2025 has not been a forgettable year for global financial markets. Tariffs, interest rate volatility, elections, military conflicts, a federal government shutdown, rising sovereign debts, delayed/missing U.S. economic data, and AI fervor all impacted investors this year. Despite the volatility, staying the course provided opportunities for investors.

Set against a backdrop of generally high equity valuations, 2025’s events gave markets plenty of trading catalysts. While the S&P 500 nearly entered bear market territory following the Trump Administration’s initial tariff announcement, stocks rebounded furiously over the summer and autumn. Barring a precipitous fall in the waning days of the year, equity markets will end 2025 with broad-based gains. International shares have performed especially well this year due to their lower relative valuations, potential for diversification outside the tech-heavy U.S. market, and often accommodative home country policies.

Turning to bonds, growing government debt roiled many nations’ sovereign bonds. Tax hikes and spending cuts have helped to plug a few fiscal holes, but many countries simply borrowed more money. The U.S. even endured its longest federal government shutdown from October through part of November due to the lack of a budget. Central banks generally cut interest rates this year, though, as global inflation eased. The Federal Reserve lowered rates three times in 2025 for 75 basis points of total cuts. This monetary policy loosening ultimately boosted the fixed income markets after multiple subpar years of bond returns.

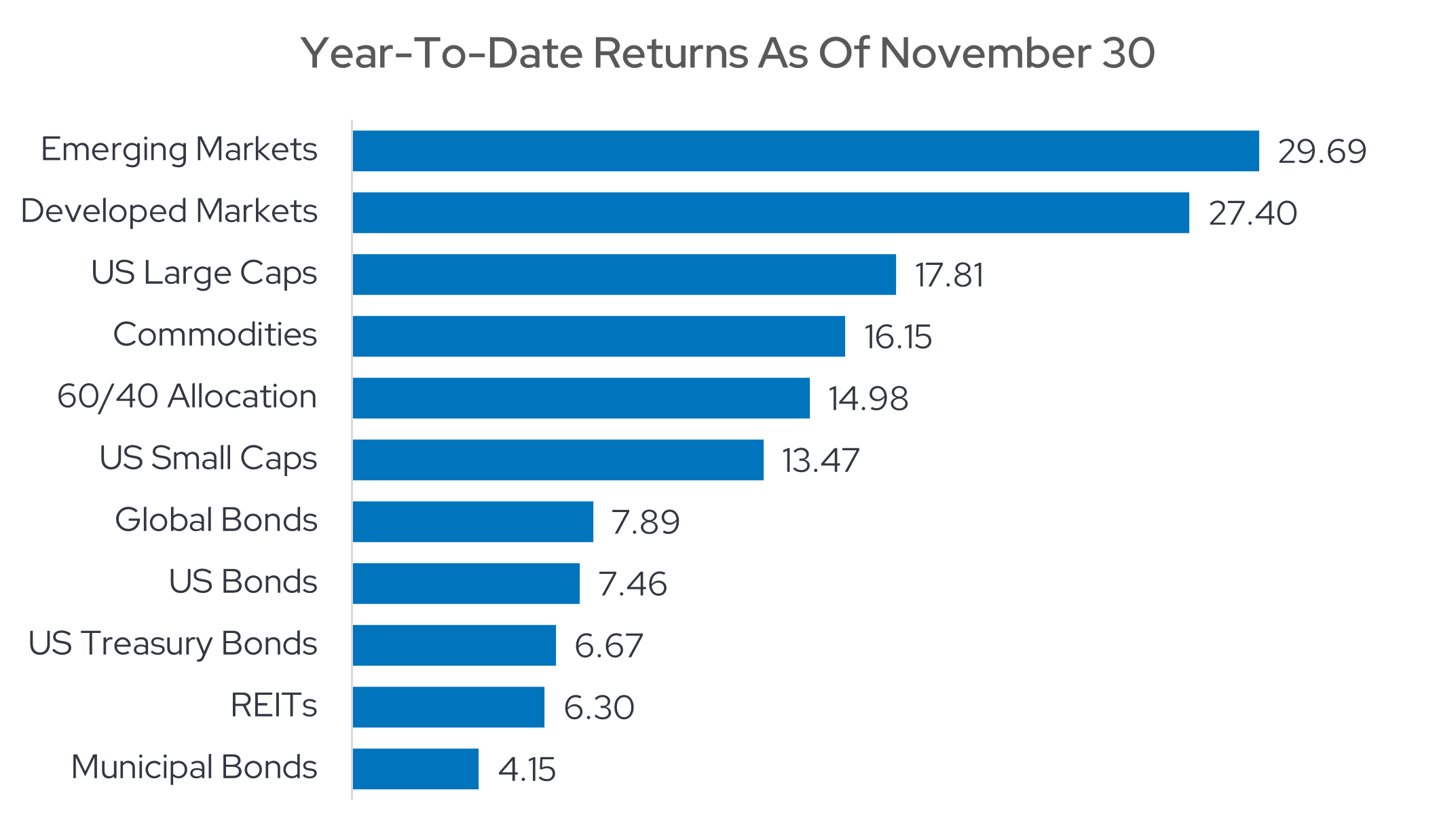

While Bitcoin notched several record highs this year, it took a tumble of over 17% in November that wiped out its 2025 gains. Gold, up over 60% year-to-date at the end of November, has performed exceptionally well this year. Commodities have generated solid 2025 returns in general as economic growth continued through the turbulence. The U.S. real estate market has been under pressure from higher interest rates since 2022, but it began to thaw in the second half of this year. Figure One summarizes 2025 returns for key asset classes through November 30.

Four themes for 2026

At Envestnet, we don’t issue annual price targets for the S&P 500 (or any other index) because these estimates can distract from long-term investing. It’s also impossible to predict every event that will impact the financial markets over the next 12 months. Instead, we’ll focus on four investment trends and economic forces likely to matter in 2026:

