Private markets, once the exclusive domain of institutional investors, are increasingly finding their way into wealth conversations with high-net-worth investors. The numbers tell a compelling story. The global alternative investment market, estimated at around $15 trillion in 2022, is projected to surge to over $24 trillion by 2028.1

Even with this growing popularity and democratization, traditional private investments remain misunderstood for many financial advisors due to accreditation rules, high minimums, and multi-year lockups.

One structure helping bridge that gap is the interval fund, which offers clients a regulated, semiliquid way to access private markets. These vehicles introduce alternatives more intentionally, without relying on the complexities of private limited partnerships.

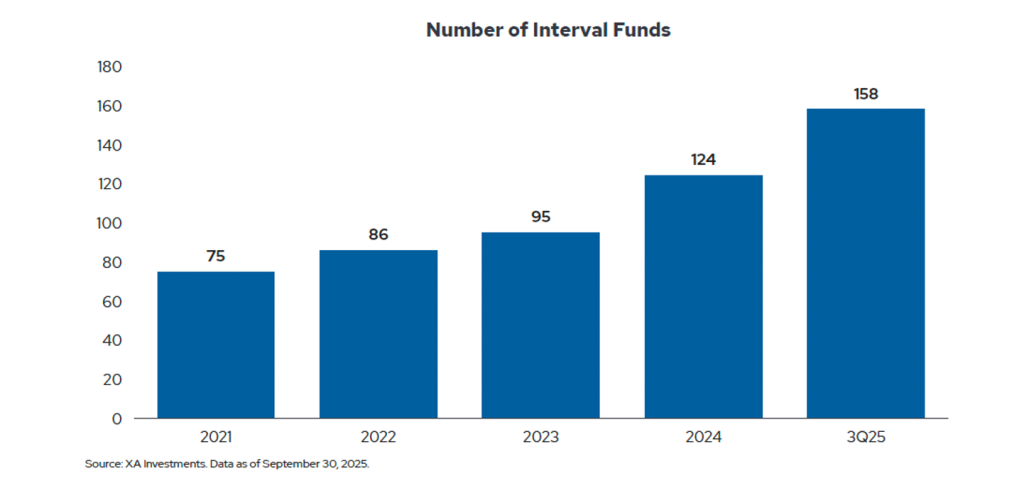

According to XA Investments, almost $146 billion is invested in interval funds, and the number of these products keeps growing.2

Here, we break down what interval funds are, how they work, why they’re gaining traction, and how to diligence them for client portfolios.

What is an interval fund?

An interval fund is a type of investment fund that doesn’t let investors redeem shares at will. Instead, it offers to buy back (or “repurchase”) a percentage of its outstanding shares at scheduled times. This structure allows the fund to invest in assets that aren’t easy to buy or sell quickly, such as private equity, private credit, or real estate. In short, interval funds give clients a way to access parts of the private markets while still providing some limited, predictable liquidity.

Key characteristics of interval funds include:

- Continuous share issuance: Shares are typically available for purchase daily or near-daily.

- Periodic liquidity windows: Shares can be sold only at set intervals (often quarterly or semiannually).

- Capacity for illiquid holdings: Without daily redemption pressure, managers can pursue strategies that may capture an illiquidity premium or otherwise offer the potential for outperformance of public markets.

Crucially, “interval fund” refers to the structure, not the strategy. Managers can use the wrapper to deliver a range of alternative exposures, though most available today are focused on income-oriented categories like private credit.

How do interval funds work?

Understanding how interval funds work helps you utilize them effectively and explain them clearly to clients:

Buying shares

Investors transact at the fund’s net asset value (NAV). Unlike traditional closed end funds that raise money through a one-time IPO, interval funds offer shares on an ongoing basis.

Investing the money

The fund manager uses the money to invest in assets that aren’t easy to sell quickly, like private equity, private credit, or real estate loans. Because the fund doesn’t have to deal with daily withdrawals, the manager can focus on longer-term strategies.

Repurchase windows

At set times, the fund offers to buy back a predetermined amount of outstanding shares, often between 5% and 25%. Investors can submit requests to redeem their shares during these windows.

