2025 brought a nearly unprecedented change in U.S. trade policy that has roiled markets and upended economic and corporate projections. No professional investor alive today had worked with U.S. tariffs this high…until April. A 16% U.S. average effective tariff on imports (our current estimate) is the highest such rate since the 1930s. While the highest of the originally announced tariffs have been reduced at least temporarily, we don’t believe that trade policies will suddenly revert to 2024's placidity. We don’t see the tariff talks and negotiations going away in the short term, given the current administration’s focus.

Because tariffs affect the global economy and financial markets in myriad ways, the current investment environment is unique. While this landscape doesn’t require investors to throw out their core principles, adapting to the current situation is key. In this blog, we'll explore practical strategies to address current concerns while adhering to our investment philosophy.

Where we stand today

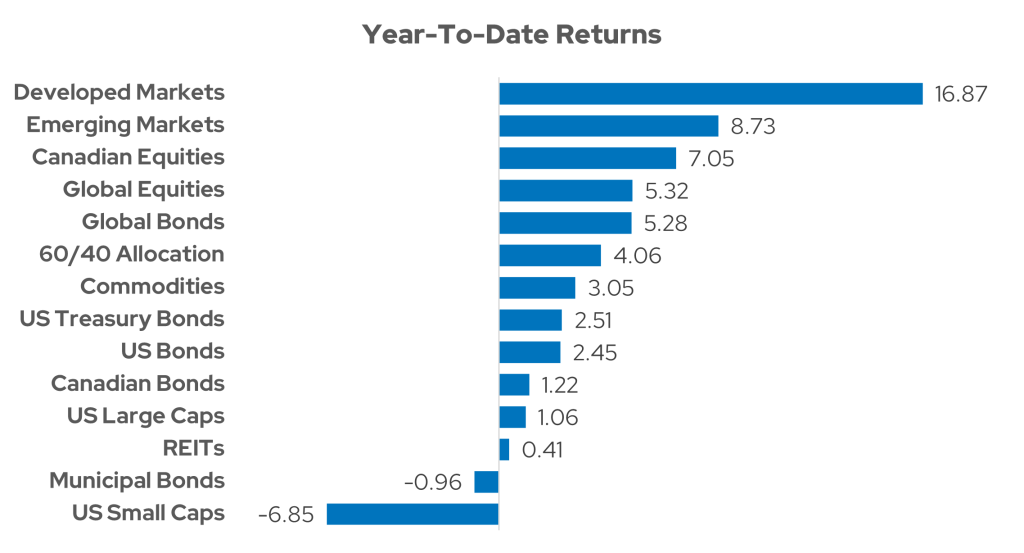

As of May 31st, 12 of the 14 major asset classes we track had positive year-to-date returns. American investors may be surprised by these gains because large cap U.S. equities are up just over 1%, while U.S. small caps are down this year. Municipal bonds have also lost ground. Instead of the outperformance of American equities seen in four of the last five years, international stocks and bonds (as well as commodities) have led the way in 2025. For U.S. investors lacking global diversification, this year has likely been disappointing.

Sources: YCharts and Bloomberg. U.S. Large Caps = S&P 500 TR USD; U.S. Small Caps = Russell 2000 TR USD; REITS = DJ US Select REIT TR USD; Global Equities = MSCI ACWI GR USD; Developed Markets = MSCI EAFE GR USD; 60/40 = PMC ACP Moderate Benchmark; Emerging Markets = MSCI EM GR USD; Canadian Equities = S&P/TSX Composite Index TR CAD; U.S. Bonds = Bloomberg US Agg Bond TR USD; Municipal Bonds = Bloomberg Municipal TR USD; Global Bonds = Bloomberg Global Aggregate TR USD; U.S. Treasury Bonds = Bloomberg US Treasury 10+ Yr TR USD; Canadian Bonds = Bloomberg Canada Aggregate TR Index Unhedged CAD; Commodities = Bloomberg Commodity TR USD. As of May 31st, 2025.

Navigating this environment

Before delving into the asset class implications of tariffs and the present landscape, note that this year’s market volatility may offer opportunities for tax-loss harvesting in portfolios. If you typically wait until December to harvest losses, consider doing so sooner because many U.S. stocks are down YTD. An algorithmic tax overlay can largely automate this process and bring year-round tax management for your clients.