Don’t fight the fed

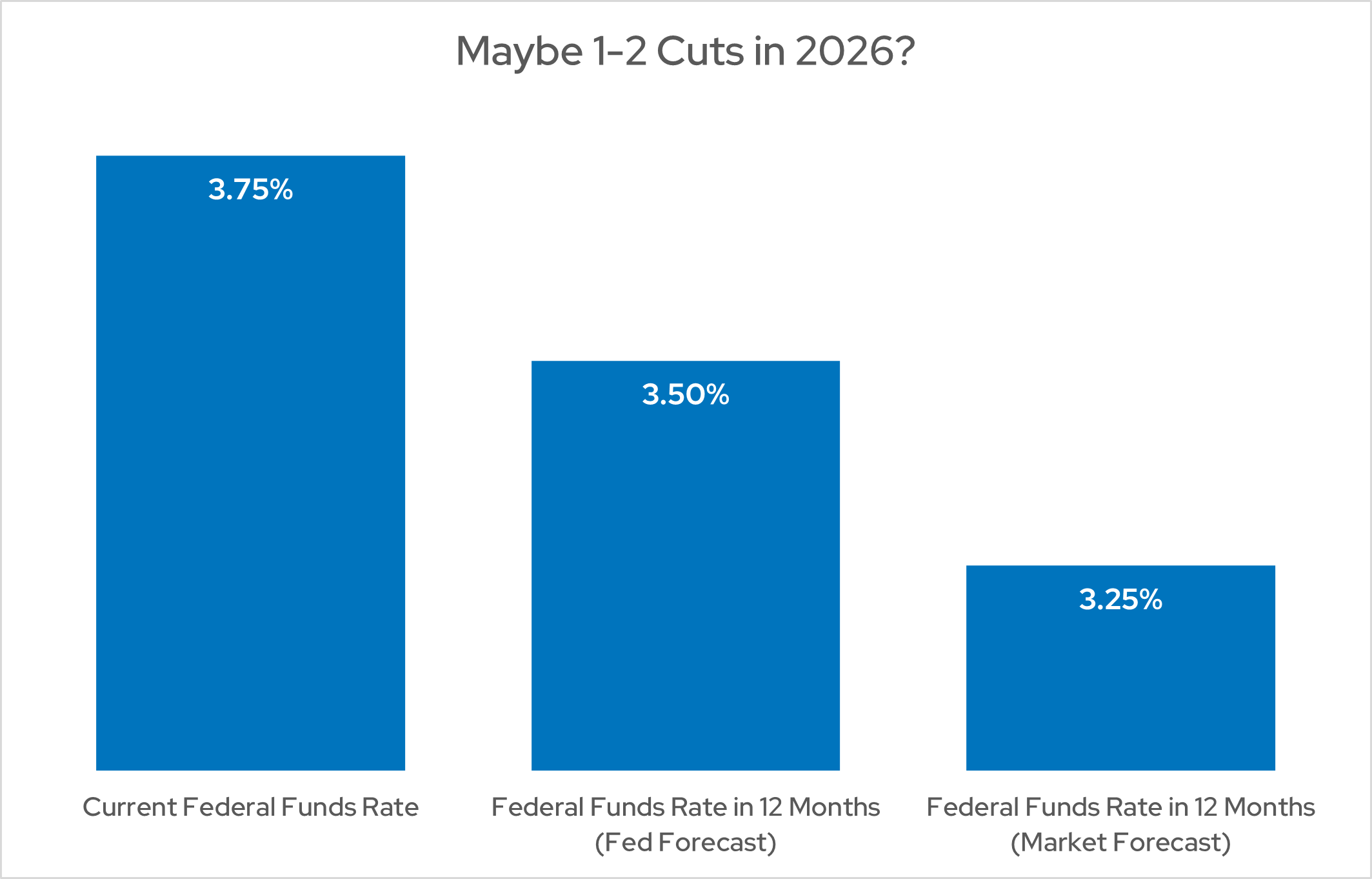

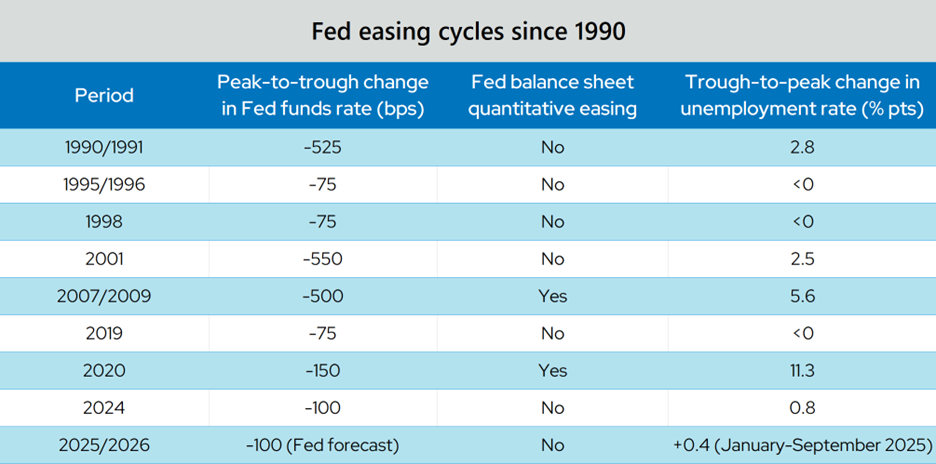

This maxim is often repeated because it’s so true. Like it or not, a group of unelected economists at this quasi-governmental central bank can powerfully influence investment returns. The Federal Reserve’s control over the U.S. money supply gives it unrivalled economic might that can bring joy or tears to investors. An individual or firm that bets against the Fed’s power is like a salmon attempting to reverse a river by swimming upstream. Based on the December 10 Federal Open Market Committee (FOMC) meeting, though, Federal Reserve members anticipate only a trickle of policy changes next year. In fact, the Fed only penciled in a single 2026 interest rate cut. Interest rate futures traders largely agree and currently expect just two rate cuts next year. Whether or not the Fed’s current interest rate forecast is accurate will undoubtedly affect investment markets next year. The following illustrates the market’s expected trajectory for the Fed’s main policy rate.

How high can equity valuations rise?