Handling redemptions

If total redemption requests exceed available liquidity, the fund will repurchase shares on a pro rata basis. The NAV used for repurchases is usually calculated after investors submit their requests.

Running the fund

Similar to other registered funds under the Investment Company Act of 1940, interval funds are required to publish regular disclosures, provide tax reporting, and follow regulatory rules.

Unlike drawdown funds with distinct fundraising, investing, and distribution phases before ultimate closure, interval funds are designed to operate perpetually. They are “evergreen” because they continuously raise, allocate, and return capital to investors without any time limits. This flexibility eliminates the complex liquidity challenges and potential vintage year similarities of drawdown funds.

While interval funds are purchased with convenience, their liquidity profile is fundamentally different—and that distinction must guide suitability and allocation decisions for each client.

How liquid are interval funds?

Interval funds are not liquid in the way most investors have come to expect of their holdings, so they should be thought of as semiliquid alternatives rather than daily access investments. Clients need to know that they can only sell their shares during scheduled repurchase windows, and the fund will only buy back a set percentage of all investors’ shares at each interval. If more investors request redemptions than the fund can handle, the fund will repurchase shares on a pro rata basis. For clients with a long-term investment horizon, interval funds can be a useful part of a private markets allocation. However, for clients who need quick access to their money, these funds may not be suitable.

Liquidity comparison: interval funds vs. mutual funds vs. private funds

| INTERVAL FUNDS | MUTUAL FUNDS / ETFS | DRAWDOWN FUNDS | |

|---|---|---|---|

| LIQUIDITY FREQUENCY | Periodic (e.g., quarterly, semiannually, or annually) | Daily for mutual funds, intraday for ETFs | Very limited (multi-year lockups) with occasional distributions possible |

| REDEMPTION LIMITS | Yes—typically 5–25% of outstanding shares | No limits | Redemption generally not permitted before the end of the term |

| NAV TRANSPARENCY | Daily or periodic | Daily | Varies |

| MINIMUM INVESTMENT | Low to moderate | Low or very low | High (often $250k+) |

| ACCREDITATION REQUIREMENTS | None | None | Required |

| UNDERLYING ASSET LIQUIDITY | Liquid / illiquid mix | Generally liquid | Illiquid |

Why advisors are turning to private market interval funds

Advisors are increasingly adopting private market interval funds for several reasons:

- Expanded access: Interval funds provide a regulated, lower-minimum path to private-market exposures without accreditation hurdles.

- Diversification and return potential: The ability to invest in less-liquid assets may support an illiquidity premium and deliver low-correlation exposures.

- Simplified tax and reporting: Investors receive 1099s, not K-1s -reducing tax-season complexity.

- Portfolio construction utility: Interval funds can help build out a private market or alternative sleeve in a scalable, controlled way.

For investors who can tolerate a semiliquid profile, interval funds may be an attractive way to introduce differentiated alternatives.

Interval funds can provide an entry point into private market investing and be used as long-term components of diversified portfolios. While not without risks and constraints unique to each strategy, interval funds offer potential diversification through their investment in assets that have historically shown less than perfect correlations with public markets.

Considerations and due diligence checklist

Before recommending interval funds to clients, it’s important to review several key points. First, understand the fund’s strategy and the types of assets it holds. Make sure you know the liquidity terms, including how often investors can sell shares and whether redemption requests have ever been prorated. Check the fee structure to ensure the costs make sense for the potential returns. Consider whether the client’s goals and liquidity needs align with the fund’s semiliquid nature. It’s also important to understand how the fund values illiquid holdings, the transparency of its disclosures, and how it fits within the client’s overall portfolio. Finally, clarify exit expectations and the process for repurchases.

Interval funds represent a meaningful way to give clients access to alternative investments, offering a structured, transparent vehicle with periodic liquidity. They aren’t meant to replace fully liquid funds, but they can responsibly broaden the range of opportunities in a client’s portfolio. When used with clear communication and appropriate allocation and position sizing, interval funds have the potential to be a powerful tool for clients seeking long-term, differentiated exposure.

Need more? Download our latest whitepaper for Interval Funds 101. Envestnet has launched access to professionally managed model portfolios featuring interval funds on its platform. Learn more and hear from our partners.