Envestnet | PMC is an industry pioneer in blending the two opposing investment styles: active and passive. We have been implementing this approach within client portfolios well before the asset flow dominance into passive vehicles in recent years. We leverage Envestnet | PMC’s core competencies of manager research and due diligence, manager selection, asset allocation, and active/passive research to engage with our clients. We know active management is cyclical, but we are firm advocates of active strategies. We recognize the benefits of passive investing, too.

Market overview

Global markets wrapped up 2025 on a high note, with stocks finishing near record levels as investors were buoyed by resilient U.S. growth, robust corporate earnings, and ongoing excitement around artificial intelligence. Despite challenges including a lengthy government shutdown and the economic uncertainty it created, persistent trade tensions, lingering inflation, rising unemployment, periodic unwinding of the AI trade, concerns about market bubbles, and declines in consumer confidence, risk assets delivered positive returns across the board. The S&P 500 Index gained 2.66% in Q4 (17.88% for the year), with large caps narrowly outpacing small caps, while microcaps led the way, reflecting a broadening rally beyond the mega-cap tech leaders. Value stocks took the spotlight, outperforming growth, and sectors such as Health Care and Communication Services posted standout gains. International and emerging markets shone even brighter, handily outpacing U.S. equities amid supportive rate cuts and a softer dollar.

The Federal Reserve (Fed) cut rates twice in Q4, bringing the target range to 3.50%–3.75%, while Treasury yields ended the quarter little changed (the 10-year at 4.17%). Short-term yields declined following two Fed rate cuts in Q4, while the 10-year yield was flat, leading to a steepening of the yield curve. High yield bonds outperformed investment grade, and municipal bonds led fixed income performance. Prices of non-US fixed income securities were modestly lower in the quarter, reflecting a stronger U.S. dollar and divergences in monetary policies, inflation expectations, and economic growth prospects across regions.

Commodities delivered positive results, buoyed by the spectacular performance of precious metals. Gold (+64% YTD) and silver (+140% YTD) posted their best year since 1979, while oil prices declined. Despite softer inflation (CPI +2.7% y/y through November) and a cooling labor market, investor optimism persisted. However, market leadership broadened beyond mega-cap tech, and selectivity increased amid questions about the durability of the AI investment theme and the pace of monetary easing heading into 2026.

Our scorecard

Our ActivePassive Scorecard shows active funds beating our category benchmarks in 7 of the 20 asset classes we tracked for the fourth quarter.

In 2025, active funds led our category benchmarks in two of these analyzed asset classes.

U.S. equity

| Active Fund Category | Q4 Return | Vs. Benchmark | 2025 Return | Vs. Benchmark |

|---|---|---|---|---|

| Large Cap Core | 2.27% | -0.14% | 15.22% | -2.15% |

| Large Cap Growth | 0.51% | -0.61% | 15.66% | -2.90% |

| Large Cap Value | 3.24% | -0.57% | 15.06% | -0.85% |

| Mid Cap Core | 0.92% | 0.76% | 8.69% | -1.91% |

| Mid Cap Growth | -1.97% | 1.73% | 7.07% | -1.59% |

| Mid Cap Value | 2.09% | 0.67% | 9.93% | -1.12% |

| Small Cap Core | 1.50% | -0.69% | 7.43% | -5.38% |

| Small Cap Growth | 1.47% | 0.25% | 7.61% | -5.40% |

| Small Cap Value | 1.91% | -1.35% | 6.87% | -5.72% |

Data from Morningstar as of December 31, 2025. The Morningstar US Active Fund categories used in this analysis represent US-domiciled mutual funds and exchange-traded funds classified as actively managed by Morningstar. The asset classes are represented by (in order of table): Russell 1000 TR USD, Russell 1000 Growth TR USD, Russell 1000 Value TR USD, Russell Mid Cap TR USD, Russell Mid Cap Growth TR USD, Russell Mid Cap Value TR USD, Russell 2000 TR USD, Russell 2000 Growth TR USD, and Russell 2000 Value TR USD.