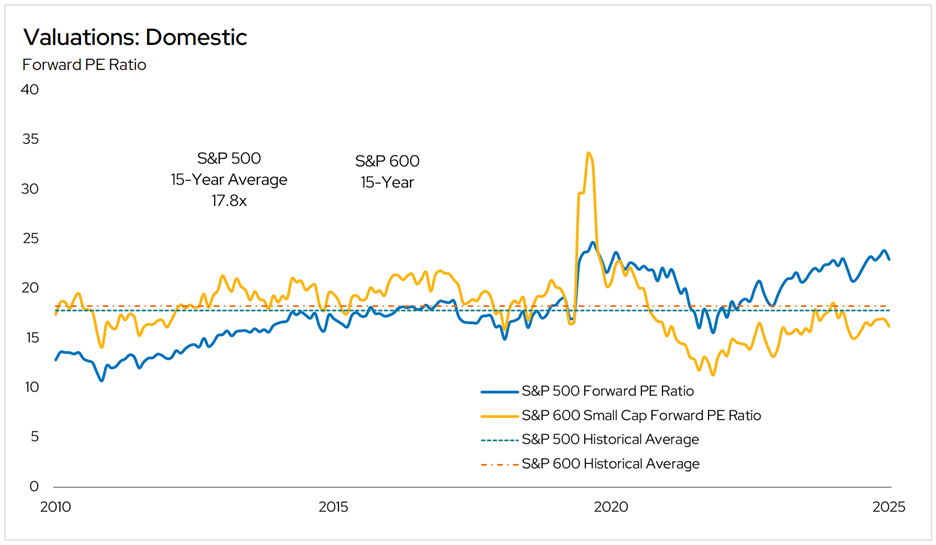

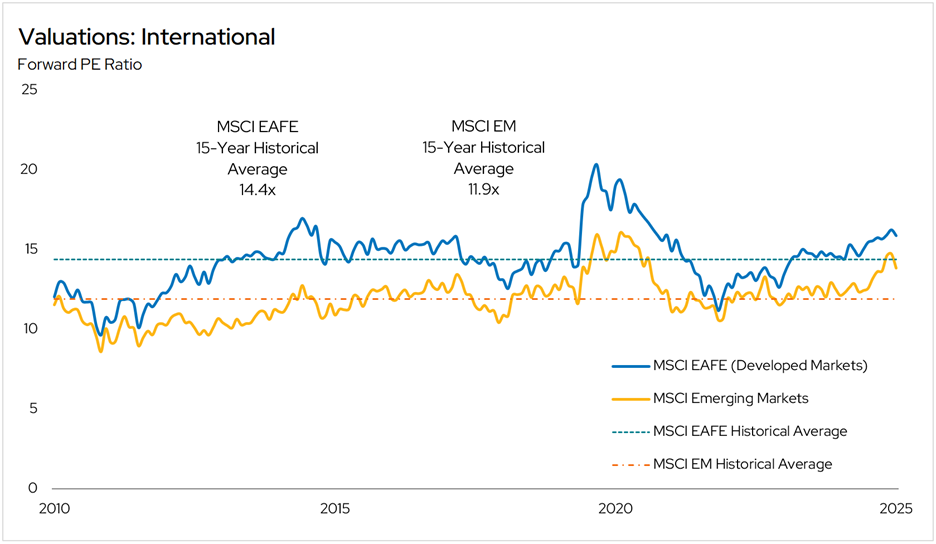

What’s cheap in global equity markets? Not much, based on historical comparisons. When we assess forward price-to-earnings (PE) ratios for four major equity asset classes, we find that ¾ are trading above their 15-year average valuations. Of these four asset classes, only U.S. small caps appear inexpensive using the forward PE. Does that mean you should sell other stocks solely to load up on small caps in 2026? Not quite. Based on research from Strategas, valuations have historically not been effective market timing tools. Current valuations do indicate that U.S. large cap returns over the next 10 years may be lower than they have been over the past 10 years, though. 20%+ annual S&P 500 returns should not be viewed as the new normal. For portfolios lacking diversification into small caps, consider adding an appropriate allocation.

AI’s effect on everything

Previous cycles of Fed rate cuts have often been used to rescue the labor market. Can the recent Fed cuts protect jobs in the age of artificial intelligence (AI)? Or will AI ultimately create more jobs than it destroys (as has been the historical norm for technological revolutions)? The interplay of AI and employment will be critical for the economy and investors next year.

