U.S. fixed income investors endured years of low yields after the Great Recession of 2008–09, followed by widespread bond market declines in 2021–22. Bonds saw losses throughout much of 2023, too, even though the year ended on a positive note. This environment limited the appeal of fixed income securities for many investors.

From 2008–2023, the U.S. bond market delivered an average annual return of just 2.81%. Treasury Bonds fared even worse—generating an average annual return of only 2.35% over the same period.1

Longer-term fixed income securities were especially hard hit by rising interest rates in 2022–23 due to their rate sensitivity, which is frequently measured by duration. Because money market funds, savings accounts, and other bank deposit products (what we’ll collectively refer to as “cash”) have a duration of zero, they aren’t in danger of losing money when interest rates rise. In fact, higher rates have swelled U.S. money market fund balances to over $6 trillion, a record sum.2

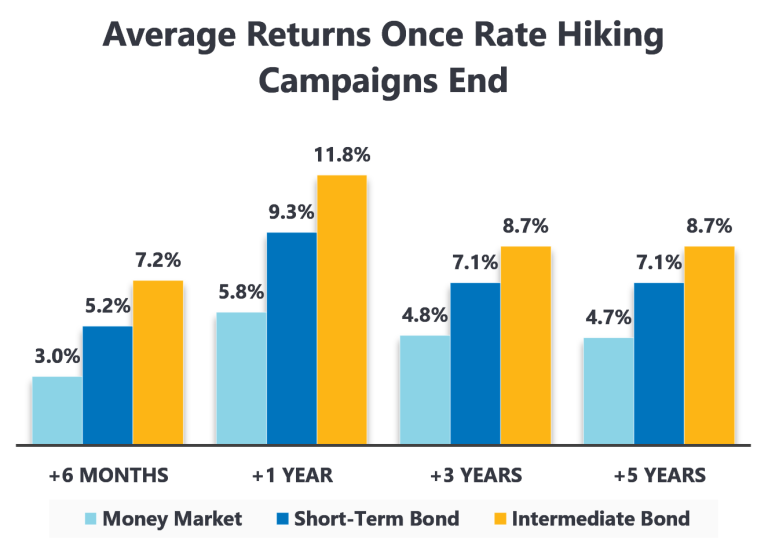

While the Federal Reserve’s January 31st meeting tempered expectations for a Q1 interest rate cut, the next move is still likely to be lower. The Fed’s rate hiking campaign (starting in March of 2022 and likely having ended in July of 2023) brought short-term pain and frustrating losses to bond investors, but this effort also elevated yields from historically meager levels. Investors can finally earn higher income from bonds and cash than was generally possible for many years. Cash yields, however, will fall if, and when, the Federal Reserve lowers interest rates. Bonds, though, enable investors to lock in coupons for years or even decades. Falling interest rates can also serve as a tailwind for bond prices. (Remember that bond prices and yields have an inverse relationship.) For these reasons, many investors are reconsidering fixed income opportunities. Exchange-traded funds (ETFs) may provide an attractive vehicle to tap into the current bond market.

Shifting allocations

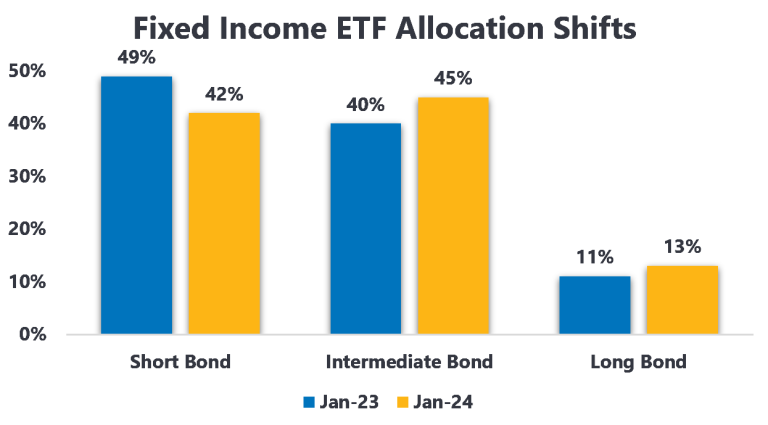

Envestnet platform data indicate that advisors have shifted their allocations to bond ETFs since January of 2023. Let’s examine the fixed income ETF positioning from January 31st, 2023, and compare it to the breakdown one year later.