U.S. equities generated broadly positive results in the fourth quarter of 2025, though performance varied across size and segment. Large‑cap equities posted modest gains, which can be attributed to the Core and Value asset classes. Importantly, the relative strength of value over growth within large caps reflected a shift toward more attractively valued, earnings‑stable companies as markets digested evolving macroeconomic conditions and a cooling in the year’s earlier momentum trade.

Mid‑cap stocks delivered a mixed picture, highlighting the continued dispersion beneath the market surface. This softness suggests that more speculative or earnings‑dependent names faced pressure as investors favored segments with stronger near‑term fundamentals and lower valuation risk in a moderating economic environment.

Overall, U.S. equities delivered a constructive but uneven Q4. Value‑oriented segments generally outperformed growth across large, mid, and small caps, pointing to a market that rewarded balance‑sheet strength, resilient earnings, and more moderate valuations.

Non-U.S. equity

| Active Fund Category | Q4 Return | Vs. Benchmark | 2025 Return | Vs. Benchmark |

|---|---|---|---|---|

| Developed Markets | 4.21% | -0.65% | 30.50% | -0.72% |

| Emerging Markets | 4.97% | 0.24% | 31.10% | -2.47% |

Data from Morningstar as of December 31, 2025. The Morningstar US Active Fund categories used in this analysis represent US-domiciled mutual funds and exchange-traded funds classified as actively managed by Morningstar. The asset classes are represented by (in the order of table): MSCI EAFE NR USD and MSCI EM NR USD.

International stocks delivered a solid return in Q4 2025, with the most recent quarter capping off a generally constructive year for both emerging and developed markets. Both asset classes benefited from easing global financial conditions, improved corporate earnings, and continued strength across major international regions. Over the course of 2025 both the MSCI EAFE (Developed Markets) and MSCI EM (Emerging Markets) indexes significantly outperformed U.S. equities, demonstrating the importance of global diversification on portfolio performance.

For the full year, Emerging Markets posted a strong fourth-quarter performance, ranking among the top-performing global equity segments. Yet the dispersion within the asset class was striking, as sector and style dynamics influenced results. Quality and growth-oriented tilts generally lagged, while value, cyclicals, and speculative growth areas were favored in the market environment, creating headwinds for strategies focused on higher‑quality earnings.

Fixed income

| Active Fund Category | Q4 Return | Vs. Benchmark | 2025 Return | Vs. Benchmark |

|---|---|---|---|---|

| Intermediate Bond | 1.04% | -0.06% | 7.07% | -0.23% |

| Short-Term Bond | 1.14% | -0.04% | 5.90% | 0.51% |

| Intermediate Muni | 1.47% | 0.97% | 4.35% | -0.68% |

| Short-Term Muni | 0.68% | 0.22% | 3.88% | -0.23% |

| High Yield | 1.26% | -0.05% | 7.84% | -0.78% |

Data from Morningstar as of December 31, 2025. The Morningstar US Active Fund categories used in this analysis represent US-domiciled mutual funds and exchange-traded funds classified as actively managed by Morningstar. The asset classes are represented by (in order of table): Bloomberg US Agg Bond TR USD, Bloomberg US Agg 1-3 Yr TR USD, Bloomberg Municipal 5 Yr 4-6 TR USD, Bloomberg Municipal 3 Yr 2-4 TR USD, Bloomberg US Corporate High Yield TR USD.

Over the course of 2025, fixed income performance favored taxable bonds over municipals, particularly in intermediate maturities, as higher starting yields and income carry supported returns. This performance highlighted the return advantage of taxable bonds in a higher‑rate environment, while also underscoring selective opportunities for active management, particularly at the short end of the taxable bond market.

From an active‑management perspective, municipal strategies stood out, with intermediate and short‑term municipal bonds outperforming their benchmarks by 0.97% and 0.22%, respectively.

In the most recent period, active fixed income strategies generally benefited from their flexibility in duration management and sector positioning. Some active managers adjusted interest‑rate exposure as yields moved, while selectively emphasizing higher‑quality credit and avoiding pockets of the market where spreads failed to adequately compensate for risk. In contrast, passive strategies remained fully exposed to benchmark‑driven allocations, eliminating their ability to respond to changing market conditions. This dynamic continues to support the potential case for active management in core bond and credit‑oriented segments of the fixed income universe.

