61% of wealth management firm leaders rated tax minimization as an important goal of high net worth clients.1 As I mentioned in a "The future of tax management is year-round, not year-end," the conversations advisors have with their clients around taxes, and the tax savings that they help them to achieve, can strengthen the advisor/client relationship and the future of the advisor’s business.

If only personalized tax management were as easy to execute as it is to talk about. Most advisors don’t have the time or tools required to offer that level of service to all of their clients. Outsourcing is key. By outsourcing tax management, advisors can excel in this area and provide this highly personalized service with efficiency.

Here are three examples of how it could work for you:

Enhance your value proposition

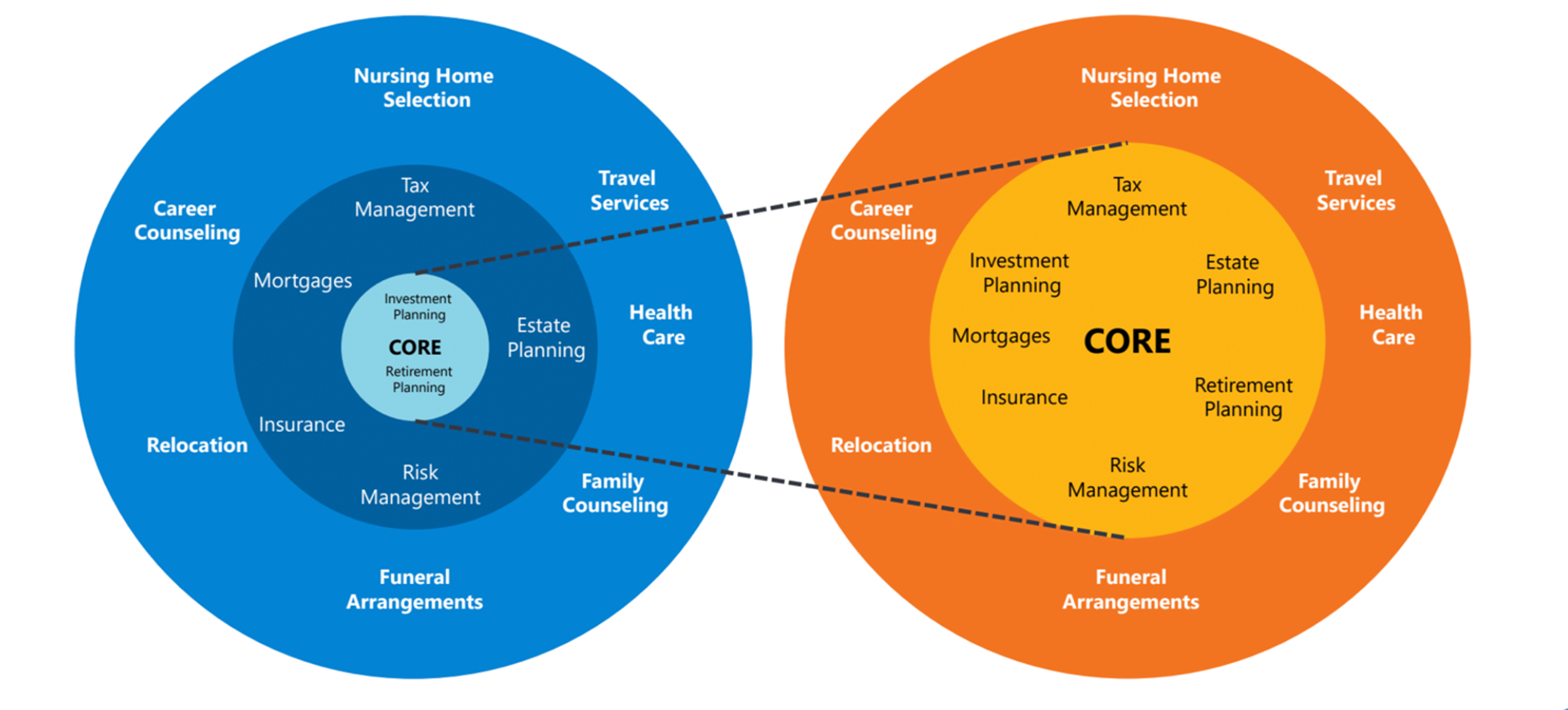

Many of the advisors we speak with are focused on providing their clients with more offerings than they used to. Where they might have focused primarily on investment management just five-to-ten years ago, today their core services have fundamentally changed.