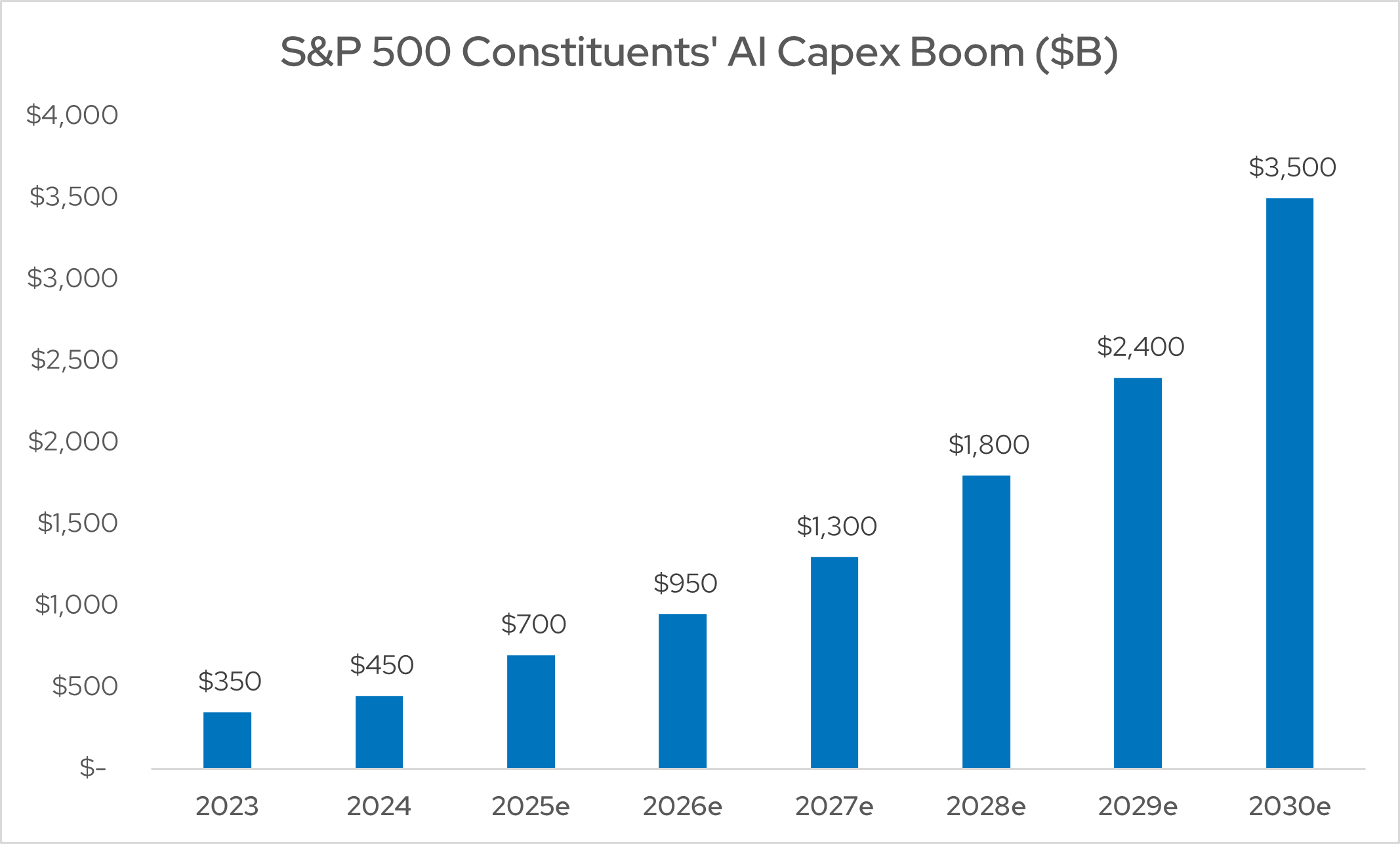

As companies continue to invest in artificial intelligence, technology capital expenditures are forecast to climb in 2026 and beyond. This spending boom has a lengthy runway as long as companies see benefits, such as enhanced employee productivity and improved product quality, from their AI investments. Since U.S. technology companies are currently highly profitable, unlike during the dot-com bubble, 2026 doesn’t seem like 2000 all over again. Still, a decline in AI’s perceived value and usefulness would be a stock market headwind.

