Selecting the right trading tool is crucial to helping clients meet their financial goals. The Envestnet Wealth Management Platform serves as the central access point for our clients throughout the entire investment lifecycle. Envestnet offers an open architecture approach to help meet any trading needs. Let’s explore how firms are leveraging Envestnet’s trading capabilities to transform their practices and deliver more impactful results for their clients.

How do trading platforms add value to a firm?

A comprehensive wealth trading tool can help grow advisors’ practices through flexible, efficient trading workflows that support portfolio personalization, scale, and a seamless user experience, regardless of the advisor’s business model or structure.

What sets this type of platform apart is its ability to deliver a consistent and intuitive experience for all users, its unmatched processing power across large volumes of accounts, and its capacity to personalize portfolios at scale.

The trading workflow typically progresses through four key phases:

- Portfolio Explorer: Advisors begin their day with a centralized dashboard offering a detailed view of the portfolios they manage. This workspace includes customizable layouts, built-in working lists, and a wide array of dynamic filters that help advisors quickly identify which portfolios require attention and action.

- Order Generation: Once portfolios are selected for trading, advisors can choose from a suite of tools tailored to different use cases and volumes. Tools like Quick Trade, Manual Upload, and Worksheet Trading are ideal for smaller or one-off trades, while capabilities like Rebalancer, Trade to Target, and Tax Harvest support trading across multiple portfolios simultaneously. Each tool allows for customized parameters and trade preferences, helping advisors fine-tune the strategy behind every trade.

- Order Review: After generating proposed trades, advisors can review them within a centralized Order Review page. This area provides both summary-level insights and detailed portfolio-level data, enabling efficient analysis and adjustments. Each batch of trades is automatically saved within a unique “Scenario,” which records a snapshot of portfolios, proposed orders, and settings—offering a reference point that can be accessed or reused later.

- Order Management: In the final step, advisors can view, edit, and approve orders before they are systematically blocked and sent for execution through straight-through processing. Real-time execution data is available directly within the interface for full transparency and oversight.

This type of platform has proven especially effective for advisors seeking to quickly analyze portfolios, identify opportunities, and review the impact of proposed trades—all within a single, integrated workflow.

What should a firm look for in a trading tool?

Selecting the right trading tool is crucial to helping clients meet their financial goals. As a firm is evaluating a trading tool, I would look for the following capabilities:

- Modern and flexible user experience: By providing a seamless advisor experience, they can review information quickly and take action effortlessly.

- Intuitive workflows: Whether you are looking to manually trade one account or one thousand accounts, having workflows that match your needs is essential. For high-volume trading, an instructions-based user experience enables an advisor to execute trades across multiple accounts with a single click, automating client workflows.

- Highly integrated and scalable: An integrated solution across the entire wealth management life cycle is critical for managing accounts efficiently and delivering a seamless client experience. As your business grows, your trading tool should scale with you, supporting higher account volumes, more complex workflows, and greater automation and compliance needs.

- Teams-based investing: Firms may want the ability to outsource all the trading on behalf of the home office and advisors.

What should a firm look for in terms of trading service and support?

Over the course of an investment, advisors will likely make numerous changes to their clients’ accounts. To support this dynamic environment, firms need a trading solution that offers a wide range of service requests—empowering advisors to efficiently manage accounts while ensuring compliance and clear communication.

A robust service request system enables advisors to initiate and track changes related to trading, account maintenance, and modifications. These workflows help streamline operations and foster collaboration among advisors, sponsors, and portfolio managers throughout the investment lifecycle.

Envestnet’s service request capabilities include:

- Comprehensive request types: Service requests span key areas such as asset management (e.g., raising cash, rebalancing), account maintenance (e.g., trade holds, systematic withdrawals), and account modifications (e.g., registration changes, strategy updates).

- Asset management actions: Advisors can execute trading activities within managed accounts, including rebalancing portfolios, harvesting gains or losses, and performing full or partial liquidations.

