It’s no wonder that professionals in our industry were drawn to the HBO series, Succession. As fun as it was to watch (and judge) the family as they planned for the future and vied for prominence within the family firm, I think very few of would wish that level of drama for our clients. In an ideal world, estate plans and business succession plans should provide families with a level of comfort, not stress.

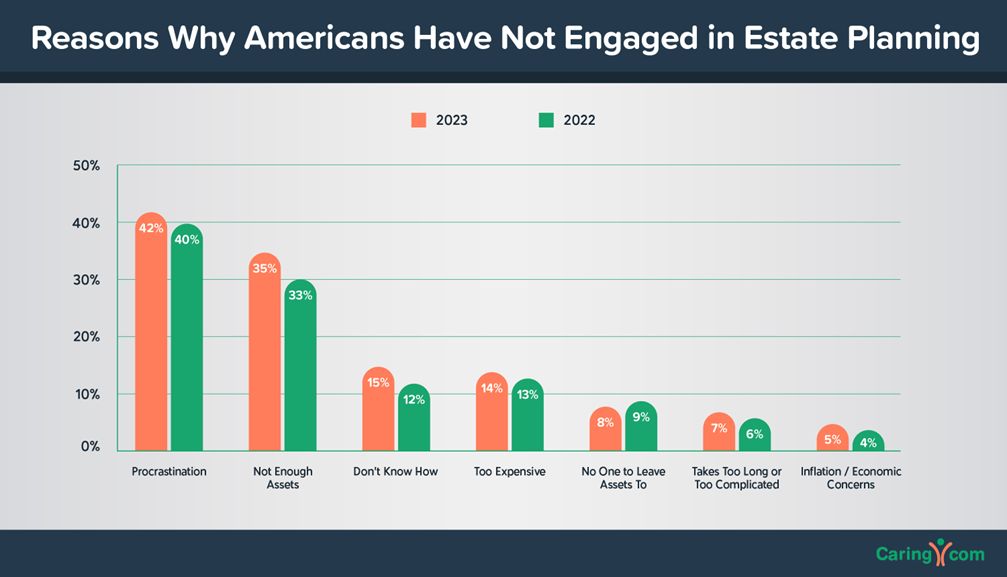

While it is obvious why Logan Roy’s family needed a clear estate plan in place, it can be argued that too few Americans make similar preparations for their own families. Surveys show that while 64% of Americans think having a will is important, only 34% of Americans have an estate plan.1

“Although estate planning is increasingly recognized as an important process, some may hesitate to take action due to the perceived discomfort and difficulty associated with estate planning,”

- Patrick Hicks, General Counsel and Head of Legal at Trust & Will.1

Estate planning discussions with our clients need to go beyond the simple “you need to do this to protect your family” argument. Indeed, most of us have many things we “should” do on any given day. Providing our clients with clear information on the estate planning process, gathering key stakeholders, and actively involving them in decision making are key steps for helping more clients protect their wealth into the future and an ensure their wishes are followed.

1. Initiate the estate planning discussion and help address knowledge gaps

According to the 2022 State of Estate Planning report, 46% of people with an estate plan felt the most difficult thing about setting up their estate plan was figuring out how to begin. That same survey found that advice from a financial planner was a top reason they established an estate plan.2 Financial advisors are well positioned to help their clients—correcting any misconceptions, addressing hurdles that may stop individuals from getting started and establishing an estate plan.

In addition to the challenges faced when getting started, it’s also highly likely that your clients have some gaps in their estate planning knowledge, for example:

Closing those gaps can increase your clients’ comfort level with the estate planning process and can help them to understand the value that you can provide to their family.

Start by explaining that an estate plan goes beyond just a will and addresses more than just financial assets. The most basic estate planning documents should include:

- Property power of attorney (i.e., financial power of attorney)

- Healthcare power of attorney

- Will

- Advance directive or living will

- Trust, revocable trust, and/or other relevant trust documents

As part of this process, you can help clients understand the options that are available for passing on their assets depending on the type of asset, the intended beneficiaries, and the client’s objectives. These options can include establishing beneficiary designations for life insurance policies and retirement accounts, creating trusts, setting a gifting plan or establishing a donor-advised fund. Guiding them through both the process and the strategies that can be used to help carry out their wishes for their legacy will provide them with an improved understanding of how you can support them.

