High-net-worth (HNW) portfolios often have two core objectives: tax-efficient income and capital preservation. Municipal bonds (munis) are a way to address both, offering tax-exempt interest that is especially valuable for investors in higher tax brackets. To enhance outcomes when incorporating munis into a client’s financial plan, some advisors recommend using separately managed accounts (SMAs) to tailor portfolios, enabling the optimization of yield curve exposure, efficient tax lot management, issuer-specific customization, and pre-transition risk analysis through advanced portfolio analytics tools.

If this is a path you are considering for your HNW clients, there are three factors to keep in mind:

- Structure

- After-tax income

- Research and diversification

Structure matters: Blend for stability and opportunity

For HNW clients, a well-structured municipal bond portfolio helps balance income, flexibility, and risk management. It’s your role as an advisor to help get that structure right. A common starting point is a laddered SMA with maturities ranging from 1 to 10 years, which can deliver steady income and predictable cash flows while managing interest rate risk. Many HNW investors also may benefit from hybrid portfolios (e.g., combining 80% individual bonds with 20% municipal bond mutual funds or exchange-traded funds) to maintain customization while adding tactical flexibility. No matter the blend, your duration strategy should align with both your client’s liquidity needs and your view on interest rates.

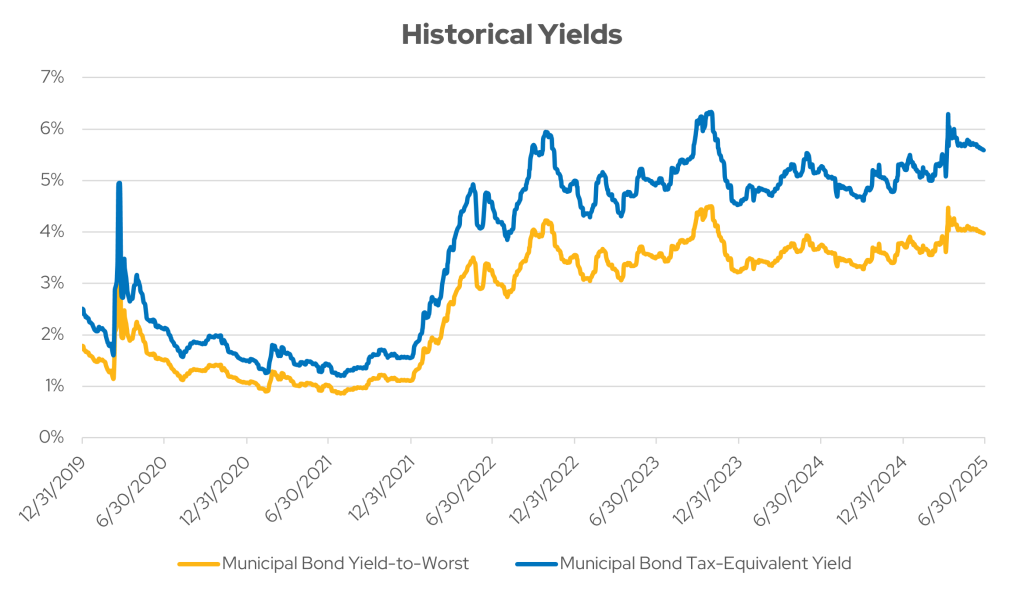

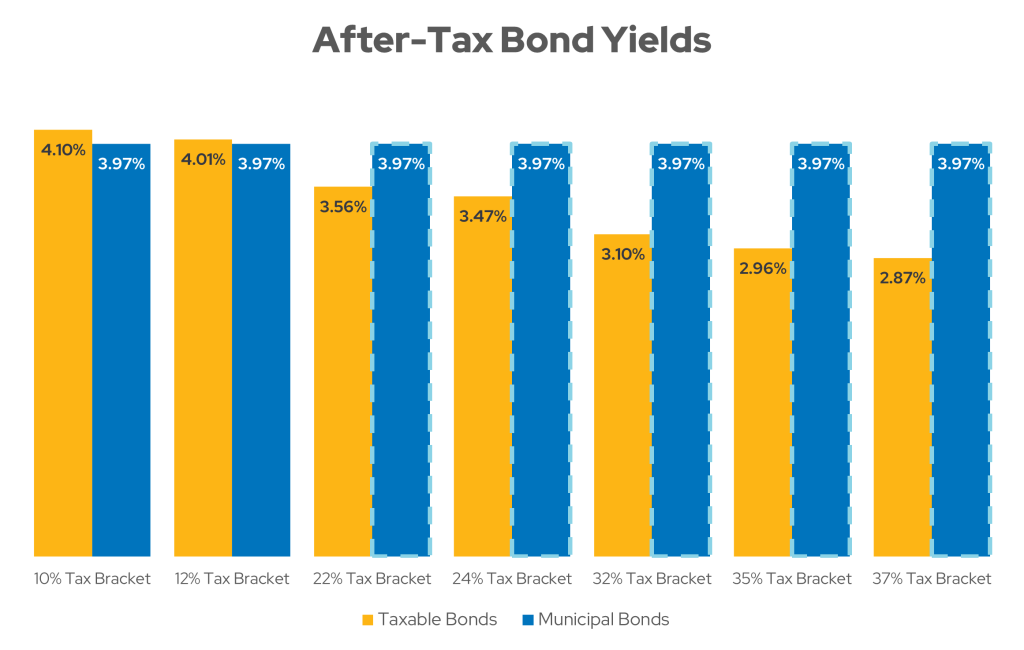

Munis still deliver compelling after-tax income

Municipal bonds continue to offer compelling after-tax income, making them especially attractive for HNW clients in higher tax brackets. When you factor in tax-equivalent yields, munis often outperform comparable taxable fixed income options, reinforcing their role as a core income-generating asset. For example, a 4% yield on a tax-exempt municipal bond can be equivalent to a 6.5% taxable yield for a client in the top federal tax bracket, making the muni a clear winner on an after-tax basis.

For clients seeking even greater yield, high-yield municipal bonds can be a logical addition. While they do carry slightly more credit risk, defaults in this space have historically been rare. A well-diversified allocation to high-yield munis — say 10–15% of the total portfolio — can have the potential to enhance income without taking on excessive risk.

Research and diversification drive quality outcomes

Strong municipal bond portfolios don’t happen by accident. They’re built through rigorous research and thoughtful diversification. Portfolios benefit from deep credit analysis and active oversight, with advisors and managers carefully selecting issuers, monitoring sector exposure, and rotating risk as conditions change. For example, if a client's portfolio is overweight in hospital revenue bonds, reallocating some exposure to general obligation or essential service bonds can help reduce concentration risk. Diversifying by credit rating, geography, and issuer type further helps manage both credit and liquidity risk while supporting consistent performance.

This kind of strategic construction not only enhances long-term resilience but also reinforces your value as an advisor who understands how to protect and grow wealth through disciplined fixed income management. An experienced advisor, often working with an asset manager, brings the judgment needed to evaluate relative value, navigate evolving tax considerations, and align municipal bond strategies with a client’s broader financial goals. Deep research and customization deliver a level of insight and accountability that automated platforms can’t replicate.