- Workflow flexibility: Service request workflows are tailored to firm-specific processes, platform configurations, and account types. The responsibilities for initiating and processing requests vary depending on whether accounts are traded by Envestnet, sponsors, managers, or advisors.

Our service request capabilities are directly integrated with our outsourced trading services, which lower operational overhead and mitigate trading risk. Using service requests, advisors can efficiently onboard and maintain client accounts while taking advantage of the ability to personalize client portfolios at scale with additional services such as tax overlay management, direct indexing, and high-net-worth solutions.

How do trading tools integrate into the rest of the tech stack?

Leveraging adaptive wealthtech can lead to significant gains in advisor productivity. By unifying financial planning, research, proposal creation, account opening, trading, reporting, risk management, and compliance tools, advisors can operate more efficiently and deliver a more seamless client experience.

From an advisor’s perspective, having their trading tools integrated within the tech stack reduces the need for dual maintenance of client data and the need to swivel-chair between systems. All client data, accounts, and models are centralized and maintained within a unified system. From a firm’s perspective, having the trading tools directly integrated enables efficient monitoring and compliance.

Plus, eliminate data silos and reduce manual processes when adopting a trading tool that is integrated with third-party solutions, including CRM systems, alternative investments, and custodial services.

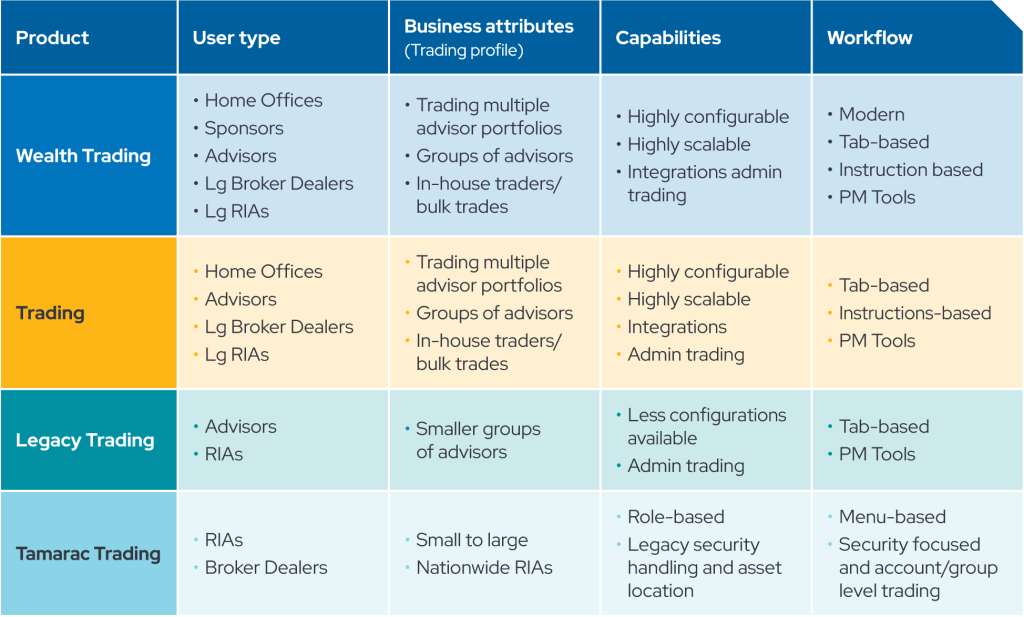

Envestnet trading tools for enterprises: compare and contrast

What’s next for wealth trading?

Our team is dedicated to continuously advancing our trading technology capabilities. We’re focused on empowering advisors to review and act more efficiently within Envestnet’s Wealth trading platform. As an adaptive wealthtech company, Envestnet is excited to introduce options trading capabilities to the platform, enabling advisors to create options trades for their clients, deliver greater personalization, and provide added value to their clients.

Explore the Envestnet and Tamarac trading tools at www.envestnet.com/wealth-management/trading.