RIAs today face tremendous pressure to build and deepen client relationships, enhance their expertise, broaden their service offerings, and grow their client base. But there are only so many hours in a day. How are advisors supposed to do it all?

One strategy we are seeing more and advisors use to meet these growing demands is a team-based approach to investing. A recent study found that advisors who outsource investment management save about 9 hours a week.1 This time can then be spent externally on growing client relationships or internally on enhancing skills, knowledge, and capabilities.

No wonder a majority of advisors say leveraging external investment management providers enables them to be more successful as financial advisors and even have a better work-life balance as a result.2

Team-based investing isn’t an all-or-nothing decision

If a team-based approach sounds intriguing but you’re unsure of where to begin, there are four key areas to look at when delegating investment management: CMAs and asset allocation, manager research and selection, trading, and portfolio construction. Think of these as a spectrum of solutions and consider where it makes sense to supplement your own talents and the skills of your team to strengthen your practice.

Determine what to delegate

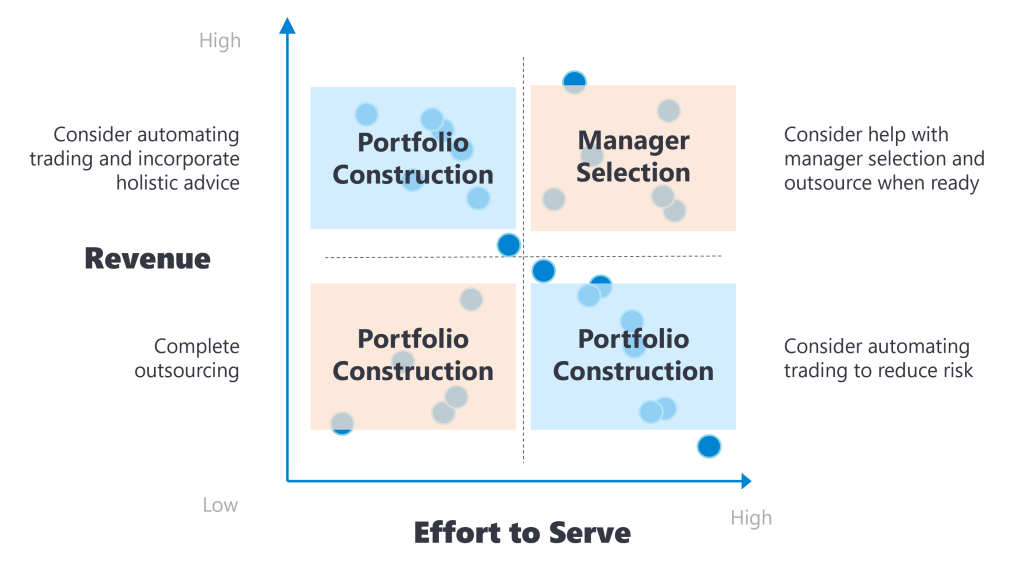

When determining which services and accounts to outsource, it helps to evaluate revenue potential against the resources needed to effectively service each account.

Many RIAs begin by outsourcing investment management for their resource-intensive, lower-revenue clients. Regardless of what you choose to outsource, commit to your strategy for a full year while tracking performance metrics. Then, based on the results, expand outsourcing across other client segments that align with your business goals.

After the first year, take a look at how much time you’ve saved, and redirect your expertise to areas that further business growth.

Which investment solutions can benefit your firm most?

You don’t have to spend years building partnerships and coordinated solutions – not when there are a number of investment management tools, services, and platforms available for you to leverage:

Fund Strategist Portfolios (FSPs) – FSPs are an investment model comprised of ETFs and mutual funds managed by asset managers.

Separately Managed Accounts (SMAs) – SMAs are professionally managed separately from other portfolios. SMAs can be ideal for high-net-worth investors who have specialized needs and desire a more tailored approach.

Unified Managed Accounts (UMAs) – As one of the fastest-growing segments of managed investment solutions, UMAs are managed accounts that have developed out of separate accounts. While separate accounts hold the securities associated with a single investment manager or style managed for a client, UMAs typically hold multiple separate accounts, as well as other investment products such as mutual funds and ETFs.

Custom Case – Allows advisors to work with investment specialists to develop tailored portfolios for mass-affluent and high-net-worth clients.

Ways to enable greater personalization

Advisors can continue to demonstrate their value by integrating highly tailored solutions like values overlay, tax management, and direct indexing into their team-based strategy and offerings. Through these investment strategies, you can to increase the value you provide to clients without having to build these full capabilities in-house.

As an advisor, your value extends beyond bespoke portfolio construction. It’s more about delivering a holistic wealth management experience that seamlessly connects all elements for your clients . A team-based approach allows you to maintain control while leaning on others to do the work on your behalf.

Explore the Envestnet RIA Marketplace

One easy way to get started with a team-based approach is to explore the Envestnet RIA Marketplace. This program offers advisors a low-cost managed account solution that was built to allow advisors to expand their investment capabilities through access to third-party money managers, and ultimately assists you in delivering personalized portfolio management that aligns with your clients’ evolving needs.

Through the marketplace, you can choose from nearly 200 FSPs from five world-class asset managers – BlackRock, Fidelity Investments, Franklin Templeton, State Street Global Advisors, and Envestnet | PMC, to scale your investment capabilities and deliver personalized portfolio management that aligns with your clients’ evolving financial goals and expectations. And even better, Envestnet | Tamarac clients can gain access to FSPs at zero platform fee.*

Our asset manager partners not only have a significant global footprint, they also have a valuable perspective on how to successfully build investment portfolios that address the challenges faced by wealth managers around the world. To take a deeper dive into their managed account solutions, watch our on-demand webinar: RIA Marketplace Insights: Enhancing Value Through Strategic Outsourcing.

Lean on us to get started with team-based investing. Visit https://go.envestnet.com/Envestnet-RIA-Marketplace to learn more or reach out!