Allocation benefits & risks to consider

As you consider municipal bonds for your clients, here are just some of the opportunities and risks you’ll need to balance.

| Opportunity | Risk/Consideration | Explanation & Example |

|---|---|---|

| Higher after-tax yield | Interest‑rate sensitivity – longer durations more vulnerable |

Longer‑term muni bonds are generally more sensitive to rising interest rates, which can lead to price declines. Example: If rates rise by 1%, a 10‑year muni bond might drop in price more than a 5‑year bond. |

| Portfolio diversification & equity hedge during downturns | Liquidity risk in less liquid credit segments |

Some municipal bonds, particularly in niche sectors or smaller issuances, can be hard to trade—especially in volatile markets. Example: In periods of market stress, it may be difficult to sell certain high‑yield or unrated muni bonds without accepting a significant discount. |

| Tax-lot optimization and strategic transitions | Alternative Minimum Tax (AMT) may apply |

Some municipal bonds, especially private activity bonds, are subject to the AMT—impacting HNW clients who already fall under AMT rules. Example: A client subject to AMT buys a bond that pays 3%, but after AMT liability, the tax benefit is significantly reduced. |

Put it all together for your HNW investors

For HNW clients, a thoughtful municipal bond strategy often begins with a core intermediate municipal separately managed account (SMA), typically with a duration of approximately 2–8 years. This provides a strong foundation for yield, tax efficiency, and capital preservation. For those seeking greater income and willing to assume more risk, layering in high-yield municipal bonds or opportunistic vehicles can enhance return potential. Investors who want their portfolios to reflect their values can also incorporate impact or ESG-focused municipal funds, though it’s important to monitor credit quality and structural nuances.

BlackRock’s SMA approach offers distinct advantages. As one of the largest municipal bond managers, BlackRock provides broad access to primary market issuances and benefits from tighter trading spreads, which can improve execution. Its SMA strategies are supported by advanced Aladdin risk modeling tools, allowing for dynamic scenario analysis that captures rate shocks and credit spread movements specific to current portfolio holdings.

For more advanced strategies, BlackRock offers solutions such as the Municipal Credit Alpha Portfolio—an interval fund with 75–90% exposure to high-yield, opportunistic, and distressed municipal credits. This strategy is designed to pursue elevated tax-equivalent yields while maintaining a historically low default rate. For impact-minded investors, the BlackRock Impact Municipal Fund focuses on delivering tax-free income alongside measurable positive social and environmental outcomes. The fund invests across sectors aligned with the UN Sustainable Development Goals and allows for up to 50% exposure to lower-rated or unrated credits, along with modest leverage to support its objectives.

Munis still matter

Munis can form a powerful core of HNW portfolios. They deliver tax-efficient income, diversification, customization, and access to a deep bond supply. BlackRock’s SMA structures and active strategies — spanning from core to high-yield and impact vehicles — offer scalable options aligned with varying risk, duration, and return objectives.

Explore how a customized muni strategy could enhance your clients’ after-tax returns: https://www.blackrock.com/us/financial-professionals/literature/whitepaper/2025-guide-to-using-municipal-bonds-in-hnw-portfolios.pdf