When wealth expects more

Your high-net-worth clients have worked hard to build their wealth. They have high expectations for how it should be managed. The Envestnet Private Wealth team works directly alongside advisors of clients with more than $1M+ of investable assets, to unlock the potential of our $7T+ ecosystem.

Helping advisors deliver personalized wealth experiences

As client expectations for wealth management become more personalized, we help you deliver where it matters most. Backed by 120+ investment professionals, over 39+ years of consulting experience, and more than 5,000 approved investment strategies across SMAs, alternatives, and beyond, Envestnet empowers advisors to create customized wealth experiences for high-net-worth and ultra-high-net-worth clients.*

Line Break

High-net-worth portfolio management that delivers

A sophisticated investment approach

Our ActivePassive investment philosophy, combined with capabilities like tax overlays and direct indexing, helps you build efficient portfolios, enabling clients to keep more of what they earn.

Solutions designed for high-net-worth needs

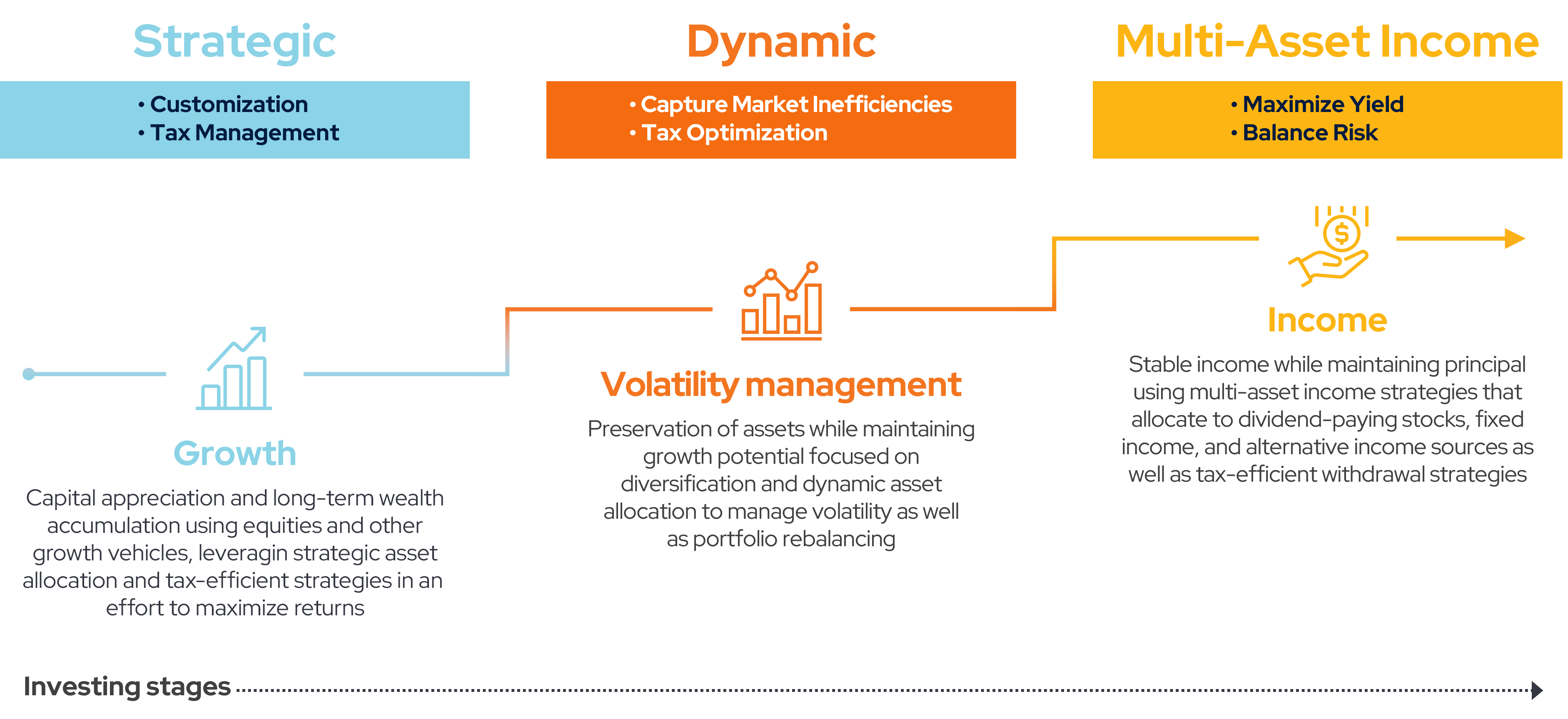

That’s why we offer portfolios with a range of customization options. Building a portfolio that adapts to a high-net-worth client’s evolving needs is key to helping clients stay invested over the long-term.

