Many clients, particularly high net worth clients, understand that the taxes they pay on gains from investments, or capital gains taxes, could be their portfolio's largest expense. For some investors, the taxes they pay on these gains could approach 50% or higher. With ever-changing tax laws and regulations, investors have to rely on the professionals they work with to manage the intricacies of tax planning and optimization.

Services desired by wealthy investors as part of a wealth management offering, vs. services received1

The great news is that when tax management is seamlessly built into your overall practice management, advisors have an opportunity to not just deepen client relationships, but to also capture significantly more value from those relationships. Leveraging modern outsourced tax management solutions can empower advisors to accomplish this more efficiently than ever before.

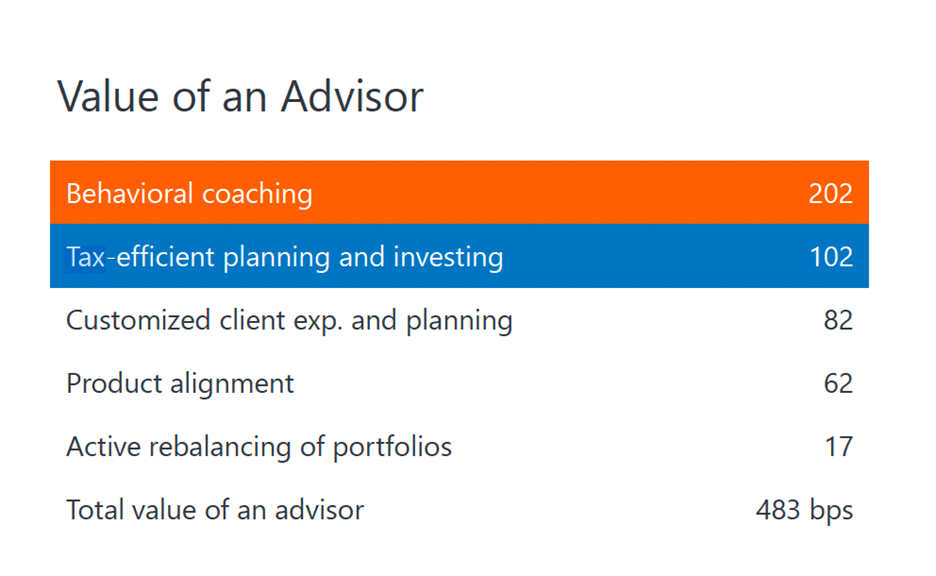

The evidence is compelling. From an investment standpoint, advisors have the potential to add 300+ basis points in annual value for clients, particularly through tax efficiency and behavioral coaching.

Let’s take a look at what tax-efficient planning and investing can look like in your practice.

Optimize practice management with tax efficiency

There are generally two components to delivering tax efficient planning at scale, as we see it.

First, managing your clients’ capital gains starts with strategic portfolio construction. Each investment should undergo thorough review for its tax efficiency. Tax-inefficient investments can be placed into qualified accounts to minimize their tax exposure, while more tax efficient investments can be allocated into nonqualified accounts.

The share of unified managed account (UMA) assets has increased more than five times over the last 13+ years to represent 22% of managed accounts assets.3

One reason we expect UMAs to remain the fastest growth area of managed accounts is their holistic nature and unique tax benefits. UMAs offer investors the ability to consolidate various investments, including separately managed accounts (SMAs), mutual funds, and exchange traded funds (ETFs), into a single account. This helps the advisor offer a holistic approach to portfolio construction, which attracts a greater share of the investor’s taxable assets into this one account. In addition, when outsourcing the management to an overlay manager, this consolidation facilitates automated tax management across all UMA investments, laying the groundwork for the second component of tax-efficient planning and investing.

Envestnet’s Tax Overlay service, not only automates the tax management of the portfolio and allows the client to customize its tax settings, but it also manages the account to specific client driven capitals gains budgets, which provide clarity to the investor of what their portfolio’s tax cost will actually be. This tax budget allows the advisor to demonstrate that they are effectively incorporating tax planning into their value proposition. This approach goes well beyond mere tax loss harvesting by continuously addressing comprehensive tax management needs while adhering to the client's portfolio strategy.

The power of outsourced tax management

Here is an example of how an advisor might work with an outsourced provider, like Envestnet, to offer ongoing tax management to all of their clients at scale.

During the proposal process, you and your client will work with an Envestnet Overlay Specialist to analyze the client’s existing holdings against their desired UMA portfolio allocation. This analysis will demonstrate the tradeoff between limiting capital gains realization and accepting higher tracking error. Based on this analysis, your client determines the long-term capital gains budget they wish to establish, setting the stage for initial portfolio trading.

Then, on the client’s behalf, you’ll communicate to Envestnet the target portfolio allocation and tax budgets, as well as other account settings such as rebalancing frequency. Envestnet invests the portfolio according to your clients target allocation and guidelines while also considering the capital gains budget using a risk optimization engine. The risk engine analyzes the portfolio changes, possible tax implications of the changes, and provides trade recommendations that enable Envestnet to trade the account in a way that balances the tax cost with the client’s portfolio's risk, measured by tracking error.

If you're thinking, 'This process removes a significant analytical burden from my workload,' you're correct. Outsourcing tax management not only enables advisors to deliver sophisticated tax services efficiently to all clients, but it also ensures that even smaller accounts benefit from solutions like Fund Strategist Tax Management. By alleviating this burden, advisors can offer tax efficiency across their entire client base, addressing the tax needs of investors regardless of their tax bracket or portfolio size.

Get started today

It is safe to assume that most, if not all, of your clients are concerned about their taxes. If you aren’t already discussing capital gains with your clients, start now. Evaluate how your clients’ portfolios are affected by capital gains and speak with your firm about accessing Envestnet’s tax overlay services. We find that some advisors already have access through their home office without realizing it.

By addressing tax management you’ll not only be delivering value to your clients, but also strengthening your own business. Tax efficient strategies have the potential to be a win-win for everyone involved.

Envestnet | PMC's Tax Overlay Services team automates tax management for more than $15B in assets at over 100 firms (as of April 2024). Contact us at PMCOverlayServices@Envestnet.com to learn how you can help your clients manage their capital gains taxes.