Envestnet’s Wealth Management Platform supports financial professionals throughout the investor life cycle by providing a comprehensive technology experience and various solutions, with accompanying service and assistance. This release delivers a suite of enhancements designed to streamline advisor workflows, improve data visibility, and support more personalized client engagement. From proposal generation to portfolio accounting, we are introducing tools that help advisors and home offices operate with greater precision and flexibility.

Let's explore the key updates and how they support an advisors’ day-to-day practice.

Smarter navigation and platform performance

Platform and portal enhancements in this release focus on client insights, usability, and speed:

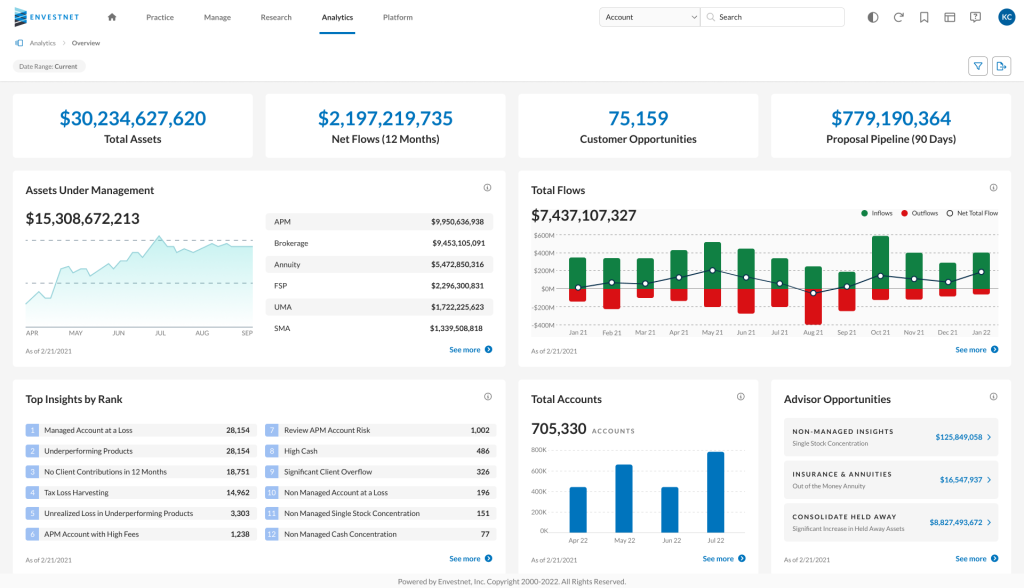

- Client insights at a glance: A new Analytics tab in our Wealth Data Platform aggregates key metrics and insights, enabling faster, more informed decision-making. To enable this feature, please get in touch with our support team.

- Saved layouts redefined: Advisors can now categorize, search, and edit saved layouts more efficiently, reducing time spent navigating the platform.

- Pagination for high-volume pages: A new pagination option on the Accounts page improves load times, which is especially valuable for users managing large datasets.

Greater control in proposal construction

ISP stands for Investment Strategy Proposal. It is a document designed to assist in presenting and converting investment proposals, reflecting a modern look and feel, enhancing usability and content to better support investment discussions. ISP Lite document enhancements offer greater customization and flexibility:

- Custom content management: Sponsors can now upload and manage multiple PDFs, configure permissions, and share content across firm hierarchies—streamlining proposal storytelling.

- Improved workflow flexibility: The ISP Lite document can now be generated during both the Preview and Re-registration steps, ensuring visibility and consistency throughout the proposal process.

Expanded portfolio management capabilities

We’ve made several updates that enhance portfolio oversight and client alignment:

- Include off-platform traded accounts in proposals: Advisors can now include off-platform traded accounts in proposals, improving portfolio completeness and client transparency.

- Extended support for off-platform accounts: New capabilities allow for billing, suitability, and risk profiling of off-platform accounts like 529 plans—without disrupting external trading workflows.

- Security restrictions at scale: Advisors and sponsors can now manage security restrictions by registration type and apply changes in bulk, with enhanced audit trails and permission controls.

- Do not sell-only restrictions: APM accounts can now restrict sales at the account-level while allowing purchases, supporting more nuanced investment strategies and client needs.

Improved accuracy in portfolio accounting

Data integrity and benchmarking flexibility are central to the accounting updates:

- Harvest VSP, or Versus Purchase, Lot Mismatch Reporting: A new report flags mismatches between platform-proposed and custodian-retired lots, helping reduce operational delays and manual reconciliation tasks.

- Delisted and inactive securities handling: The platform now allows users to proactively restrict trading of delisted or expired securities and introduce alerts for users during model edits.

- Secondary benchmarks at the account level: Advisors can now apply benchmark overrides at the individual account level, supporting more tailored performance tracking.

Enhanced proposal filtering

Tax-appropriate filter in the proposal tool has been refined:

- Advisors can now adjust the Tax Appropriate filter in proposals, allowing for more precise investment selection based on account registration types.

Get the most out of each platform release

We are committed to delivering platform enhancements that support the evolving needs of financial professionals like you. These updates are designed to help you work smarter, deliver more value to clients, and scale your practice with confidence.

For our comprehensive release notes and additional information, reach out to your Envestnet Enterprise or Regional Consultant. We also invite you to learn more about these exciting enhancements at our designated resource center for our third release of 2025.