Delivering a wider set of core services for your full book of business can be extremely challenging and time consuming, but these advisors know that if they don’t serve their clients, someone else will.

Outsourcing provides a way to efficiently address that expansion while continuing to provide a great client experience and optimizing outcomes. 69% of advisors believe outsourcing will allow them to spend more time with clients, addressing other needs and concerns. And more than half of the advisors who are outsourcing believe it has allowed them to increase their firms’ revenue.2

Generally speaking, all or most of your clients can benefit from additional tax management support. By not taking on that service alone and outsourcing it allows you to provide that level of service to a larger scale of clients.

Target clients with concentrated holdings

Let’s imagine a potential client named “John.”

John has spent the last 35 years at a small company that has since gone public. As such, much of his wealth is in a very concentrated stock holding.

As you’ve reviewed John’s financial plan, it has become obvious to you that John and his family would benefit from some tax-smart diversification, in an effort to manage risk and to increase income.

Any advisor could walk into a meeting with John and tell him he needs to diversify. That’s true, but it could also have significant tax implications. Instead, imagine walking into that first meeting with John and showing him that you already know HOW he might want to diversity. Imagine presenting several creative options to broaden his holdings that help mitigate the tax cost of diversifying. Having concrete suggestions for tax minimization might very well win you John’s hypothetical business.

Now imagine if you have outsourced that work. An outsourced tax management service can help you to identify the best ways for a client with concentrated holdings to expand their portfolio in a tax efficient way. But it can also help you anytime you need to identify tax efficient suggestions for a client, or importantly, a potential client, which might help you to win more business.

Gain more business with existing clients

Now let’s imagine a client named “Jan.”

Jan has been working with you for several years and seems generally happy with her investment performance. But you have a hunch that she has money in other accounts that she could have with you. Having money in multiple accounts can lead to inefficient tax consequences by not having realized gains coordinated across the various accounts. How can you start a conversation with her that could lead to you consolidating accounts and gaining more of her business?

The answer is by bringing up tax optimization. Start by explaining how some clients like managed accounts for their tax efficiency and transparency. If applicable, highlight how there may be reduced fee and administrative burdens. Then explain that you’d be happy to help review her accounts to see where she could potentially benefit from transitioning to managed accounts.

Taking a holistic approach by outsourcing tax management to a centralized overlay manager can ensure a coordinated tax management experience that implements a specific tax budget for the client. Using the service, you’ll be able to efficiently identify what managed account options might be a fit for Jan and also what the best transition plans might be. And because you are outsourcing, you can offer the same support to as many clients as you wish, with the hope that some of them will chose to invest more of their wealth with you.

Deliver what clients are asking for—your attention and expertise

Clients have made it abundantly clear that they expect personalized service. 70% of wealth management clients view highly personalized service as a factor in deciding whether to stay with their current advisor.3 I think the examples above do a great job of showing how offering tax support to your clients is a way to deliver personalized service in an effective, efficient manner.

For more examples of how to use personalized services to grow your business, visit envestnet.com/personalize.

The information, analysis and opinions expressed herein are for informational purposes only and do not necessarily reflect the views of Envestnet. These views reflect the judgment of the author as of the date of writing and are subject to change at any time without notice. Nothing contained in this piece is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type.

Neither Envestnet, Envestnet | PMC™ nor its representatives render tax, accounting or legal advice. Any tax statements contained herein are not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state, or local tax penalties. Taxpayers should always seek advice based on their own particular circumstances from an independent tax advisor. Client must carefully determine if the use of tax overlay services is appropriate for their circumstances, risk tolerance, and investment objectives. Tax management services are limited in scope and are not designed to permanently eliminate taxes in the account. In providing tax overlay services, Envestnet will allow Client's account to deviate from Client's selected investment strategy. Client's account may experience significant performance differences from the selected investment strategy due to Client's selection of tax overlay services. Envestnet makes no guarantee that the account's performance will be within any range of the selected investment strategy or the strategy´s benchmark. If Client subsequently disables tax overlay services this may result in the recognition of significant capital gains.

FOR INVESTMENT PROFESSIONAL USE ONLY ©2023 Envestnet. All rights reserved.

1 Cerulli Edge, 2021

2 FlexShares’ “The Race to Scalability 2022”

3 2018 Gartner report titled, “Predicts 2019: Marketing Seeks a New Equilibrium”