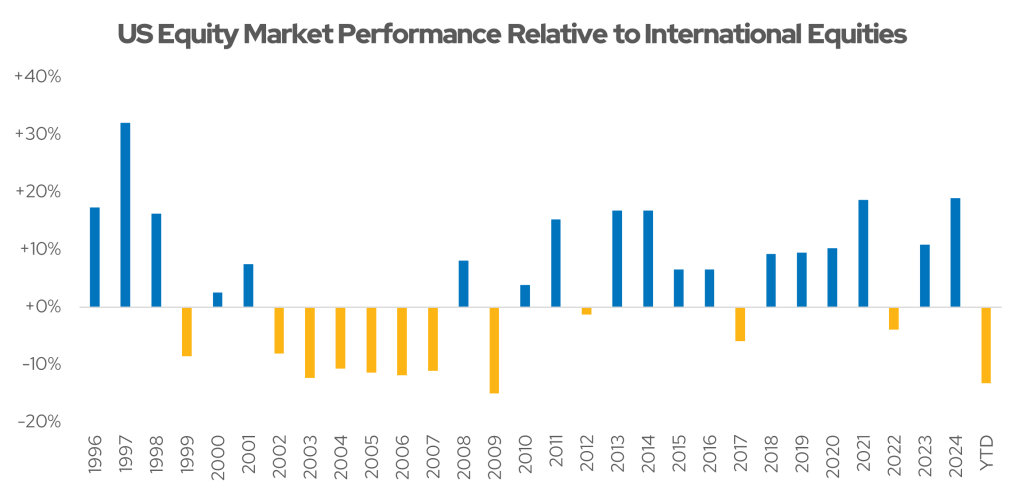

Stocks

As you can see in Figure 1 above, international stocks have thoroughly outperformed their U.S. counterparts in 2025. While domestic stocks have largely dominated foreign shares in recent years, that’s not to say investing overseas is pointless or that 2025 is a rare outlier. From 1996 to 2024, international equities beat U.S. stocks during 11 years.1 From 2002 through 2009, the American stock market lagged the rest of the world’s equity markets in six out of seven years. When international markets have led, their outperformance has been meaningful, too. In the 11 years since 1996 that foreign shares bested domestic stocks, they delivered average annual outperformance of 9.1%. Figure 2 illustrates our data.

Data from YCharts. MSCI USA Annual Total Returns minus MSCI ACWI Ex USA Annual Total Returns. As of May 31st, 2025.

We find that many investors eschewed international equities in recent years due to the triumph of large U.S. technology companies. The stock market buzz has largely been centered on Wall Street since the pandemic, but we believe that a strategic allocation to international stocks makes sense for U.S. investors. There’s no ideal international allocation suitable for all investors, but we believe clients should have a meaningful level of global diversification. International investment can also be divided between developed and emerging markets. Committing to this foreign equity allocation for the long-term is important—we do not believe in chasing returns around the globe through short-term trading. Since international equity valuations remain lower, in aggregate, than the weighted average valuation of S&P 500 constituents, we think it is an appropriate time to consider initiating (or potentially raising) non-U.S. allocations. While most international companies exporting to the U.S. now face significant tariffs, the typical foreign stock is more connected to its domestic market than U.S. trade. Exports from foreign nations to countries other than the U.S. also remain largely unaffected by new tariffs.