An exceptional experience

Your Envestnet Private Wealth team, including a dedicated client portfolio manager and experienced CFAs, help you deliver the elevated wealth experience your clients deserve.

![]()

Tailored Portfolios That Evolve With Your Clients

Our Private Wealth team partners with you, offering white-glove service and a dedicated client portfolio manager to guide the process. We work alongside you to design personalized portfolios that reflect each client’s goals, life stage, and evolving needs, helping them stay invested for the long term. This is more than a service, it’s a lasting partnership built to support your high-net-worth clients throughout their financial journey. Here’s how our Private Wealth team works with you to deliver a seamless experience:

Discovery

Our first step with each client is to gain a deep understanding of their goals and investor profile, identifying their investing stage and unique needs.

Portfolio development and optimization

Using those insights, along with a review of your client’s existing holdings, we develop a tailored proposed portfolio. Our client portfolio team specializes in identifying inefficiencies and opportunities through:

Strategic asset allocation: Leveraging a mix of Active and Passive strategies aligned with each asset class in an effort to enhance risk-adjusted returns.

Broad investment access: Offering over 5,000 rigorously vetted and approved investment strategies, including SMAs, mutual funds, ETFs, and alternatives, allowing for deep customization based on each client’s unique needs.

Tax efficiency and cost transparency: Designing allocations that optimize for tax outcomes and clarify cost structures, with thoughtful consideration of vehicle selection (e.g., mutual funds vs. SMAs, ETFs vs. direct indexing) and overlay strategies such as tax or value overlays.

Enhanced diversification: Providing clients with greater personalization through our flagship direct indexing solutions, which allow for ownership of underlying securities and enable the construction of more diversified, tax-efficient portfolios.

For more details on Envestnet PMC’s research and approval processes, please contact pmc@envestnet.com or call 1-888-612-9300.

Advisors should always conduct their own research and due diligence on investment products and the product managers prior to offering or making a recommendation to a client.

Presentation

We present the proposed portfolio to both you and your client, ensuring alignment with their goals and circumstances. To facilitate the conversation, we'll access FlightPath, our fully digital investment proposal tool, pending firm availability.

Understand today, visualize tomorrow.

Simplify the complexity of high-net-worth portfolios.

Help clients appreciate the value and vision behind your advice.

Ongoing support

Our commitment doesn’t stop at implementation. We continuously monitor, analyze, and report investment performance, ensuring your client’s portfolio remains aligned with their goals. We are also available to participate in annual in annual client review meetings.

Built to Last: Investing Through Uncertainty

When looking back at the last 100+ years of the S&P 500, the stock market tends to recover and continue to climb following periods of stress. It’s times like these where it’s important to stick to your plan and stay invested.

January 2026 Market Outlook

Eleven of the twelve asset classes tracked in this recap recorded gains last month.

Commodities led the way in January, despite the rout in precious metals on the last trading day of the month. International shares and US small caps continued to attract interest as investors look to diversity away (at least a big more) from the Magnificent 7 stocks. Stretched valuations across the big technology company landscape have made investors more skittish.

Quarterly Chart Book - Q1 2026

The data in this chart book has been updated through the end of Q4, when possible, to serve as your companion during Q1. We carefully curated the visuals in this presentation to provide you wtih a mix of essential information and unique content you won't see every day. Our charts also incorporate a range of data sources to keep you abreast of today's markets and economic events. Ultimately, we ant you to find this chart book to be comprehensive but not needlessly lengthy.

Ready to meet the moment when wealth expects more?

Learn more

-

Whitepaper

Unlocking Personalization at Scale to Better Help Serve Clients Today and Tomorrow

Envestnet’s concept of the Intelligent Financial Life™ represents a shift in the way we approach financial management.

-

Whitepaper

Annuities as an Asset Class for Fee Based Advisors

RIAs usually emphasize investment-centric approaches that rely on earning the risk premium from the stock market as the most effective way to support a retired client's financial goals.

-

Whitepaper

Help Clients Keep More: Managing the Impact of Taxes in a Personalized Way

In this issue of Sharing Perspectives, we offer insights on the importance of tax optimization and why a personalized approach matters.