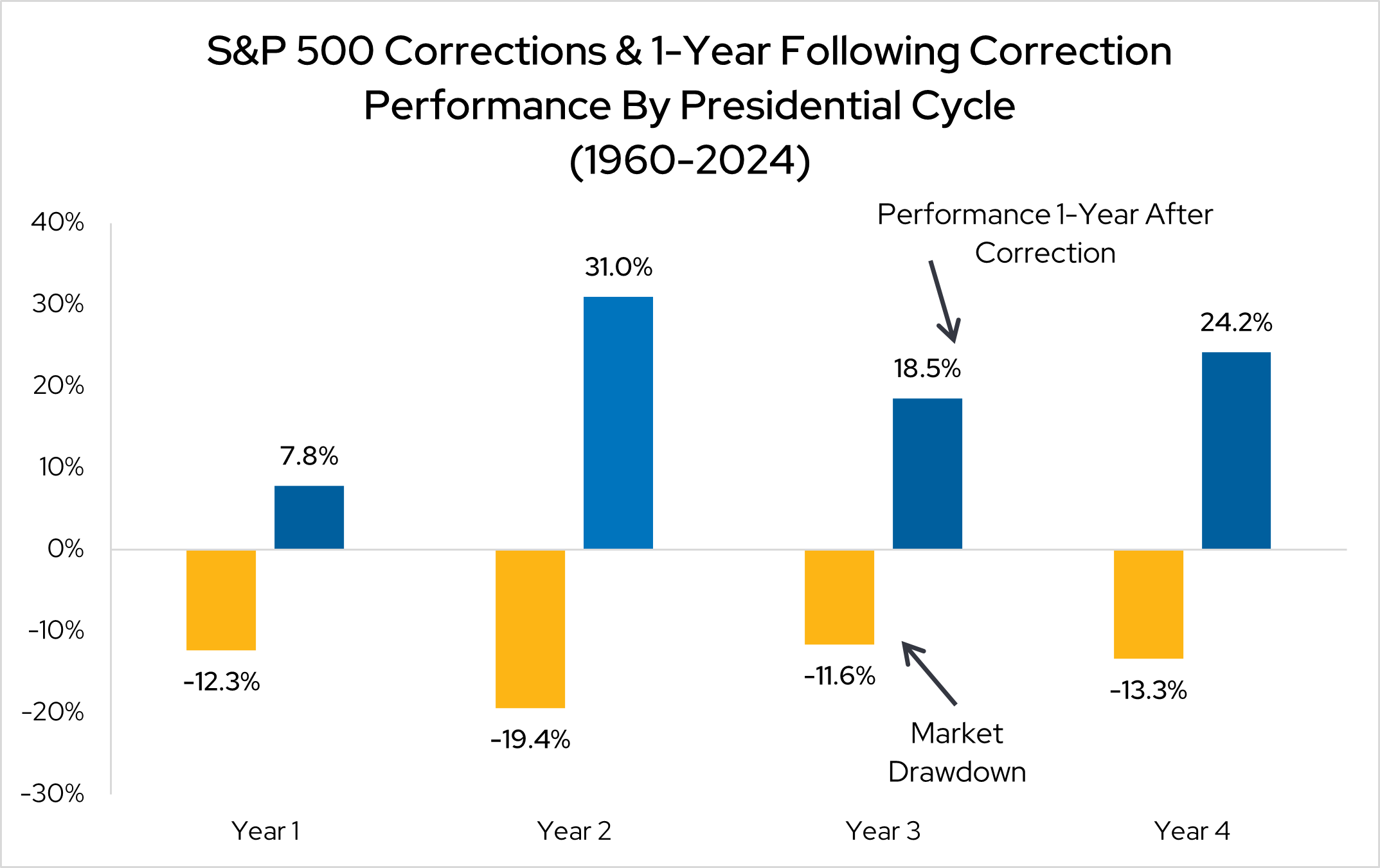

Midterm election volatility

Whether you’re a political junkie who finds C-SPAN riveting or you cringe at the thought of politics, midterm elections are still coming in 2026. Partisan competition can create financial market volatility, and the outcome of the elections can sway everything from tax rates to investment industry regulation. According to Strategas, midterm election years have historically suffered steeper U.S. equity market drawdowns than any other year of the presidential cycle. 19.4% is the average S&P 500 correction in midterm years. The good news is that the S&P 500 has historically enjoyed a 31% rebound in the year following the midterm drawdowns. See Figure Seven. Because the length and depth of the midterm corrections have varied widely in the past, we don’t suggest trying to time dips and bounces. Patience is the key, no matter which party wins next November.

2025 closing, 2026 loading

However you celebrate the season, we wish you the happiest holidays ever. No matter what the New Year brings, we’ll be here to deliver the adaptive wealth tech and innovative investment solutions you need to meet the moment in 2026. We can’t wait to serve you!

Keep up with our industry insights at www.envestnet.com/blog.