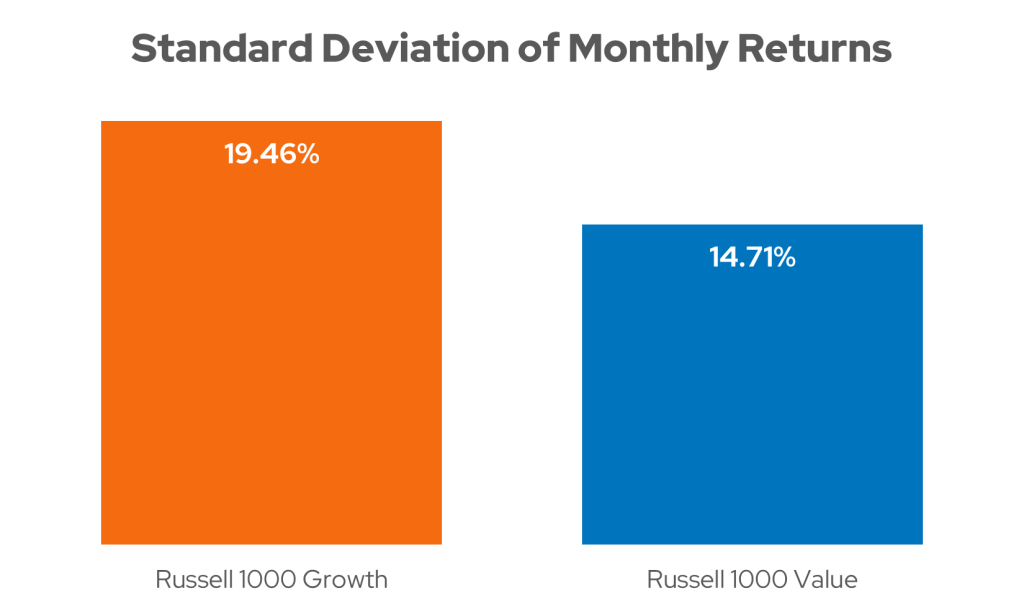

We also want to discuss two somewhat underappreciated areas of the U.S. stock market: Value stocks and small caps. In recent years, large cap growth stocks have generally excelled. The Magnificent 7 companies (Alphabet [GOOGL; GOOG], Amazon [AMZN], Apple [AAPL], Meta Platforms [META], Microsoft [MSFT], NVIDIA [NVDA], and Tesla [TSLA]) have become market darlings, but they aren’t the only game in town. Despite the size and innovative technologies developed by these companies, we believe portfolios need more than seven U.S. holdings. Historically, value stocks have been less volatile than growth stocks, making them potential portfolio stabilizers in difficult market environments. International retaliation for U.S. tariffs can obviously affect value stocks, but these generally mature companies are typically positioned to weather the storm. On a total return basis, the Russell 1000 Value was up 2.50% YTD while the Russell 1000 Growth was down 0.27%, as of May 31st, 2025. Because value stocks typically don’t become “hot trades,” their valuations typically remain lower than those for growth stocks, too. Figure 3 illustrates the greater stability of value stocks over the past three years. Still, note that a return to extreme market bullishness could push growth stocks ahead of value equities. We believe that diversified portfolios should hold both value and growth stocks for the long term due to their unique characteristics and return profiles. Targeting the Value factor through a quantitative methodology is just one possible way to add value stocks to your clients’ holdings.

Data from YCharts. Standard deviation of monthly returns with a three-year lookback. As of May 31st, 2025.