Diversifying asset classes

| Active Fund Category | Q4 Return | Vs. Benchmark | 2025 Return | Vs. Benchmark |

|---|---|---|---|---|

| Commodities | 5.02% | -0.83% | 17.55% | 1.78% |

| Real Estate | -1.85% | -1.06% | 0.57% | -3.10% |

| TIPS | 0.05% | -0.08% | 6.94% | -0.07% |

| Bank Loan | 1.09% | -0.13% | 5.17% | -0.73% |

Data from Morningstar as of December 31, 2025. The Morningstar US Active Fund categories used in this analysis represent US-domiciled mutual funds and exchange-traded funds classified as actively managed by Morningstar. The asset classes are represented by (in order of table): Bloomberg Commodity TR USD, DJ US Select REIT TR USD, BBgBarc US Treasury US TIPS TR USD, and Morningstar LSTA LL TR USD.

Commodities delivered a strong performance in the fourth quarter, reinforcing their role as a meaningful diversifier within multi‑asset portfolios. Strength across the quarter and the full year helped offset periods of volatility in traditional stock and bond markets, while also providing a degree of inflation sensitivity as price pressures remained uneven. The magnitude and consistency of returns in 2025 highlighted commodities’ contribution to portfolio resilience, particularly during periods when economic conditions and interest‑rate dynamics challenged more rate‑sensitive asset classes.

Real estate underperformed its asset class benchmark by 3.10% in 2025, reflecting a challenging environment driven by higher interest rates and pressure on property valuations. These results highlight the difficulty of overcoming broad, benchmark‑level headwinds, underscoring the need for selectivity and disciplined expectations when allocating real estate within diversified portfolios.

Factor update

Below, we examine the performance of the five key factors (described by the infographic above) in the current market environment. This analysis is relevant to our scorecard because factors are integral to many active management strategies.

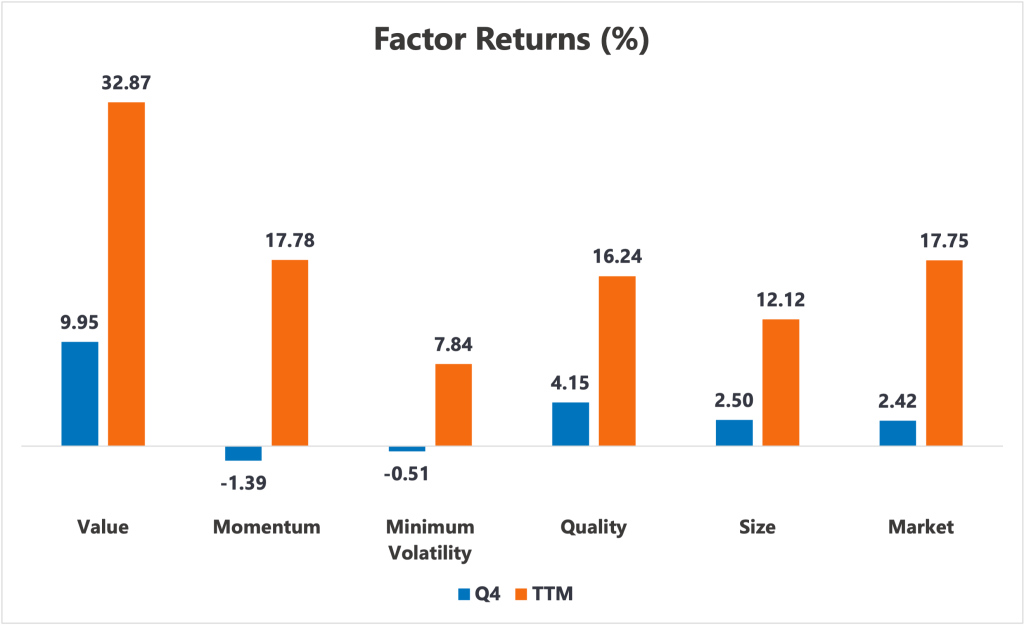

Data from Morningstar as of December 31, 2025. These indices represent U.S. factor returns: MSCI USA Enhanced Value, MSCI USA Momentum, MSCI USA Minimum Volatility, MSCI USA Quality, MSCI USA Small Cap, and MSCI USA GR USD.

