Climate change has been increasing the magnitude, intensity, and frequency of exposure to natural disasters—and the costs that come with those disasters—for industries across the global economy.

Climate disasters include those that are acute, like droughts, floods, wildfires, and storms, and those that are chronic, like rising sea levels, biodiversity loss, and increasing average temperatures. Both acute and chronic climate disasters can have severe economic ramifications. In 2022, floods in Pakistan wiped out 2.2% of the country’s gross domestic product.1 More recently, drought in the Panama Canal has impaired a waterway that handles $270 billion a year in global trade.2 These events can damage assets and disrupt operations, posing climate-related financial risks to companies and impacting the creditworthiness of state and local issuers.

By helping investors understand these physical climate risks, advisors can equip them with the insights they need to make more informed decisions.

Extreme weather, vulnerable industries

Among the industries at greatest climate risk are those that power both our global food supply and energy system. Some examples:

- Agriculture: Animals raised for consumption are highly resource-dependent, requiring mass amounts of land, water, and feed. Extreme weather events and changing climates have a negative impact on these resources. In the first three quarters of 2021, Tyson Foods reported its operating income decreased by $410 million compared to 2020 as a result of increased feed costs, declines in hatch rates, and disruptions caused by extreme weather. Extreme temperatures have also been found to stunt animal growth and development, resulting in slower growth rates, and ultimately lower overall weights, according to a study published by Elsevier in the Animal journal. In fact, a one day increase in the frequency of heatwaves every 100 days reduces cattle weights by about 200g.3 Less meat per animal raised means less profit for the meat farmer, despite requiring the same resources to raise the animal.

- Utilities: In California, because of extreme drought, the risk of transmission lines igniting wildfires is particularly high. In the last five years, the state suffered 10 of the most destructive wildfires in its history, according to a California State Auditor report. with utilities found to be the cause for some.4 Since 2018, Pacific Gas & Electric (PG&E) has paid out over $5 billion in settlements to wildfire victims, with an additional $8 billion in proposed settlements, and has paid hundreds of millions of dollars in fines. The company was found liable in court for the notorious “Camp Fire” which caused record-setting death and destruction, including 85 lives lost. Ultimately, in 2019, they filed for bankruptcy and remain at risk for a state takeover. And a year later, S&P lowered its rating outlook for California utilities from “stable” to “negative” as a direct result of their handling of that year’s wildfire season. Moody’s joined them shortly thereafter, lowering PG&E’s rating to “junk.”

As climate events become more pervasive and costly, one looming question is who will bear the financial burden. In 2022, almost half of all economic losses globally resulting from natural disasters were covered by insurance, according to Aon. Over the last three years, as reported by the Insurance Industry Institute, underwriting losses across the insurance industry in Florida have totaled over $1 billion. In fact, property and casualty insurers there have not seen a profit since 2016 on underwriting.5 According to Jefferies, global property-catastrophe reinsurance rates were up 37% last year. Insurance companies are not able to absorb the increase in premiums and they’re beginning to leave states like Florida, Louisiana, and Texas.

My recent conversation with Jeff Gitterman, Partner at Gitterman Wealth Management, and Spencer Glendon, Founder of Probable Futures, reiterated this reality. As Jeff made clear, right now, there is no risk premium in the market to reflect physical climate risks. And these risks are actually easier to measure and predict than other types of risks. So, if you’re not giving up returns to consider these risks, the question becomes…why wouldn’t you?

Adapting through resilience

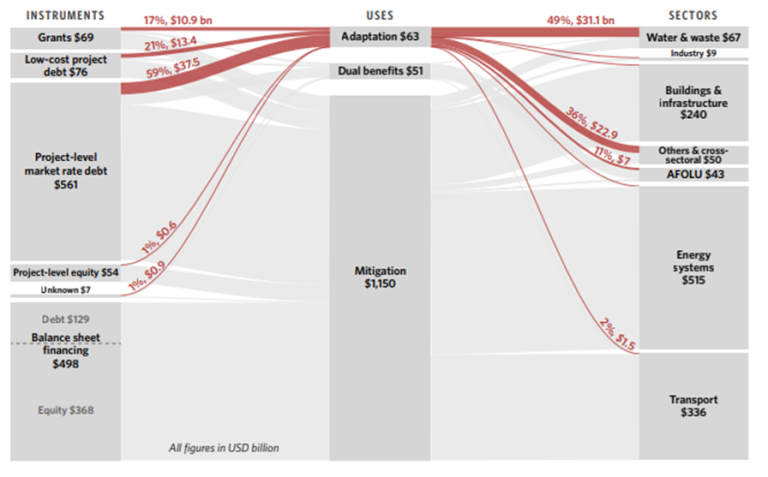

The foil to these climate-related financial risks are the investment opportunities that exist in climate adaptation and resilience solutions. Beyond the retrofitting of buildings and infrastructure, these types of solutions include flood and wildfire prevention, agriculture resilience, water supply purification and adaptation, storm and extreme temperature resilience, and even population resettlement. As of 2021, only 7% of climate-related investment opportunities aided in adapting to climate volatility. However, that same year, analysts with Bank of America predicted that the market for these solutions could be worth $2 trillion by 2026.6,7