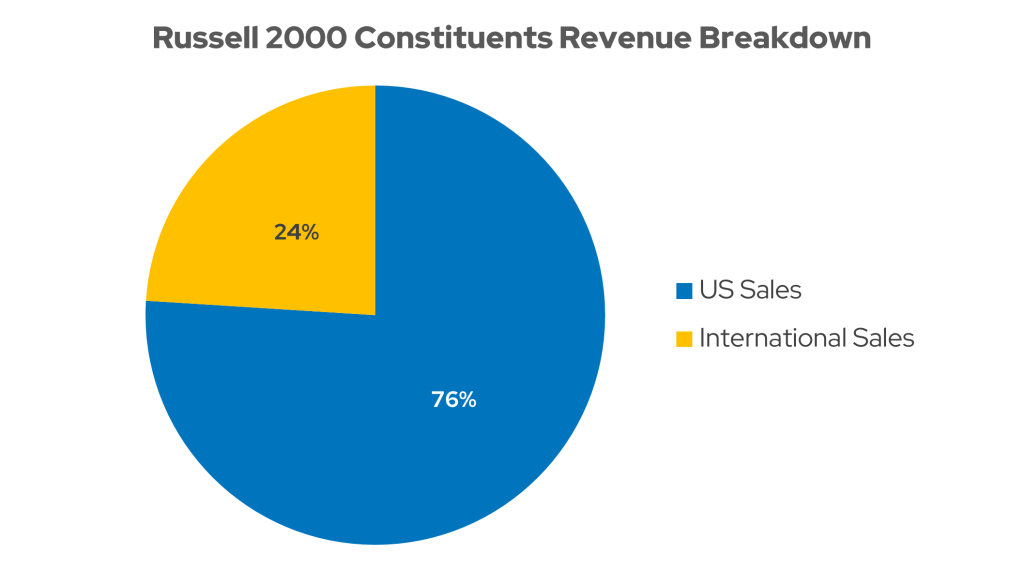

As for small caps, they have suffered this year. The Russell 2000 was down 6.85% YTD as of May 31st, 2025. Tariffs, tax cuts, and lingering inflation have pushed U.S. interest rates higher this year, and elevated rates provide a headwind for smaller companies. Why? These firms are more likely to issue floating rate debt and typically face higher financing costs than large corporations. However, U.S. small caps have one potentially significant advantage in a world of tariffs: Only 24% of their sales come from outside the U.S., while S&P 500 constituents derived 41% of their revenue from other countries.2 As many nations retaliate against U.S. tariffs, smaller companies may be more insulated from harm. Figure 4 shows the revenue split for small caps.

Data from Citi Global Wealth Investments. As of July 25th, 2024.

Small cap valuations are also lower than large-cap valuations. The Russell 2000 has an aggregate Price-to-earnings (PE) ratio of 18.5, but the S&P 500’s PE is 25.5.3 Even though mega cap companies have been the stars in recent years, a strategic small cap allocation can still make sense to diversify equity portfolios. Our Q1 ActivePassive Scorecard indicates that active small cap managers delivered strong performance to start 2025, illustrating potential opportunities for outperformance from quality small cap strategies.

Bonds

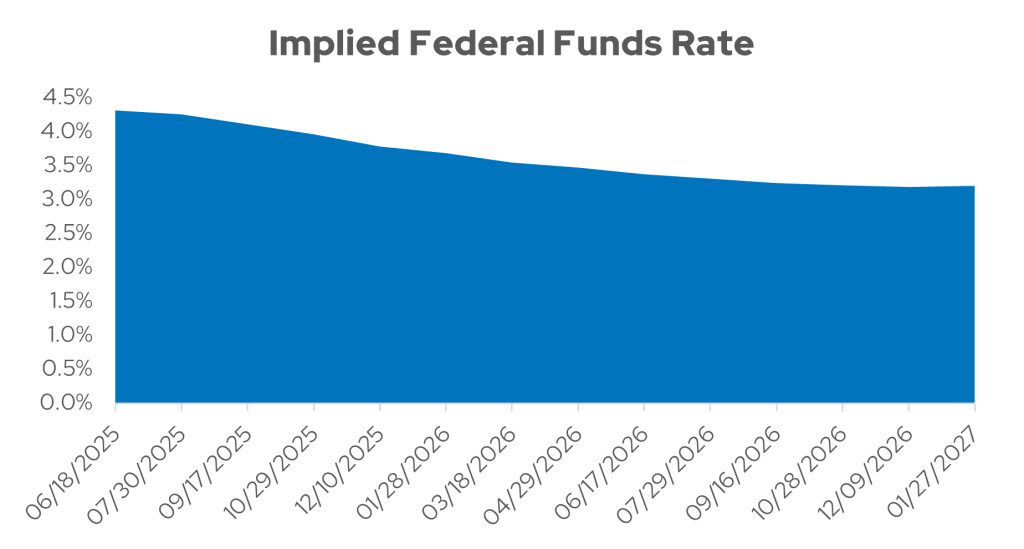

Tariffs don’t impact fixed income returns directly, but they do affect bond yields in less obvious ways. Since tariffs influence inflation and economic growth, two key determinants of fixed income interest rates, trade policy inevitably touches the bond market. U.S. rates dropped immediately following the April 2nd tariff announcement but have risen since then. Falling bond prices, especially in the long-term segment of the market, have disappointed U.S. investors who had expected Federal Reserve rate cuts to buoy fixed income securities this year. (Remember that bond prices and interest rates have an inverse relationship.) Instead, the Fed hasn’t eased monetary policy at all thus far in 2025. Currently, the futures market indicates that the Fed will only cut rates twice this year, with the first reduction expected in October. Figure 5 plots implied Federal Funds Rates based on futures market activity.