It is wise to encourage all clients to start planning as early as possible. The premiere episode of the first season of Succession began with Logan Roy’s upcoming 80th birthday celebration. There is no reason to wait that long. In fact, I think the show demonstrated that the delay only added to the drama rather than avoiding it. As an advisor, drama is unpleasant for your clients, but it can actually make it difficult for you to do your job as well. Starting estate planning well before a client’s 80th birthday ensures that you have the time (and cooler heads) needed to do a thorough, careful job.

2. Help identify key players and facilitate discussions

In my article with Kiplinger, “This Is How Logan Roy of 'Succession' Should Have Approached Estate Planning,” I note that open and honest communication with heirs is key to avoiding “Roy family level” drama. There is no question that families can be complicated, and tensions can boil over when sensitive topics like money and inheritances are at stake. But it doesn’t have to be that way.

One of the first steps is to understand the key family members, heirs, and other essential individuals that should be identified as part of the process. Also, it is important to remember that we’re not just referring to heirs. Your clients may need to identify loved ones to hold specific roles, such as:

- Healthcare and property powers of attorney

- Guardian of your children

- Trustee or executor

While involving spouses, children, and other loved ones early in the planning process can be helpful in avoiding drama, when to engage family members and how much information to share is a personal decision which your clients likely have strong opinions. You can help clients navigate those decisions and determine the appropriate timing.

Once the timing of these conversions has been decided, you have a critical role to play in facilitating these discussions and helping to make sure that important information is shared appropriately so that these discussions can be as productive as possible.

3. Ensure clients are actively involved in the process

For many clients, estate planning can be overwhelming. Between the breadth of what is covered (tax, legal and financial topics), understanding the process and the depth of emotions involved, it is no wonder that some clients are resistant to getting started. Another way you can support your clients through this process is by giving them “user friendly” ways to be directly involved in the process.