-

eBook

Rethinking Expectations for High-Net-Worth Investors

This study looks at advisors who serve HNW clients to find out which services they use most, what they’re happy with, and where there is room for improvement.

-

eBook

An Opportunity within Reach: A Guide to Retaining Today's High-Net-Worth Investor

Whether your clients have wealth in the $1 to $5 million range, the $5 to $30 million range, or $30 million and above, this guide to retaining HNW clients is intended to provide valuable insights.

-

eBook

An Opportunity within Reach: A Guide to Understanding Today's High-Net-Worth Investor

This guide, the first in a series of practical implementation guides, is meant to help you understand today’s HNW investors.

-

eBook

Investment Methodology Guide

This Investment Methodology Guide summarizes PMC’s research and portfolio construction work, which are embedded into services available on the Envestnet platform.

-

Whitepaper

Asset Class Portfolios Methodology

More than half a century has passed since Markowitz introduced the Nobel Prize-winning theory of optimal portfolio allocation in the mean-variance framework.

-

Brochure

Active ETFs are Gathering Steam. What Are They Anyway?

When most people think of Exchange-Traded Funds (ETFs), their minds turn to passively managed products. The growth of active ETFs is changing the landscape, though.

-

Brochure

Overview: FIDx Desk

FIDX Desk expands the solutions you can bring your clients by providing access to a diverse selection of annuity providers and products.

-

Brochure

PMC Foundation Series Portfolios

Using a proprietary methodology, PMC constructs a series of risk-based asset class portfolios (ACPs) at various domestic equity tiers, each with a multitude of diversifying asset class combinations.

-

Brochure

Values Overlay: Personalized Values-Based Screening

The values overlay program at Envestnet allows clients to apply customized values-based restrictions to their investment portfolios.

-

Brochure

Tax Overlay Service: Tax Efficient Investing

The Tax Overlay Service is designed to help reduce tax exposure with the goal of improving after-tax returns.

-

Brochure

The Nuts and Bolts of ETFs

In the first post of this series, we investigated the potential advantages of ETFs and how they may benefit investors.

-

Brochure

Do Active ETFs Delivery on Tax Efficiency?

Active ETFs can offer significant tax reductions, on average, versus active mutual funds in three of the four categories we examine. Active ETFs may provide direct cost savings, too.

-

Brochure

Foundation Series Portfolios: Low Cost, Low Minimum Models

For accounts over $2,000, the PMC Foundation Series include five suites of portfolios designed to provide low-cost investment exposure through index mutual funds or ETFs.

-

Brochure

PMC Active Passive Foundation Portfolios

Constructed exclusively with PMC’s proprietary ActivePassive ETFs, the PMC ActivePassive Foundation Portfolios bring together two seeming opposite investment approaches.

-

Brochure

PMC Environmental Active Passive Portfolios

A diversified portfolio solution for investors looking to manage exposure to climate risks and capture climate related investment opportunities.

-

Brochure

Values Overlay Services

Values Overlay Services provides a truly customized experience, allowing advisors to exclude investment exposures based on a client’s personal preferences.

-

Brochure

Strategic ETF Portfolios

Featuring thoughtful asset allocation and systematic rebalancing, the PMC Strategic ETF portfolios are a straightforward investment solution intended to help investors.

*As of December 31, 2024

Disclosures

Investment decisions should always be made based on the investor’s specific financial needs and objectives, goals, time horizon, and risk tolerance. Past performance is not indicative of future results.

Investments in smaller companies carry greater risk than is customarily associated with larger companies for various reasons such as volatility of earnings and prospects, higher failure rates, and limited markets, product lines or financial resources. Investing overseas involves special risks, including the volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. Income (bond) funds are subject to interest rate risk which is the risk that debt securities in a fund’s portfolio will decline in value because of increases in market interest rates.

Advisors should always conduct their own research and due diligence on investment products and the product managers prior to offering or making a recommendation to a client.

Neither Envestnet, Envestnet | PMC™ nor its representatives render tax, accounting or legal advice. Any tax statements contained herein are not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state, or local tax penalties. Taxpayers should always seek advice based on their own particular circumstances from an independent tax advisor.

Diversification does not guarantee a profit or guarantee protection against losses. Advisors should always conduct their own research and due diligence on investment products and the product managers prior to offering or making a recommendation to a client.

FOR ONE-ON-ONE USE WITH A CLIENT’S FINANCIAL ADVISOR ONLY.