Every dollar invested in adaptation could provide net economic benefits in the range of $2 to $10 in the form of reduced risks, losses, increased productivity, and innovation, according to the Global Commission on Adaptation.8

In the interim, climate adaptation is almost entirely funded by public entities, with roughly 98% of adaptation finance globally in 2023 coming from the public sector, according to Climate Policy Initiative data.9 National and multinational development finance institutions led this through market-rate debt issuances, concessionary loans, and grants.10

The UN Environment Programme estimates that adaptation finance required in poorer countries is likely to reach as much as $300 billion by 2030 and double that by 2050.11

COP28’s call to action on just a transition

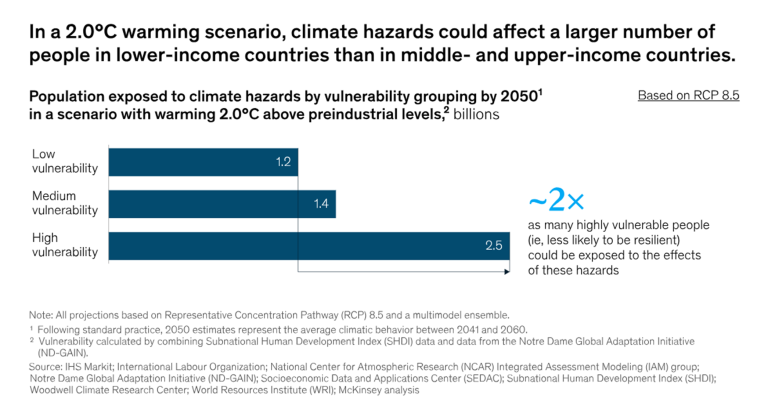

The effects of climate change are unevenly distributed. Often the most under-resourced and ill-equipped populations are those that experience climate impacts more severely. Achieving a just and equitable transition as we progress into a more sustainable, lower carbon economy was a key focus area during COP28 in December.

On average, lower-income countries are more likely to be exposed to certain climate hazards compared with many upper-income countries because of where they’re located and how their economies are structured. Countries that fall within the most vulnerable categories are also more likely to be exposed to a physical climate hazard. A McKinsey & Co. analysis suggests that nearly twice as many highly vulnerable people (those estimated to have lower income and who may also have inadequate shelter, transportation, skills, or funds to protect themselves from climate risks) could be exposed to a climate hazard.12

Fortunately, investors have options to address highly vulnerable populations in their portfolio, which advisors can help them implement.

For example, Breckinridge Capital Advisors recently launched new customizations to its flagship intermediate tax-efficient portfolio strategy, and one option enables investors to allocate capital directly to climate-vulnerable communities in the US. The firm measures vulnerability to physical climate risk by targeting communities that have very high exposure to flood, hurricane, wildfires, droughts or heat events, and then evaluating a community’s resource capacity and age of its infrastructure.

In addition, Community Capital Management offers customizations within its fixed income portfolios to allow investors to direct capital to specific impact themes. One theme is Disaster Recovery, Resilience, and Remediation, which focuses on supporting economic development activities in federally designated disaster areas as well as physical and civic infrastructure to better prepare communities for the effects of climate change, natural disasters, and widespread health emergencies.13

Within populations that are more socioeconomically vulnerable, many affordable housing projects incorporate resiliency and energy efficiency improvements into the projects. For example, Adam Guerino, Associate Portfolio Manager for Nuveen’s Fixed Income, Responsible Investing strategy, identified Preservation of Affordable Housing Inc. (POAH) as one of its investments. POAH takes seasoned affordable projects that need to be refreshed, and incorporates passive housing standards into the rehabilitation. More widely implemented in Europe, passive housing utilizes materials and design to improve energy efficiency. Mr. Guerino shared with me that he and his team view this not only as a benefit to residents in terms of reducing the impact of climate change on their communities, but also as a way to lower operating expenses to help maintain affordability—plus, there is an additional potential advantage for bondholders, who can obtain healthy cash flows.

For investors seeking more direct and targeted climate and community-related outcomes from their investments, there are a growing number of opportunities in both public and private markets to consider. We’re likely to see more innovation as a result of the commitments agreed to at COP28 and the various government actions that have been announced over the last few years, such as the Inflation Reduction Act and the Infrastructure Investment and Jobs Act in the US, various directives in the EU, and actions in other countries. Advisors can demonstrate even greater value to clients by discussing these opportunities, and incorporating them into customized financial plans, when appropriate.

To learn more about supporting your clients with sustainable investing solutions, reach out to our team at sustainable@envestnet.com or visit envestnet.com/sustainable.