly efficient, are ideally implemented using passive strategies such as direct indexing, whereas satellite asset classes that are often deemed less efficient (particularly domestic and foreign small cap) could be implemented by selecting active managers.

For advisors, the practical takeaway of this academic and industry research is clear: the single most important decision in portfolio construction is choosing an appropriate strategic asset allocation that reflects a client’s objectives, risk tolerance, and time horizon. Once that asset allocation is set, it should generally be implemented using low-cost, broadly diversified vehicles—such as direct indexing strategies—to capture the major asset-class exposures. In many asset classes, including domestic large cap and fixed income, attempts to add value through active management are unlikely, on average, to move the needle appreciably and may simply increase fees and turnover.

Potential performance benefits of direct indexing

Many advisors often assume that, because active managers have higher portfolio management fees, they are more easily able to outperform passive direct indexing strategies. However, the evidence supports the findings in academic and industry research that, at least in certain asset classes, clients are better off using direct indexing rather than actively managed strategies.

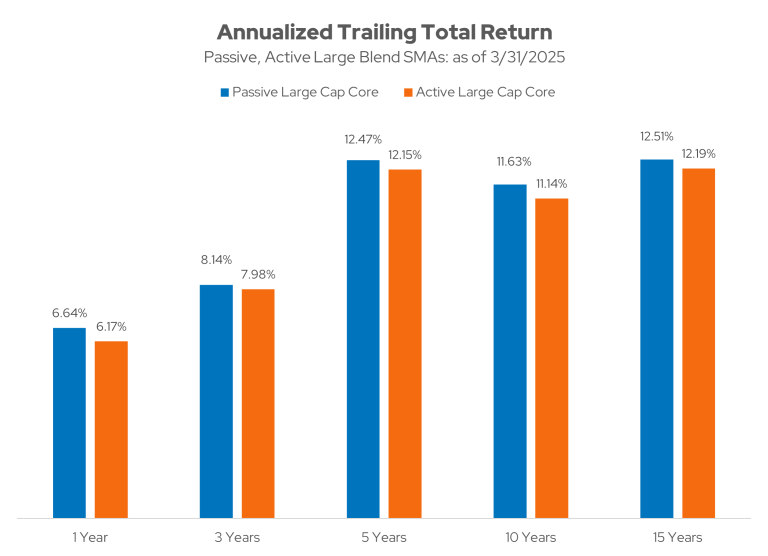

The table below shows the average annualized gross-of-fee performance of passive (direct indexing) and active managers in Morningstar’s Separate Account Large Blend universe. For at least the past 15 years, and over each of the trailing sub-periods, direct indexing strategies have outperformed active managers in the large cap core asset class.

Comparing customization, diversification, and tax efficiency

In addition to potential performance benefits, direct indexing strategies also offer distinct attributes over actively managed separate accounts across customization, diversification, tax management, and cost dimensions:

Customization

With direct indexing, advisors and clients have greater control over the securities comprising the portfolio, enabling more personalized portfolio designs. You can exclude or overweight individual stocks, sectors, or countries down to the security level, and implement impact screens designed to align the portfolio with the client’s values. Factor exposures (for example, value, momentum, and quality) can be selected to align with objectives or risk constraints. By contrast, actively managed separate accounts follow a manager’s high-conviction process and style mandate: clients own individual securities, but their ability to tweak holdings for personal preferences or add bespoke tilts is limited by the manager’s investment universe and willingness to alter their strategy.

Diversification

Direct indexing strategies typically replicate a broad benchmark, such as the CRSP US Large Cap index or a global equity index, through owning potentially individual holdings. This approach delivers market-level diversification and limits idiosyncratic risk while preserving the targeted asset class exposures. Active, separate accounts that pursue alpha often concentrate on 30–60 high-conviction names. While concentration can amplify potential outperformance, it also increases single-stock risk. It may drift from the client’s desired asset class exposure, potentially exposing portfolios to unintended sector or style bets.

Tax management

A hallmark feature of direct indexing is tax optimization. Direct indexing allows for selective monetization of low–cost basis positions, timing sales to fit clients’ annual capital-gains allowances. Transitions are executed in phases across multiple tax periods, keeping liabilities within set budgets. Moreover, the wide range of eligible replacement securities in a direct index strategy helps sidestep wash-sale issues. Active managers, however, tend to offer strategies that are indifferent to taxes, and when tax management is applied to the account, it may result in a high tracking error compared to the underlying strategy. In addition, with fewer securities in concentrated portfolios, finding non-infringing substitutes to bypass wash-sale rules becomes more challenging, potentially eroding after-tax returns.

Fees

Cost differences between the two approaches are significant. Actively managed separate accounts often charge a management fee of approximately 50 basis points (0.50%) annually to cover research, trading, and portfolio management resources. Direct indexing strategies, by contrast, typically charge only 15–20 basis points (0.15–0.20%) for similar market exposures. Over time, that 30–35 basis points gap compounds, directly enhancing net-of-fee performance for investors.

Don’t sleep on direct indexing

As we’ve shown here, direct indexing strategies can be an effective tool for advisors in helping their clients achieve the desired investment outcomes. Constructing client portfolios with direct indexing strategies can not only ensure that they capture consistent asset class exposures over time, but could also result in improved performance. In addition, these potential advantages of direct indexing are complemented by the features of customization, tax management, and lower fees, making direct indexing a valuable approach in certain asset classes for achieving client success.

By: Hunter Willis, CFA®, QRG Portfolio Manager, and Brandon Thomas, Managing Principal, QRG

For more information about Envestnet's QPs, which are managed by the company's quantitative asset management unit, QRG Capital Management, Inc., please visit: https://www.envestnet.com/qrg/.