- Value posted strong gains in both periods, materially outperforming the broad market and signaling a sustained preference for cheaper assets over the past year.

- Despite solid trailing strength, Momentum turned negative in Q4, illustrating a late‑year pause or reversal among recent winners.

- Minimum Volatility was slightly negative in Q4 despite positive trailing 12-month (TTM) performance, reinforcing a more risk‑on tone late in the year as investors favored cyclical and valuation‑driven factors over defensiveness.

- Quality delivered consistent positive returns, while the Size factor also contributed to performance, indicating continued demand for profitable firms and smaller‑cap exposure.

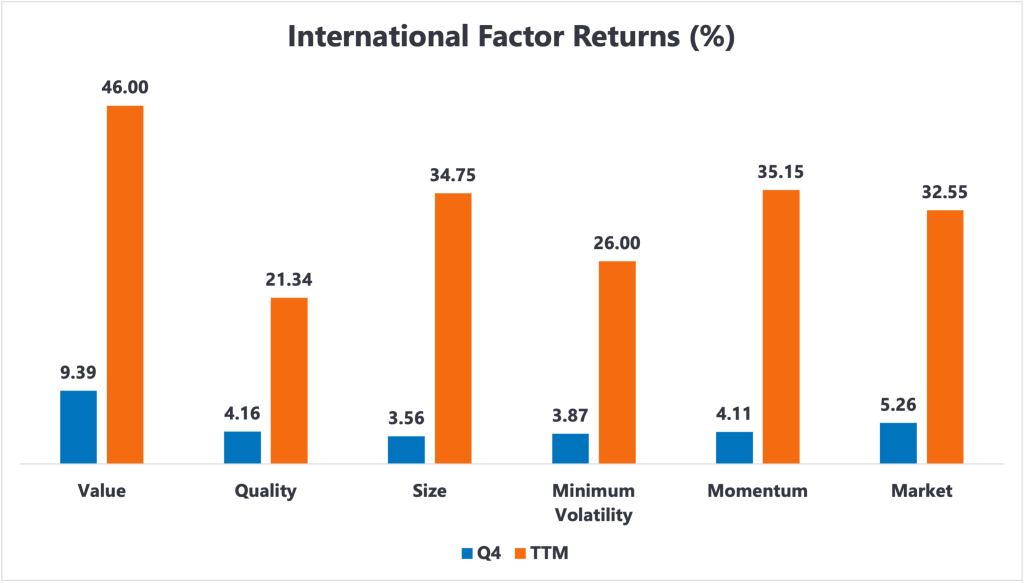

Data from Morningstar as of December 31, 2025. These indices represent international factor returns: MSCI ACWI Ex-US Momentum, MSCI ACWI Ex-US Enhanced Value, MSCI ACWI Ex-US Quality, MSCI ACWI Ex-US Small Cap, MSCI ACWI Ex-US Minimum Volatility, and MSCI ACWI Ex-US GR USD.

- Value was the clear international standout, delivering strong gains in both periods, significantly outperforming the international market and highlighting a pronounced preference for cheaper stocks abroad.

- Momentum remained a major tailwind, posting solid results and reinforcing that prior winners have continued to lead across international markets over the past year.

- The international market itself posted healthy returns, but factor returns like Value and Momentum meaningfully outpaced the benchmark, underscoring the importance of factor tilts outside the U.S.

Value in both active and passive management

This update on active and passive management covers a relatively short timeframe; however, Envestnet | PMC has a long history of research and portfolio management using our ActivePassive methodology. This framework requires patience and a deep understanding of cyclical trends. Ultimately, though, we believe there are places and times for both active and passive management.

Learn more about ActivePassive investing at www.envestnet.com/active-passive