When advisors think about tax management, many think about tax-loss harvesting. And while that tactic has its place, there’s more to the story.

Focusing exclusively on tax loss harvesting can result in missed opportunities to optimize tax outcomes for clients. So, it really should be viewed as just one element in a comprehensive tax management strategy. We believe that tax management isn’t seasonal – it should involve deep understanding of where assets are held, how gains and losses are timed, and the opportunities that may exist outside of the year-end loss harvesting cycle.

To help you go beyond tax loss harvesting, let’s explore other valuable tax strategies that can help you become the tax hero of your client’s story, the person who helped them keep more of what they earn.

Advanced tax management tactics

From strategic asset placement to avoiding costly bear traps, the four approaches outlined below demonstrate how advisors can work to create meaningful tax alpha for clients throughout the entire year.

Gain-Loss Matching: Purposeful loss harvesting

Gain-loss matching enables advisors to take a deliberate approach to tax management through coordinated gain and loss realization. By selling investments at a loss, advisors can generate tax losses to offset gains realized from selling appreciated positions.

This technique aims to reduce tax impact by limiting short-term capital gains exposure, which typically carries higher tax rates. When integrated with other strategies, gain-loss matching can be a valuable tool in your tax optimization toolkit.

Asset Location: Placing assets where they’re taxed efficiently

The basic principle of an asset location strategy is straightforward: Often clients hold assets across various accounts. An advisor can help their clients by placing tax-inefficient investments in tax-advantaged accounts and tax-efficient investments in taxable accounts, making the after-tax outcome for the client better simply by making sound decisions on where to place various investment types.

Effective asset location requires ongoing monitoring and adjustment. As tax laws change, investors’ circumstances evolve, and the relative performance of different asset classes shifts, the asset location strategy may need to be modified.

Don’t fall for the “bear trap”

Perhaps the most dangerous misconception in tax management is the belief that harvesting losses is always beneficial. This can lead investors to make decisions that provide short-term tax relief while creating long-term tax issues.

The fundamental issue with aggressive loss harvesting is that it resets the cost basis of investments to current prices. Investors often loss harvest when the market experiences a significant downturn, since that’s when significant losses are often available to harvest. However, a bear trap is sprung when the market experiences a rapid recovery after a significant downturn. If the investor reinvests the proceeds of the loss harvesting, as is typically done, the investor may end up holding positions with significant unrealized short term capital gains once the wash sale period ends. In effect, they’ve traded immediate tax savings for a larger future tax liability.

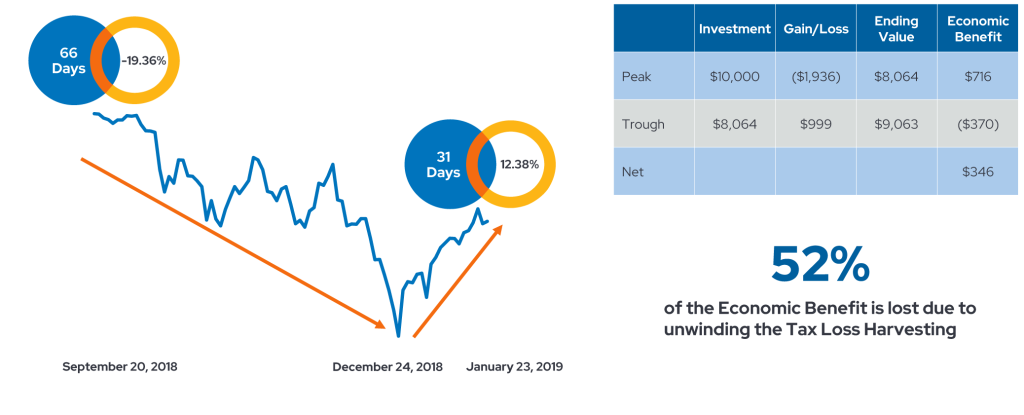

Here’s a hypothetical example of how a $10,000 investment at the market’s peak would have fared if losses were harvested at the bottom of the market. In this example below:

- $10,000 was invested into an S&P 500 ETF at the peak of the market in September 2018.

- The position was then sold at the bottom of the market in December to maximize the tax loss of $1,936.

- The remaining value was then reinvested into a replacement S&P 500 ETF.

- That new position was then sold at the end of the 31-day wash sale period to reinvest back into the original ETF, but by that time the investor had already had a $999 short term gain.

- This short-term gain reduced the benefit of the tax loss harvest by over 50%!

Sometimes a better long-term approach is to be more thoughtful on both gains realization and loss harvesting. Employing gain-loss matching strategies, deferring short-term gains until they become long-term gains, or deferring gains until the subsequent tax year can often lead to better after-tax outcomes for the clients without introducing unintended consequences or risk to the portfolio. We’ll talk more about timing and the high cost of short-term capital gains in the next article in our series.

Navigating tax strategy during market downturns

A more sophisticated approach to tax management during downturns involves several key principles:

- Maintain a long-term perspective and resist the temptation to make dramatic portfolio changes solely for tax purposes.

- Focus on rebalancing opportunities that arise from temporary price dislocations, using the volatility to improve the portfolio's risk-return profile while maintaining tax efficiency.

- Consider using the downturn as an opportunity to make strategic changes to tax location, moving assets between account types to optimize for the new market environment.

The policy conversation around tax-smart investing during downturns also highlights the importance of staying informed about potential changes to tax law. Economic stress often leads to discussions about tax policy changes, and investors who understand the political and economic dynamics at play can take steps to minimize the impact of potential changes to the tax code.

Practicing a holistic approach to tax management

Envestnet has been actively tax managing portfolios for 21 years — all the way back to 2004, with a strong breadth of capabilities that include advanced tax overlay, tax-loss harvesting, and holistic tax management solutions optimizing after-tax returns across multiple market cycles and tax law changes. We are here to help with a ride range of tax management solutions.

Effective tax management is a multifaceted discipline that requires strategic thinking across multiple dimensions, time horizons, and market conditions. It also considers not just the immediate tax impact of investment decisions, but their implications for long-term wealth, risk management, and financial planning objectives.

Advisors and investors who go beyond loss harvesting to embrace a broader, more holistic view of tax management will be better positioned to help clients achieve their long-term goals while minimizing their tax burden along the way.

To learn more about year-round tax management through Envestnet Tax Overlay, visit www.envestnet.com/tax-overlay.