As you can see in the next chart, Short Bond ETFs had the most assets of any fixed income category on the Envestnet platform in January of 2023. By January of 2024, though, Intermediate Bond ETFs had taken the #1 spot in regard to assets under management (AUM). This realignment makes sense in the context of monetary policy. As the Federal Reserve began to indicate that the most recent cycle of interest rate hikes was likely ending, advisors began looking to extend fixed income portfolio duration.

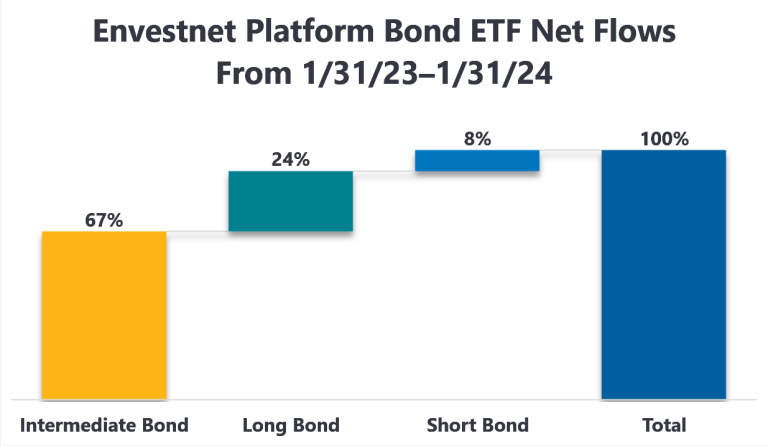

Flows data from the Envestnet platform illustrate the driving force behind the realignment in bond ETF positioning detailed above.

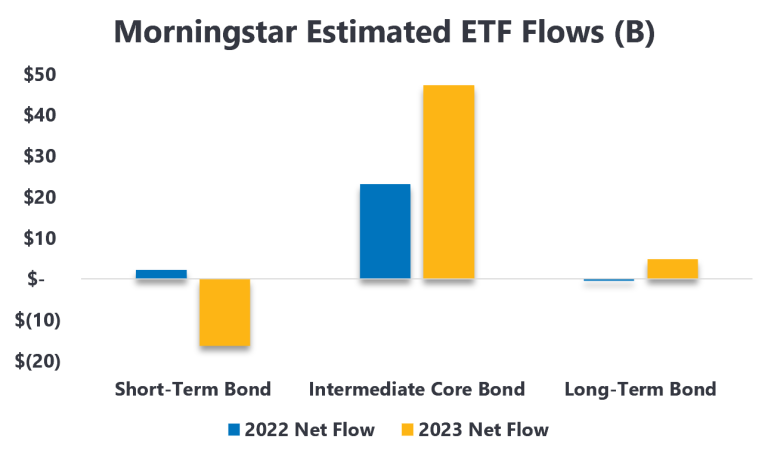

Intermediate and Long Bond ETFs combined to make up about 91% of fixed income ETF net flows on the Envestnet platform from January 31st, 2023, through January 31st, 2024.3 Short Bond ETFs gathered just over 8% of these flows. One final noteworthy data point: From January of 2023 through January of 2024, fixed income ETFs enjoyed twelve months of positive net flows our platform.4 Ultimately, these funds are steadily gathering assets and demonstrating resilience despite bond market volatility. Morningstar data indicate that a combined $35.8 billion flowed into the Short-Term, Intermediate Core, and Long-Term Bond U.S. ETF categories last year, further illuminating the demand for these fixed income products.

Advisors are reallocating

Based on our analysis of flows and position changes on the Envestnet platform, advisors are reallocating money to longer-term bond ETFs. As interest rates are widely expected to decline this year, portfolio changes are certainly logical. Based on the Fed’s own economic projections and policy commentary on December 13th, 2023, the current policy tightening cycle is complete unless high inflation reignites. As such, the Federal Reserve projects multiple interest rate cuts in 2024.

If you’re interested in a deeper dive into navigating the new fixed income regime, download our new white paper on the subject. In this guide, we explain the current interest rate environment, explore historical data, and culminate with actionable portfolio strategies advisors may want to consider for their clients.

Read our latest white paper, The New Fixed Income Regime: How Higher Interest Rates May Revitalize Bond Portfolios.