Data from Bloomberg. As of May 31st, 2025.

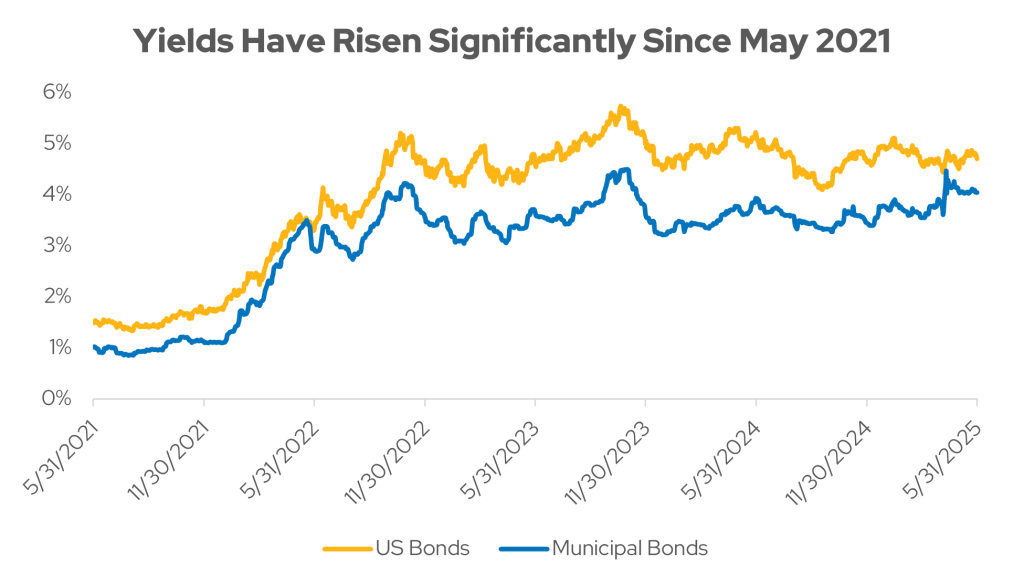

The good news from these tariff-induced higher yields is that income-oriented investors can acquire a plethora of U.S. investment-grade securities offering yields from 4-5%. No longer do bondholders have to accept 1-2% yields as they often did for years between the Great Financial Crisis and the aftermath of the COVID pandemic. Tax-efficient municipal bonds currently yield over 4%, giving them tax-equivalent yields topping 6% for most investors in the 32% federal tax bracket or above.4 If you have clients whose goals now require greater current income, whose portfolios are under-allocated to bonds, or who simply have additional funds to buy bonds, today’s higher yields can be attractive. Whether utilizing bond ladders, passive funds, or active fixed income strategies, heftier yields can help meet client needs. Tariffs could drive yields to even loftier levels this year, however we don’t recommend attempting to time a cyclical “top” in interest rates. Consider locking them in for years when rates are healthy enough to support your clients’ portfolio income requirements. As Figure 6 shows, bond yields are already far higher than they were less than three and a half years ago.

U.S. Bonds = Bloomberg US Agg Bond TR USD; Municipal Bonds = Bloomberg Municipal TR USD. Data from Bloomberg. Yield-to-worst shown. As of May 31st, 2025.

Fundamentals still apply

This year’s dramatic shift in U.S. trade policy roiled global financial markets and created tremendous anxiety for investors. Stock markets have recovered much or even all their tariff-driven losses, and bond markets have seen volatility ease. Still, this stabilization doesn’t mean that the investment landscape is the same as on April 1st. Adapting to this new environment won’t require ditching fundamental investment principles, such as diversification, or shifting away from an emphasis on strategic portfolio management. Advisors don’t have to eschew all responses to this changed economic situation, either. Stocks, bonds, and alternative investments like commodities and real estate can all be utilized to help traverse the present, and still unsettled, market backdrop.

For more information on Envestnet | PMC, please visit www.investpmc.com.