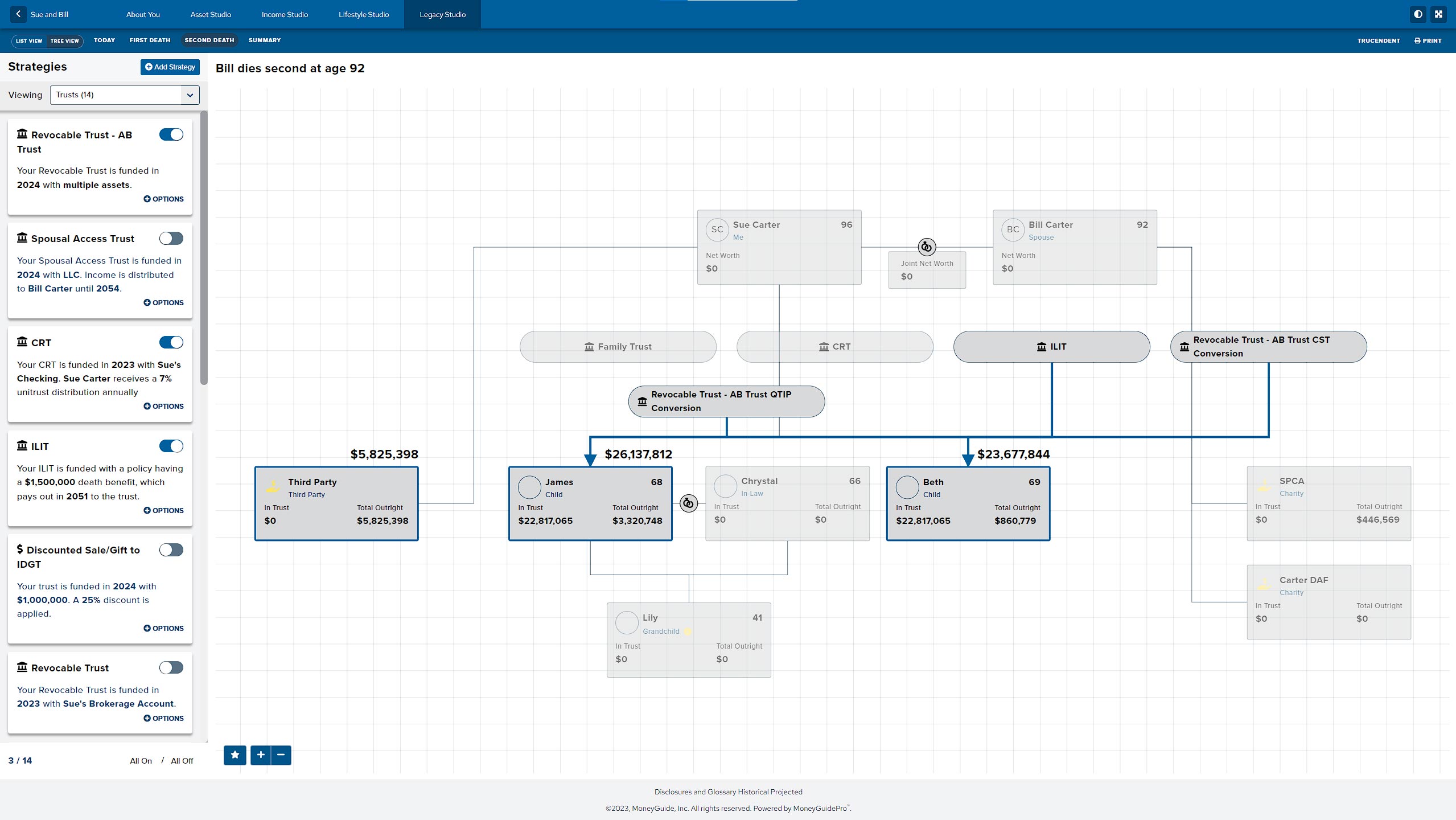

Advisors who leverage technology to interactively demonstrate the impact of advanced estate planning strategies and model dynamic net worth over time, make it all much more digestible for families who may not spend their days working in the financial industry. For example, the Family Tree View in Envestnet | MoneyGuide’s Wealth Studios overlays the flow of assets between heirs and entities at each of their projected deaths, and updates live with the modeling of strategies and recommendations.

Using a visual tool can help decision makers identify their goals and choose a path forward. Advisors can demonstrate the transition of wealth between generations, the impact of establishing trusts, and the potential benefits of various gifting strategies.

Some research has shown that 65% of the population may be visual learners. That means that more than half of your clients would prefer to understand their estate plan visually, if possible.

Discuss estate planning with all of your clients

It is important to work with your clients to establish a plan that addresses their wishes for their legacy. Often clients may be reluctant to get started because they feel they are too young to think about it, don’t have enough wealth or don’t have children or heirs.

As an advisor you can help clients overcome these misconceptions and help them to understand the value in having an estate plan.

Today is always a great time to bring up estate planning with your clients. By addressing their concerns and knowledge gaps, bringing all key players to the table, and utilizing advanced wealth planning tools like Wealth Studios, advisors can help more families avoid “Succession” drama.

For more examples of how to use personalized services to grow your business, visit envestnet.com/personalize.

The information, analysis and opinions expressed herein are for informational purposes only and do not necessarily reflect the views of Envestnet. These views reflect the judgment of the author as of the date of writing and are subject to change at any time without notice. Nothing contained in this piece is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type.

FOR INVESTMENT PROFESSIONAL USE ONLY ©2023 Envestnet. All rights reserved.

1 https://www.caring.com/caregivers/estate-planning/wills-survey/

2 https://9450632.fs1.hubspotusercontent-na1.net/hubfs/9450632/State%20of%20Estate%20Planning%20Report.pdf

3 https://www.lawdepot.com/resources/estate-articles/estate-planning-report/#the-2023-estate-planning-report-infographic

4 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6513874/#fn01